Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

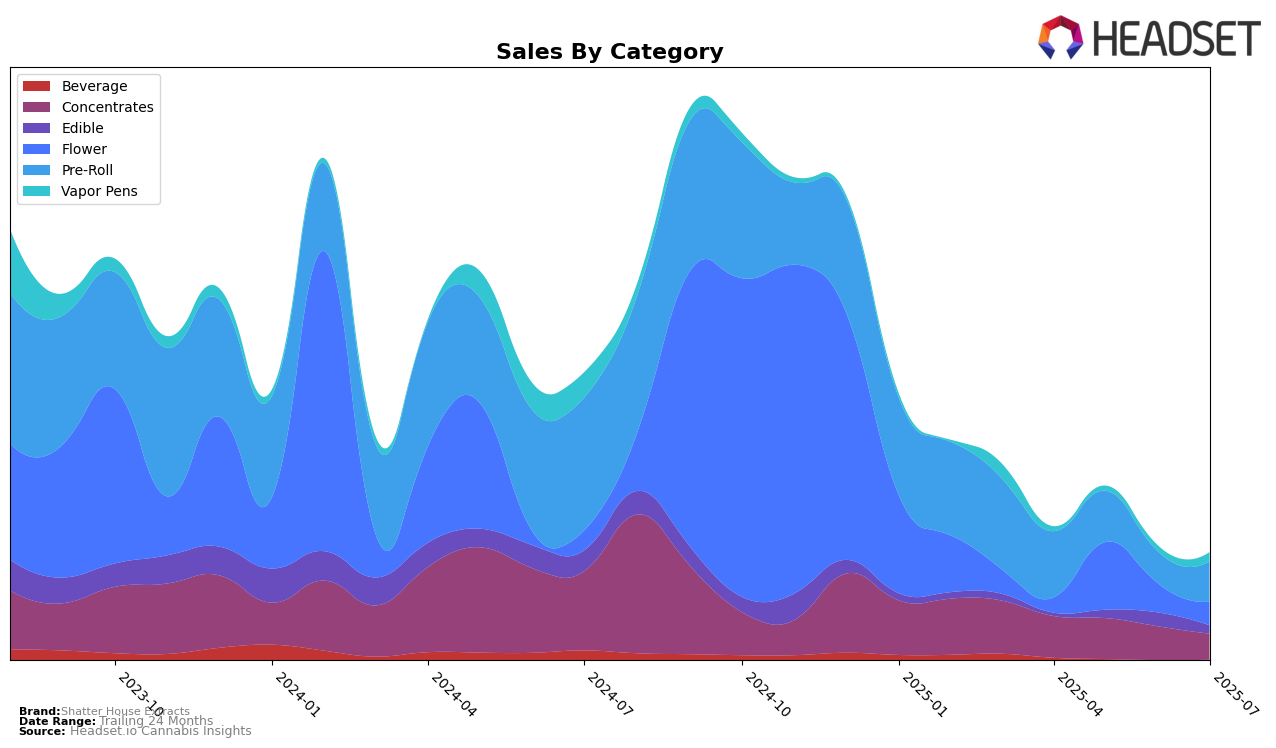

Shatter House Extracts has seen a notable shift in its performance across different product categories in Michigan. In the Concentrates category, the brand experienced a decline in its ranking from April to July 2025, moving from 60th to 80th place. This downward trend is reflective of a consistent decrease in sales over the same period, with July sales dropping to $35,746. While the brand did not make it into the top 30 in this category, the data suggests a need for strategic adjustments to regain market traction. Conversely, the Pre-Roll category saw Shatter House Extracts entering the rankings at 80th place in April, but it did not maintain a presence in the top 30 in subsequent months, indicating a challenge in sustaining momentum in this segment.

In the Edible category, Shatter House Extracts showed a promising upward trajectory, starting from outside the top 100 in April and moving up to 81st place by June, before slightly dropping to 94th in July. This fluctuation, while not placing the brand in the top 30, highlights a potential growth area for the company, as it managed to increase its sales from $11,154 in May to $18,814 in June. The brand's ability to climb the rankings in this category, despite not securing a top 30 spot, suggests that with targeted efforts, there could be further opportunities for expansion and increased market share in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Shatter House Extracts has experienced a notable decline in both rank and sales from April to July 2025. Initially ranked 60th in April, Shatter House Extracts dropped to 80th by July, indicating a downward trend in market position. This decline is mirrored in their sales figures, which decreased significantly over the same period. In contrast, Glacier Cannabis entered the top 20 in May, ranking 60th, but also saw a decline to 79th by July, suggesting a similar struggle to maintain market position. Meanwhile, Galenas made a notable entry in July at 77th, potentially capturing market share from existing players. Midwest Extracts also saw a significant drop from 41st in April to 81st in July, indicating a competitive and volatile market environment. Lastly, Thunder Canna entered the rankings in June at 98th and improved slightly to 88th by July, demonstrating potential growth. These shifts highlight the dynamic nature of the Michigan concentrates market and suggest that Shatter House Extracts may need to reassess its strategies to regain its competitive edge.

Notable Products

In July 2025, the top-performing product from Shatter House Extracts was Grand Daddy Purp Infused Pre-Roll (1g) in the Pre-Roll category, leading with sales of 1539 units. Limoncello Infused Pre-Roll (1g) followed closely behind in second place. Michigan Cherry Gummies 10-Pack (200mg) secured the third spot in the Edible category. Notably, Orange Gummies (200mg) experienced a drop from second place in June to fourth in July, indicating a shift in consumer preference. Buddha Cheese Pre-Roll (1g) rounded out the top five, demonstrating strong performance in its debut month on the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.