Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

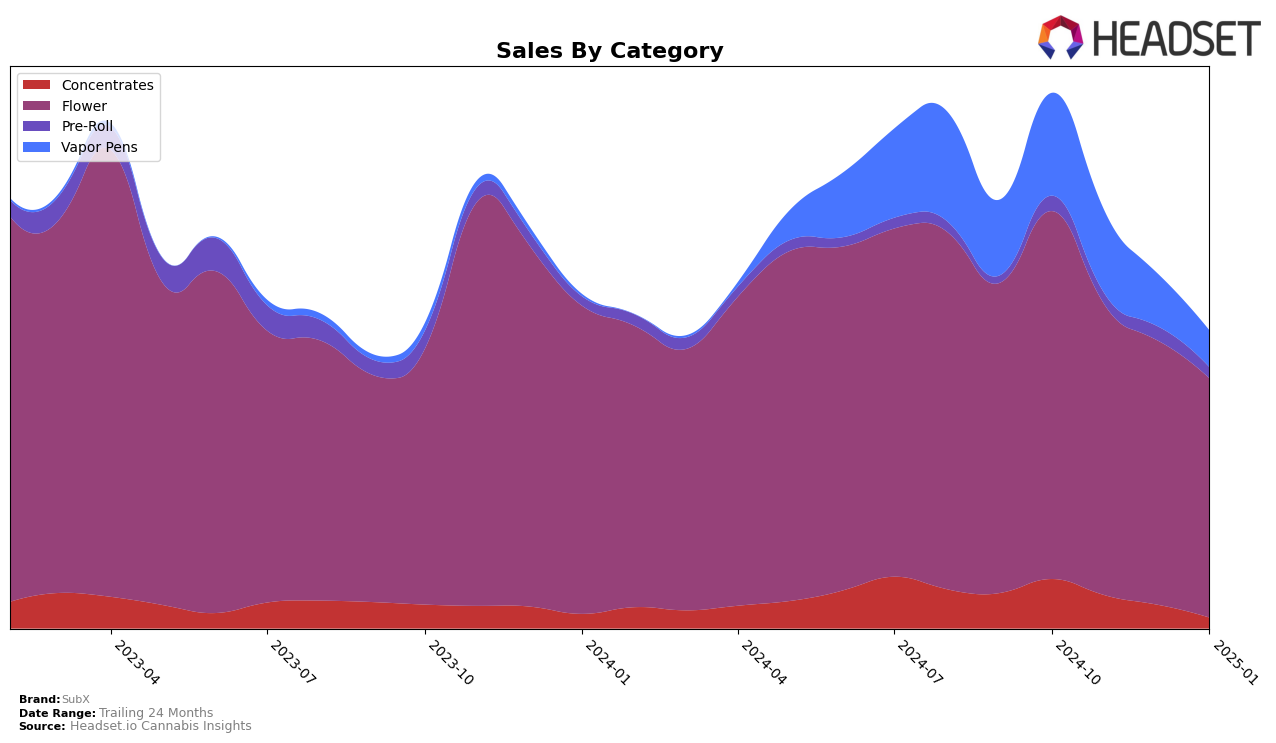

SubX's performance in the state of Washington has shown varied trends across different product categories over the past few months. In the Concentrates category, SubX has experienced a notable decline, with its ranking dropping from 36th in October 2024 to 85th by January 2025. This downward trend is accompanied by a significant decrease in sales, indicating potential challenges in maintaining market share in this segment. Conversely, in the Flower category, SubX has managed to sustain a relatively stable presence, ranking 17th in October 2024 and gradually moving to 29th by January 2025. Despite the drop in rank, the Flower category remains a stronghold for SubX, with sales figures reflecting a more moderate decline compared to Concentrates. This suggests that while there is a downward trajectory, the brand still holds a competitive position in the Flower market.

In the Vapor Pens category, SubX has faced similar challenges to those in Concentrates, with its ranking slipping from 60th in October 2024 to 92nd by January 2025. The decline in rank and sales in both Concentrates and Vapor Pens could indicate increasing competition or shifting consumer preferences in Washington. Notably, SubX failed to secure a position within the top 30 brands in any category by January 2025, which may signal the need for strategic adjustments to regain market traction. While specific sales figures for January 2025 highlight some of the pressures faced, the overall trends suggest that SubX may need to explore new strategies or product innovations to enhance its competitive standing across these categories.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, SubX has experienced a notable decline in rank from October 2024 to January 2025, dropping from 17th to 29th. This downward trend in rank coincides with a consistent decrease in sales over the same period. In contrast, brands like Sweetwater Farms initially maintained a higher rank than SubX in October 2024, but also saw a significant drop to 30th by January 2025, suggesting a similar sales challenge. Meanwhile, Plaid Jacket showed resilience, maintaining a relatively stable position, ending at 27th in January 2025, which could indicate a more effective strategy in retaining market share. Additionally, Falcanna improved its rank significantly, moving up to 28th in January 2025, potentially capturing some of the market share lost by SubX and others. These shifts highlight the competitive pressures SubX faces and underscore the importance of strategic adjustments to regain its footing in the Washington Flower market.

Notable Products

In January 2025, SubX's top-performing product was Orange Poison (3.5g) in the Flower category, maintaining its first-place ranking from December 2024, with sales reaching 1523 units. I95 Cookies (3.5g) held steady in second place, consistent with its position in December. GMO (3.5g) remained in third place, mirroring its previous month's rank as well. I-95 Cookies (1g) improved its position, moving from fifth to fourth place. Notably, Orange Poison Pre-Roll (1g) entered the rankings in January, achieving a fifth-place spot in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.