Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

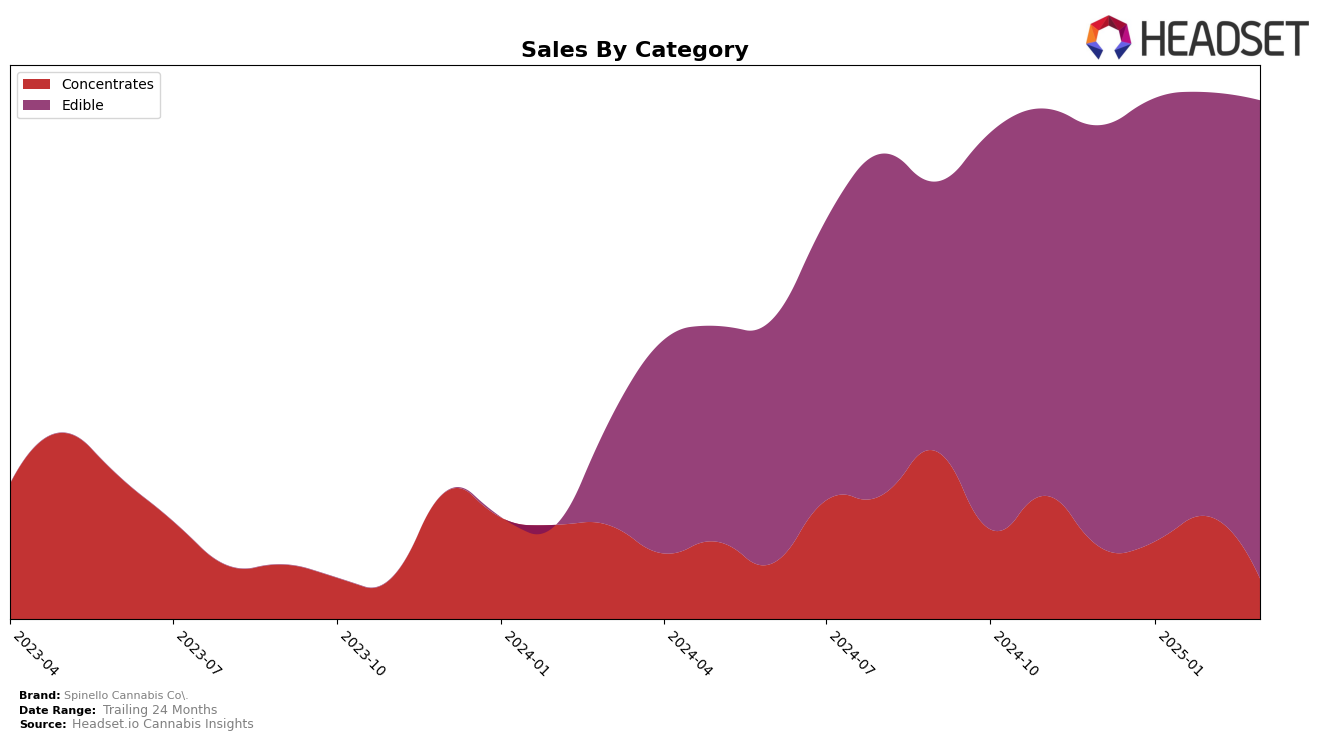

Spinello Cannabis Co. has shown varying performance across different states and product categories. In Colorado, the brand has consistently improved its ranking in the Edible category, moving from 26th place in December 2024 to 23rd by March 2025. This upward trend is indicative of a positive reception and growing market presence in the state. In contrast, their performance in the Edible category in Arizona has not been as strong, with the brand failing to enter the top 30 rankings over the same period. This suggests potential challenges in capturing market share in Arizona, which could be due to various factors such as competition or consumer preferences.

In British Columbia, Spinello Cannabis Co. has made significant strides in the Concentrates category, improving from 41st place in December 2024 to just outside the top 30 by February 2025. This improvement highlights a growing acceptance and demand for their concentrates in the province. Despite not being in the top 30 by March 2025, the upward movement suggests potential for future growth. The sales figures in British Columbia also reflect a notable increase, particularly from January to February 2025, indicating a positive market response to their products. Overall, while Spinello Cannabis Co. shows promising growth in certain areas, there are still challenges to address in others to achieve a more balanced and robust market presence.

Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, Spinello Cannabis Co. has shown a steady upward trend in rankings from December 2024 to March 2025, moving from 26th to 23rd position. This improvement is notable given the fluctuating performances of its competitors. For instance, NFuzed, which started at 16th place in December, dropped to 25th by March, indicating a significant decline in their market position. Meanwhile, Billo has been on an upward trajectory, climbing from 30th to 22nd, surpassing Spinello in the latest ranking. PAX also shows a volatile pattern, missing from the rankings in January but reappearing at 21st in March. Despite these shifts, Spinello's consistent sales growth, especially in March, positions it as a resilient player in the market, although it faces stiff competition from brands like Billo, which have shown more aggressive rank improvements.

Notable Products

In March 2025, Spinello Cannabis Co.'s top-performing product was the Blueberry Rosin Gummies 10-Pack (100mg), which climbed to the number one spot from third place in February, achieving a notable sales figure of 2144 units. The Mango Rosin Gummies 10-Pack (100mg) fell to second place after consistently holding the top rank for the previous three months. The Peach Rosin Gummies 10-Pack (100mg) maintained a steady presence in the top three, securing the third position. Sour Blueberry Hash Rosin Gummy (100mg) improved its rank to fourth, showing a positive trend from December 2024. A new entry, Sour Mango Gummy (100mg), debuted at fifth place, indicating a growing interest in sour-flavored edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.