Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

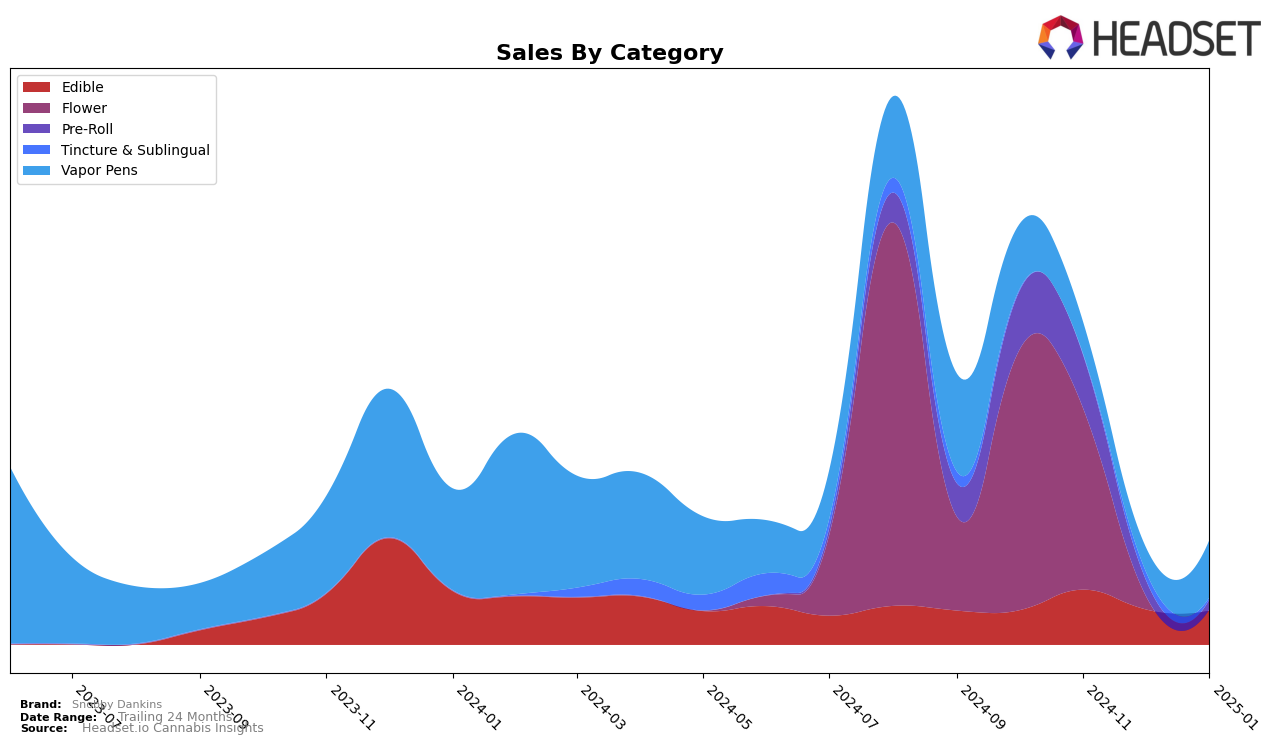

Snobby Dankins has shown varied performance across different product categories in New York. In the Edible category, the brand has maintained a relatively stable presence, ranking just outside the top 50 from October 2024 to January 2025. Despite a slight dip in sales from November to January, their consistent ranking indicates a steady consumer base. Conversely, the Flower category reveals a more concerning trend, with Snobby Dankins dropping out of the top 30 by December 2024. This decline suggests challenges in maintaining competitive market positioning within this popular segment.

Focusing on the Vapor Pens category, Snobby Dankins experienced fluctuating fortunes. After initially slipping out of the top 30 in November, they made a comeback by January 2025, suggesting some regained traction with consumers. However, the Pre-Roll category paints a less optimistic picture, as Snobby Dankins did not break into the top rankings after October. This absence from the top 30 indicates potential issues in market penetration or consumer preference within this category. Such insights are crucial for understanding the brand's overall market dynamics and identifying areas for strategic improvement.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Snobby Dankins has experienced notable fluctuations in its market position over recent months. While Snobby Dankins was ranked 76th in October 2024, it saw a decline to 90th in November, and was not in the top 20 in December, before rebounding to 73rd in January 2025. This volatility contrasts with competitors such as High Peaks, which maintained a relatively stable presence, ranking from 48th to 71st over the same period. Meanwhile, Dabgo showed a consistent performance, staying within the 70th to 79th range. Despite these challenges, Snobby Dankins' sales figures indicate a recovery in January, suggesting potential for regaining market share. The brand's ability to bounce back in January, coupled with the fluctuating ranks of competitors like Berkshire Roots and Hi*AF, highlights the dynamic nature of the vapor pen market in New York and underscores the importance of strategic positioning and marketing efforts to capitalize on growth opportunities.

Notable Products

In January 2025, the top-performing product for Snobby Dankins was Ice Cream Royale Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number 1 rank from December 2024 with sales of 185 units. Black Lemonade Live Resin Cartridge (1g) emerged strongly in the Vapor Pens category, securing the 2nd position. Ice Cream Royale Distillate Cartridge (1g) followed closely, ranking 3rd in the same category. Table Breakers Sour Blue Raspberry Gummies 10-Pack (100mg) experienced a slight drop to 4th place in the Edible category, down from its 2nd place in December. Cherry Banana OG Distillate Cartridge (1g) completed the top five with a 5th place rank, indicating a stable presence in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.