Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

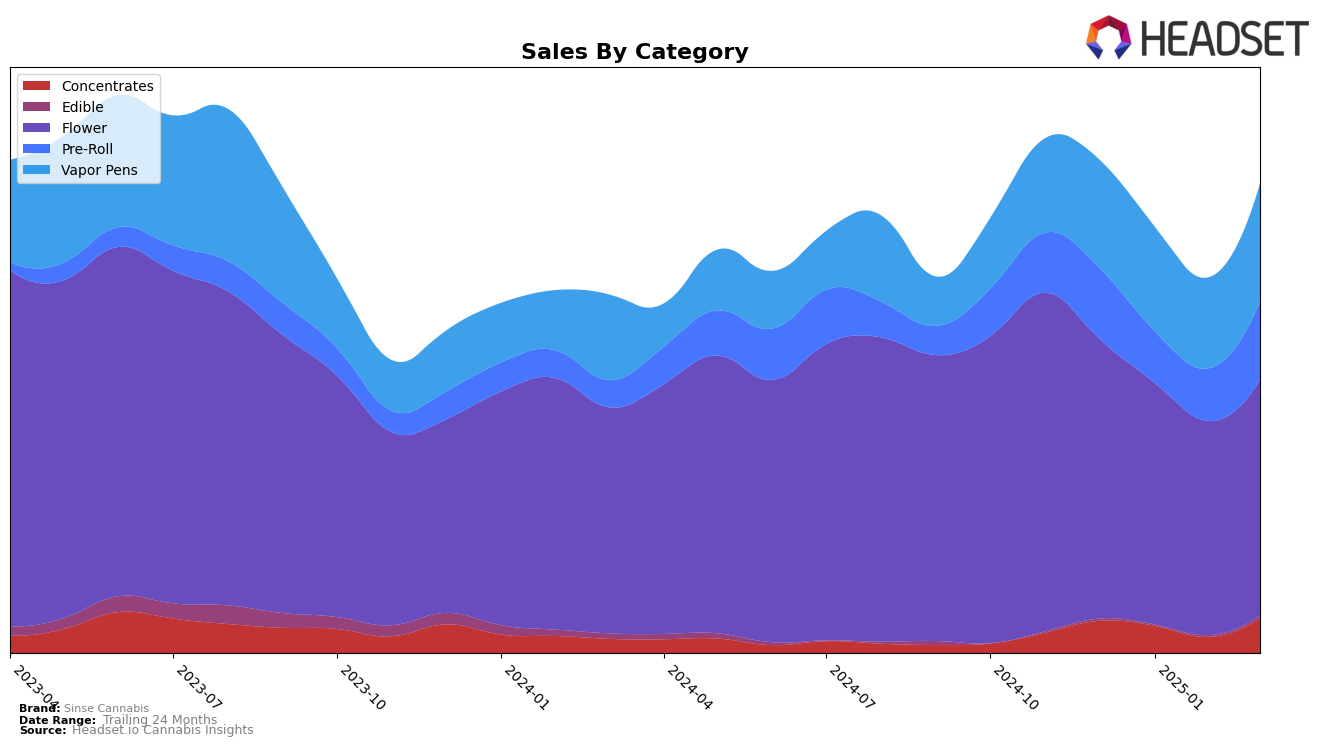

Sinse Cannabis has shown varied performance across different product categories in Missouri. In the Concentrates category, the brand has experienced some fluctuations, starting at rank 7 in December 2024, dropping to 15 by February 2025, and then recovering to rank 6 in March 2025. This indicates a significant rebound in their market position towards the end of the first quarter of 2025. The Flower category remained relatively stable, with Sinse Cannabis maintaining a presence in the top 10 throughout the period. Although there was a slight dip in sales from December to February, the brand managed to stabilize its position at rank 7 by March 2025.

In the Pre-Roll category, Sinse Cannabis consistently held the 6th rank across the observed months, suggesting a steady demand for their products in this segment. Meanwhile, in the Vapor Pens category, Sinse Cannabis started and ended strong, with a minor dip to rank 9 in February 2025, before climbing back to rank 8 in March 2025. This consistency in ranking, despite minor fluctuations, reflects a solid foothold in the Missouri market. It's noteworthy that Sinse Cannabis was not only present in the top 30 across all major categories in Missouri but also maintained competitive positions, which speaks to their brand strength and consumer loyalty in the state.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Sinse Cannabis experienced fluctuating rankings from December 2024 to March 2025, indicating a dynamic market presence. Initially ranked 6th in December 2024, Sinse Cannabis dropped to 8th in January 2025 but managed to recover slightly to 7th place by February and maintained this position through March. This fluctuation in rank is notable when compared to competitors like Good Day Farm, which consistently hovered around the 6th to 8th positions, and Vibe Cannabis (MO), which showed an upward trend, moving from 8th to 6th place by March. Meanwhile, Vivid (MO) maintained a strong and stable presence in the top 5 throughout the period. Despite the competitive pressure, Sinse Cannabis's sales demonstrated resilience, particularly in March, where they saw an uptick, suggesting effective strategies in countering the competitive dynamics and potentially capitalizing on market opportunities.

Notable Products

In March 2025, the top-performing product for Sinse Cannabis was Cherry Pie Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank from February and achieving a notable sales figure of 12,410. Blueberry Muffin (3.5g) in the Flower category held steady at the second position for the second consecutive month. Cap Junky (3.5g) also in the Flower category, rose to the third rank, improving from its previous fifth position in December. Jungle Cookies Pre-Roll 3-Pack (1.5g) emerged in March at the fourth rank, having not been ranked in prior months. Lemon Royale Pre-Roll 3-Pack (1.5g) entered the rankings for the first time as well, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.