Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

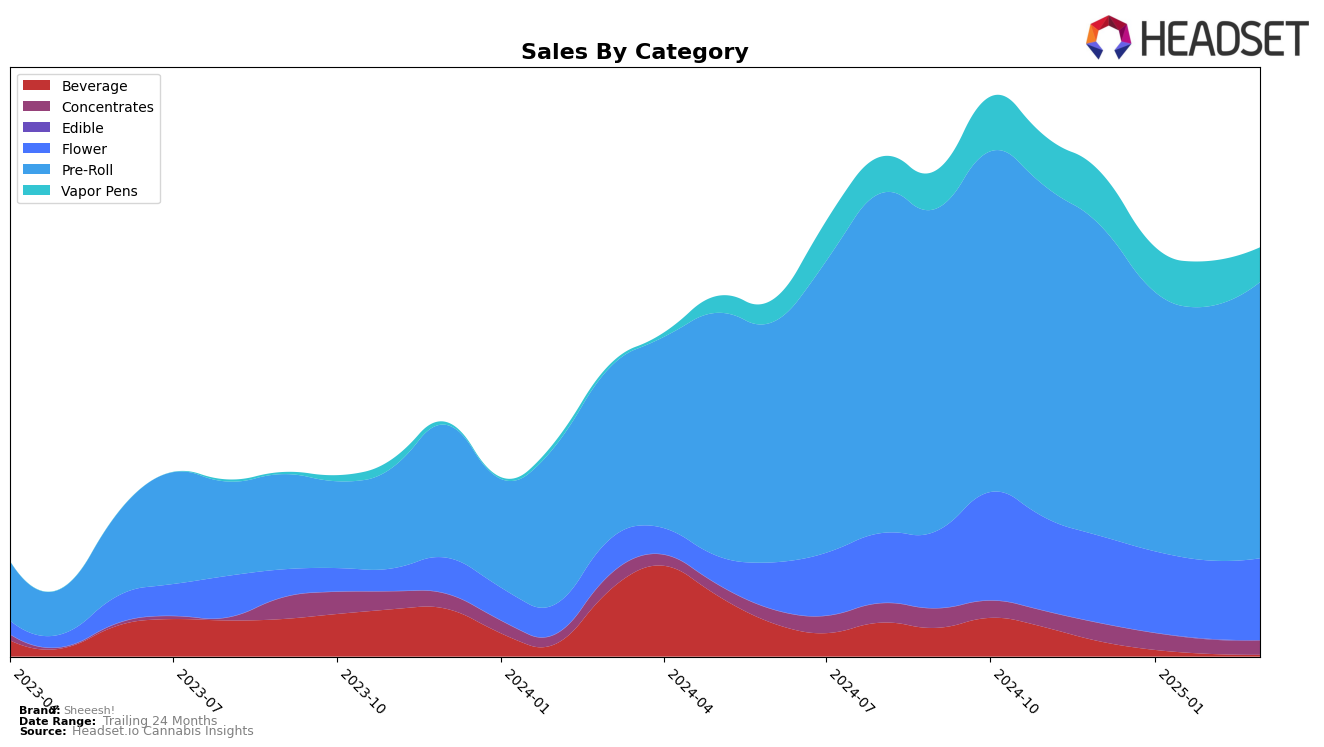

Sheeesh! has shown varied performance across different product categories and provinces, indicating a dynamic market presence. In Alberta, the brand experienced a steady climb in the Flower category, improving its rank from 56th in December 2024 to 46th by March 2025. This upward trend suggests a growing consumer base or increased market penetration. However, the Vapor Pens category in Alberta presented a more volatile trajectory, where Sheeesh! reached 44th place in February 2025 but dropped back to 57th by March, reflecting potential challenges in maintaining consistent performance in this segment. In British Columbia, the Pre-Roll category saw a notable rise, jumping from 46th to 35th over the same period, indicating a strengthening presence in this particular product line.

In Ontario, Sheeesh! showed resilience in the Pre-Roll category, maintaining a ranking within the top 33 despite a slight dip in February 2025. This consistency suggests a stable consumer demand or effective brand loyalty strategies. However, the Concentrates category did not see significant improvement, with rankings hovering around the mid-30s, which could point to competitive pressure or a need for product innovation. The Vapor Pens category in Ontario remained outside the top 30 throughout the observed months, indicating a potential area for growth or reevaluation. These insights into Sheeesh!'s performance across regions and categories highlight the brand's strengths and areas needing attention, offering a glimpse into its strategic positioning in the Canadian cannabis market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Sheeesh! has demonstrated a consistent yet fluctuating presence in the rankings from December 2024 to March 2025. Despite not breaking into the top 30 in December 2024, Sheeesh! improved its rank to 30th by February 2025, before slightly declining to 33rd in March 2025. This trajectory suggests a resilient performance amidst fierce competition. Notably, Happy & Stoned consistently outperformed Sheeesh!, peaking at 31st in March 2025, indicating a potential area for Sheeesh! to strategize for growth. Meanwhile, OHJA and The Original Fraser Valley Weed Co. exhibited a downward trend, with OHJA surpassing Sheeesh! in March 2025 by securing the 32nd rank. These dynamics highlight the competitive pressure and opportunities for Sheeesh! to leverage its sales momentum, which showed a positive increase in March 2025, to climb higher in the rankings.

Notable Products

In March 2025, SMURF Infused Pre-Roll 1g maintained its position as the top-performing product from Sheeesh!, with sales reaching 16,488 units. Trop Cherry Pre-Roll 2-Pack 2g climbed back to the second position after dropping to fourth place in February. Dia De Los Muertos Pre-Roll 7-Pack 3.5g held steady in third place, showing consistent performance across the months. Trop Juice Pre-Roll 7-Pack 3.5g entered the rankings for the first time, securing the fourth spot. Tranquilo Pre-Roll 7-Pack 3.5g slipped from its second-place ranking in February to fifth in March, indicating a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.