Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

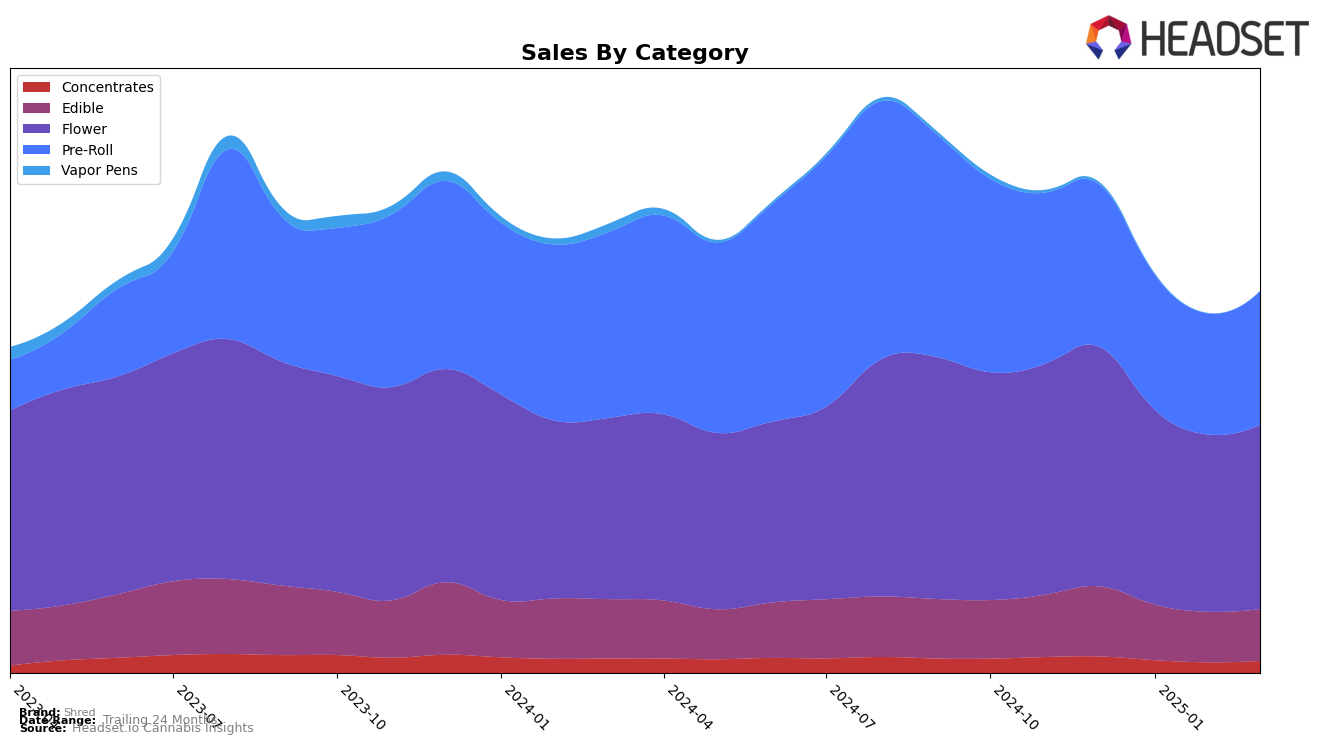

In the Canadian cannabis market, Shred has shown varied performance across different provinces and product categories. In Alberta, Shred's presence in the Flower category has been steadily improving, moving from 16th in December 2024 to 13th by March 2025. This upward trend suggests a growing consumer preference or increased market share in this category. However, in the Pre-Roll category, Shred experienced a slight decline, dropping from 8th to 10th place over the same period, indicating possible challenges or increased competition. Notably, Shred did not maintain a top 30 position in the Edible category beyond December 2024, which could be a concern for their market presence in this segment.

In Ontario, Shred has maintained a stronghold in the Flower category, consistently holding the 2nd position from January to March 2025, after being ranked 1st in December 2024. This indicates a robust demand or effective market strategies in this category. The Edible category also shows stability, with Shred consistently ranking 3rd throughout the period. However, the Concentrates category reflects some inconsistency, with Shred not ranking in February 2025, which raises questions about their competitiveness or supply issues in this area. Meanwhile, in British Columbia, Shred's performance in the Pre-Roll category remains strong, consistently ranking 3rd or 4th, suggesting a solid consumer base or effective marketing in this segment.

Competitive Landscape

In the competitive landscape of the Ontario flower category, Shred has demonstrated resilience and consistency in its market position. Although Shred started as the top-ranked brand in December 2024, it slipped to the second position by January 2025 and maintained this rank through March 2025. This shift was primarily due to the rise of Back Forty / Back 40 Cannabis, which climbed from third to first place in January 2025 and held that position through March 2025. Despite this, Shred's sales remained robust, closely trailing Back Forty / Back 40 Cannabis and outperforming other competitors like Spinach and Pure Sunfarms, which consistently ranked third and fourth, respectively. This indicates a strong brand loyalty and market presence for Shred, even amidst competitive pressures.

Notable Products

In March 2025, Shred'ems CBD/THC 4:1 Wild Berry Blaze Gummy 4-Pack maintained its position as the top-performing product, leading the sales with a figure of 47,792. Shred'ems CBD/THC 2:1 Sour Blue Razzberry Gummies 4-Pack consistently held the second position throughout the months, reflecting steady demand. The Shred'em Pop! Crazy Cream Soda Gummies 4-Pack remained third, showing a slight increase in sales compared to February. Shred'ems Pop! CBD/THC 1:1 Root Beer Blast Gummies 4-Pack continued to secure the fourth spot, with a notable sales increase from the previous month. Lastly, Gnarberry (7g) held steady in the fifth position since January, indicating consistent consumer interest in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.