Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

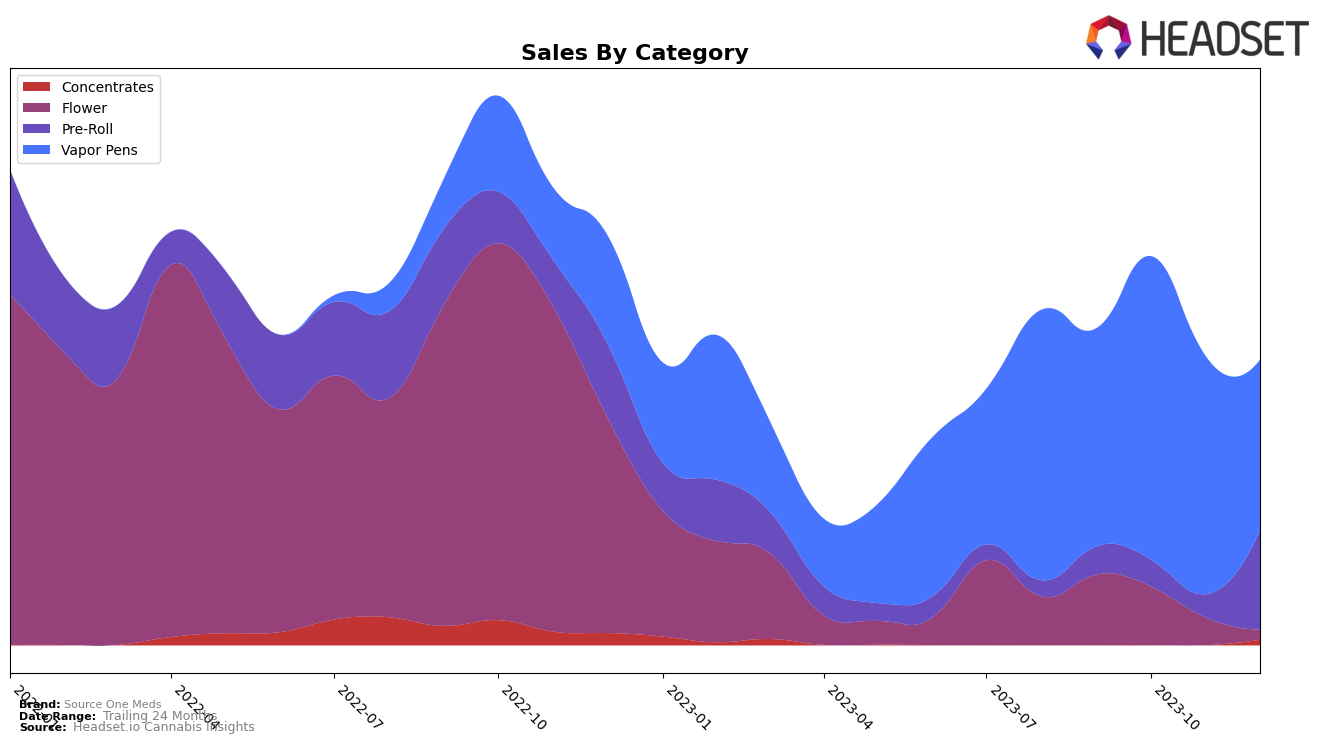

Source One Meds, a cannabis brand based in Arizona, has shown mixed performance across different product categories. In the Concentrates category, the brand was not in the top 20 for the last quarter of 2023, ending the year with a rank of 49. This could be interpreted as an area of opportunity for the brand to improve its market presence. In the Flower category, the brand saw a steady decline in its ranking, moving from 47 in September to 65 in December. This downward trend may indicate a need for the brand to reassess its strategy in this category.

On a brighter note, Source One Meds showed a significant improvement in the Pre-Roll category. Starting at rank 46 in September, the brand moved up to an impressive rank 19 by December. This positive movement suggests a growing consumer preference for the brand's Pre-Roll products. In the Vapor Pens category, the brand maintained a fairly stable position in the top 30 throughout the quarter, with ranks ranging from 18 to 26. This steady performance in a competitive category can be seen as a positive sign for the brand's market stability in Arizona.

Competitive Landscape

In the Vapor Pens category within Arizona, Source One Meds has experienced a fluctuating market position, moving from a rank of 23 in September 2023 to 18 in October, then slipping back to 21 in November and 26 in December. This indicates a somewhat unstable market presence when compared to competitors such as IO Extracts and The Pharm, which have maintained more consistent rankings within the top 25. However, Source One Meds has outperformed Sauce Essentials, which has consistently ranked outside the top 20. Notably, Venom Extracts has seen a significant drop in rank from 14 to 27, indicating a potential opportunity for Source One Meds to capitalize on. The sales trend for Source One Meds has been variable, with a peak in October followed by a decline, suggesting a need for strategies to stabilize and increase sales.

Notable Products

In December 2023, Source One Meds' top-performing product was the 'Mint Kush Pre-Roll (1g)', which rose from fourth place in November to first place, achieving sales of 2510 units. It was closely followed by the 'Blue Dream Pre-Roll (1g)', which also climbed from fifth to second place, selling 2377 units. The 'Red Velvet RTZ Pre-Roll (1g)', 'Spiked Mai Tai Pre-Roll (1g)', and 'Big Island Punch Infused Pre-Roll (0.5g)' were new entries in the top five, ranking third, fourth, and fifth, respectively. This shows a significant shift in customer preferences towards Pre-Rolls in December. It's interesting to note that all top five products were from the Pre-Roll category, indicating a strong market preference for this type of product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.