Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

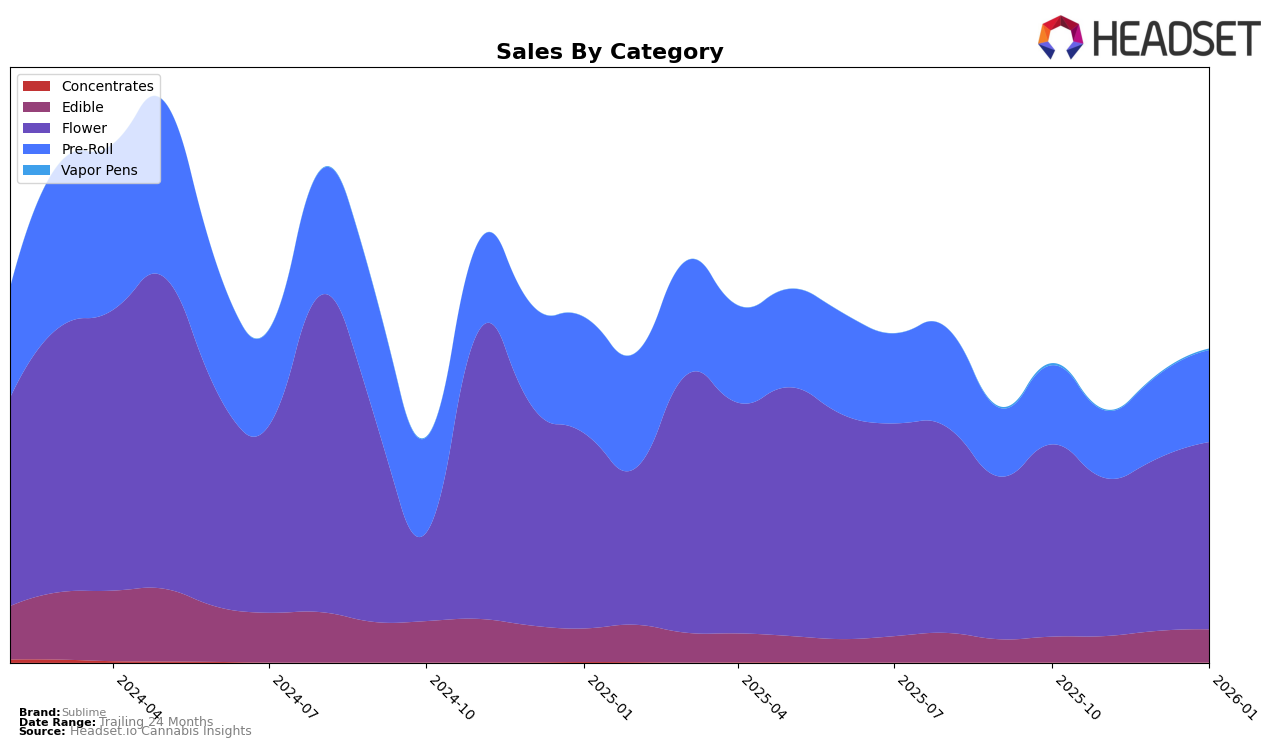

Sublime's performance in the Arizona market demonstrates notable resilience and growth in the Edible and Pre-Roll categories. In the Edible category, Sublime consistently maintained a presence within the top 30, with a slight improvement from the 21st position in October 2025 to 20th by January 2026. This upward trend is supported by a steady increase in sales over the months, indicating a growing consumer preference. Conversely, in the Flower category, Sublime did not secure a spot in the top 30 in December 2025 or January 2026, suggesting a competitive market landscape or potential shifts in consumer demand. Meanwhile, their performance in the Pre-Roll category showed a positive trajectory, climbing from 22nd in October 2025 to 17th by January 2026, bolstered by robust sales figures.

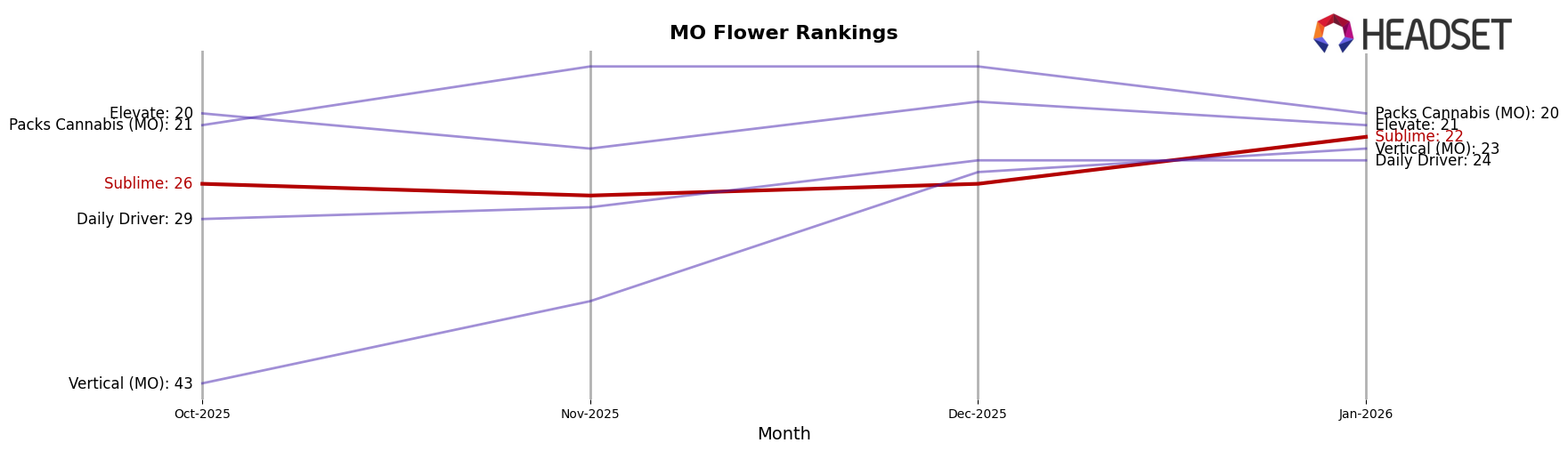

In Missouri, Sublime's Flower category exhibits a consistent presence within the top 30 rankings, showing a promising climb from the 26th position in October 2025 to 22nd in January 2026. This progression is supported by a significant uptick in sales, reflecting strong market acceptance. However, the Pre-Roll category tells a different story, with fluctuating rankings, yet a notable improvement from 39th in November 2025 to 28th by January 2026. The sales data suggests a rebound in consumer interest, which could be attributed to strategic marketing or product adjustments. Despite the challenges in some categories, Sublime's overall performance in Missouri indicates a potential for further growth and market penetration.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Sublime has shown a promising upward trajectory in recent months. From October 2025 to January 2026, Sublime improved its rank from 26th to 22nd, indicating a positive shift in market position. This improvement is particularly notable when compared to Daily Driver, which saw a similar upward trend but remained slightly behind Sublime, peaking at 24th. Meanwhile, Elevate and Packs Cannabis (MO) have been strong competitors, consistently maintaining higher ranks, although Packs Cannabis experienced a slight dip from 16th to 20th in January 2026. Interestingly, Vertical (MO) made significant strides, jumping from 43rd in October to 23rd in January, closely trailing Sublime. Despite these competitive pressures, Sublime's sales have shown a steady increase, suggesting effective market strategies and growing consumer preference, positioning it well for further growth in the Missouri market.

Notable Products

In January 2026, Sublime's top-performing product was the Hot Rod - Purple Urkle Infused Pre-Roll, which climbed to the number one rank with sales reaching 6325 units. The Hot Rod - Blue Dream Infused Pre-Roll saw significant improvement, advancing from fourth place in December to second place in January. The Hot Rod - Berry Blackout Infused Pre-Roll maintained its third-place ranking from the previous month. The Hot Rod - GDP Infused Pre-Roll experienced a drop, falling from first place in December to fourth in January. Lastly, the Hot Rod - Cherry Dream 91 Infused Pre-Roll held steady at fifth place, showing consistent performance over the last two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.