Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

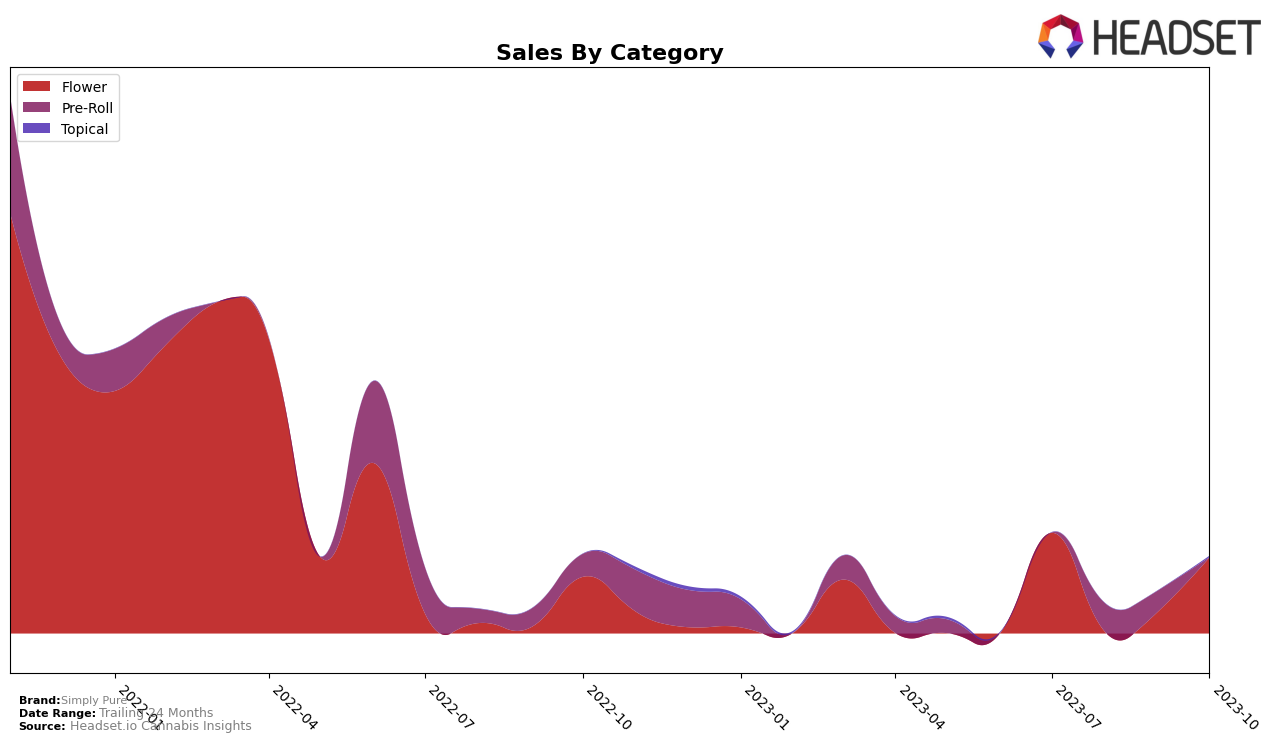

Looking at the performance of Simply Pure in the Colorado market, some interesting trends are noticeable. In the Flower category, there is no ranking data available for July through October 2023, indicating that Simply Pure was not among the top 20 brands in this category during these months. However, the brand did see sales in July, with a reported figure of $9027. This could suggest a potential for growth in this category given the right strategies.

In the Pre-Roll category, Simply Pure maintained a consistent presence in the top 100 brands from August to September 2023, ranking 87th and 89th respectively. However, no ranking data is available for July and October, indicating a possible fluctuation in their performance. In terms of sales, there was a noticeable decrease from $3377 in August to $2487 in September. The Topical category saw Simply Pure break into the top 20 brands in October, but no sales data is available for this period. This highlights Simply Pure's ability to compete in different categories, and suggests the potential for further exploration of the topical products market.

Competitive Landscape

In the Flower category in Colorado, Simply Pure has seen a significant shift in its competitive landscape. Notably, Meraki Gardens has shown a fluctuating trend, ranking 61st in July, improving to 50th in August, but then falling back to 62nd in September and further down to 86th in October. This suggests a decline in sales, which is confirmed by the data. On the other hand, Bloom has seen a steady drop in rank from 81st to 89th over August and September, indicating a decrease in sales. Northwest Cannabis Solutions and Willie's Reserve were not in the top 20 brands for some months, implying they did not perform well in those periods. Simply Pure itself ranked 99th in October, suggesting it has room for improvement in this competitive market.

Notable Products

In October 2023, Simply Pure's top-performing product was 'Super Lemon Haze (3.5g)', a Flower category product, reclaiming its top position from September's number one, 'Blue Dream Pre-Roll (1g)'. The 'Super Lemon Haze (3.5g)' product had impressive sales of 382 units, a significant increase from the previous month. The 'CBD Lavender Bath Bombs 4-Pack (100mg, CBD)', a Topical category product, made its debut in the rankings, coming in second. 'Cookies Pre-roll (1g)', a Pre-Roll category product, dropped one place from September to October, ranking third. The 'Blue Dream Pre-Roll (1g)', also a Pre-Roll category product, did not make the top three in October, despite being the top seller in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.