Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

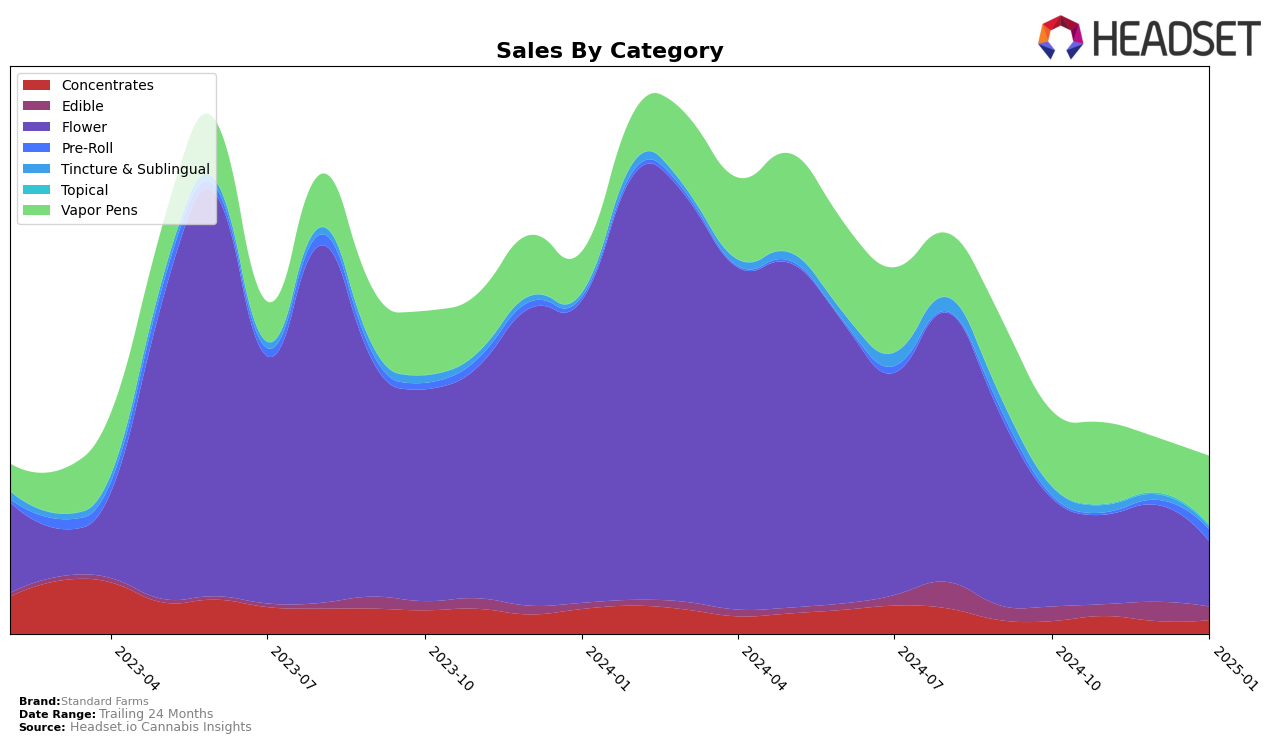

Standard Farms has shown a mixed performance across categories in Massachusetts. In the Concentrates category, the brand has made a steady climb, improving from the 51st position in October 2024 to the 44th by January 2025. This upward trajectory suggests a growing acceptance and preference for their concentrates. However, in the Flower category, the brand has seen a decline, dropping from 44th place in October to 54th in January, indicating potential challenges in maintaining competitiveness or consumer interest in this segment. Meanwhile, their Vapor Pens have experienced a noteworthy surge, moving from the 81st spot in October to 60th by January, possibly driven by a significant increase in sales from December to January. Interestingly, they entered the Pre-Roll category rankings only in January 2025 at 97th, suggesting either a new product launch or increased market penetration.

In Ohio, Standard Farms has maintained a relatively stable presence in the Concentrates category, consistently ranking in the low 20s over the observed months. This stability points to a solid foothold in the concentrates market. The brand's performance in the Edible category has been less stable, with rankings fluctuating slightly but remaining within the 30s. Notably, their Flower category performance was inconsistent, with the brand dropping out of the top 30 in November and January, which could indicate supply issues or shifting consumer preferences. In the Tincture & Sublingual category, Standard Farms maintained a strong position, consistently ranking in the top 10 until December, suggesting a robust product offering. However, their Vapor Pens have seen a decline, moving from 25th in October to 32nd in January, which might reflect increased competition or market saturation.

Competitive Landscape

In the Massachusetts flower category, Standard Farms has experienced a notable decline in both rank and sales over the past few months, indicating potential challenges in maintaining its competitive edge. From October 2024 to January 2025, Standard Farms' rank slipped from 44th to 54th, while its sales decreased significantly. This downward trend contrasts with competitors like Harbor House Collective, which improved its rank from 48th to 46th and saw an increase in sales during the same period. Similarly, The Botanist showed a fluctuating yet ultimately more stable performance, peaking at 46th rank in December 2024. Meanwhile, Common Buds and LIT also demonstrated resilience with relatively stable sales figures, suggesting that Standard Farms may need to reassess its strategies to regain its competitive position in this market.

Notable Products

In January 2025, the top-performing product from Standard Farms was Frosty Lights Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with sales of 1,440 units. Georgia Pie Pre-Roll (0.5g) followed closely, dropping to the second position after leading in December 2024. Cheetah Piss x Bahama Mama Pre-Roll (1g) debuted in January 2025 with a strong performance, ranking third. Dionysus Pre-Roll (1g) maintained its fourth position from December 2024, indicating steady demand. Emerald Express Pre-Roll (1g) rounded out the top five, marking its first appearance in the rankings for January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.