Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

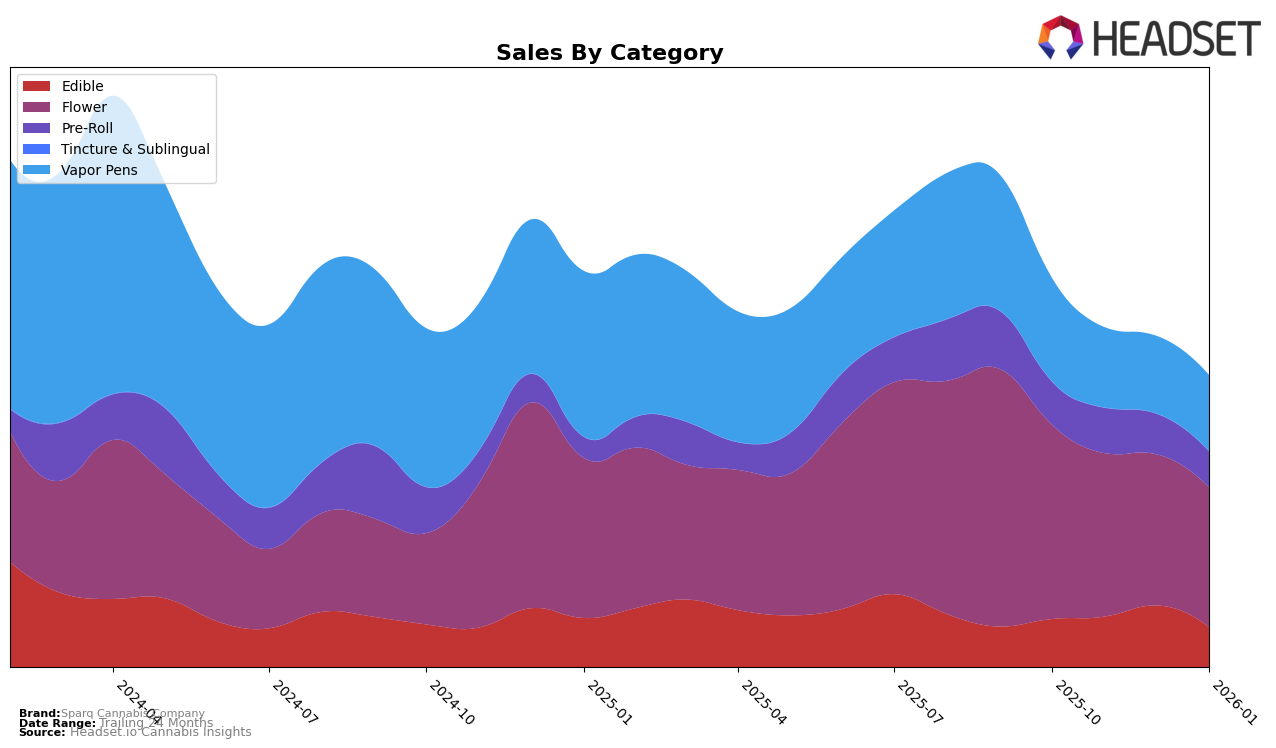

Sparq Cannabis Company has shown varied performance across different product categories in Massachusetts. In the Edible category, Sparq Cannabis Company maintained a presence within the top 30 brands, although there was a slight downward trend from 22nd place in October 2025 to 26th place by January 2026. This movement suggests a need for strategic adjustments to regain a stronger foothold. Conversely, the Flower category saw Sparq Cannabis Company ranked outside the top 30, with a consistent decline in sales from October to January, reflecting a potential challenge in maintaining competitiveness in this segment. The brand's presence in the Pre-Roll category is less prominent, as it did not break into the top 30, indicating potential areas for growth or reevaluation.

In terms of Vapor Pens, Sparq Cannabis Company experienced a slight decline in rankings, moving from 34th in October 2025 to 39th by January 2026. This gradual decline in both rank and sales could suggest increased competition or changing consumer preferences within Massachusetts. The brand's performance across these categories highlights the dynamic nature of the cannabis market and underscores the importance of adapting to market trends and consumer demands. The data suggests that while Sparq Cannabis Company maintains a presence in several categories, there are opportunities for growth and improvement, particularly in the Pre-Roll and Flower segments where they were not ranked in the top 30.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Sparq Cannabis Company has experienced fluctuating rankings, maintaining a position within the top 50 but showing a slight decline from October 2025 to January 2026. Sparq Cannabis Company ranked 35th in October 2025 and slipped to 42nd by January 2026. This trend is indicative of a competitive market where brands such as Cheech & Chong's and Old Pal have shown varying degrees of stability and decline, respectively. Notably, Cheech & Chong's maintained a stronger position, starting at 23rd in October 2025 and ending at 41st in January 2026, while Old Pal consistently dropped in rank over the same period. Meanwhile, Local Roots also saw a decline, falling from 40th to 50th. These shifts highlight the dynamic nature of the market, where Sparq Cannabis Company faces challenges in maintaining its rank amidst competitors who are also experiencing their own fluctuations in sales and rankings.

Notable Products

In January 2026, Pink Runtz (3.5g) from Sparq Cannabis Company maintained its top position in sales with a notable figure of $1710, continuing its dominance from previous months. Warheads Pre-Roll (1g) emerged as the second best-selling product, marking its debut in the rankings. Sour Strawberry Fast Acting Gummies 20-Pack (100mg) climbed up to third place from fifth in December 2025, showing a positive trend. Moondawg OG Distillate Cartridge (1g) secured the fourth spot, while Candy Sparqs (3.5g) dropped to fifth place from its previous fourth position in November and December 2025. Overall, the rankings reflect a dynamic shift in consumer preferences within Sparq Cannabis Company's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.