Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

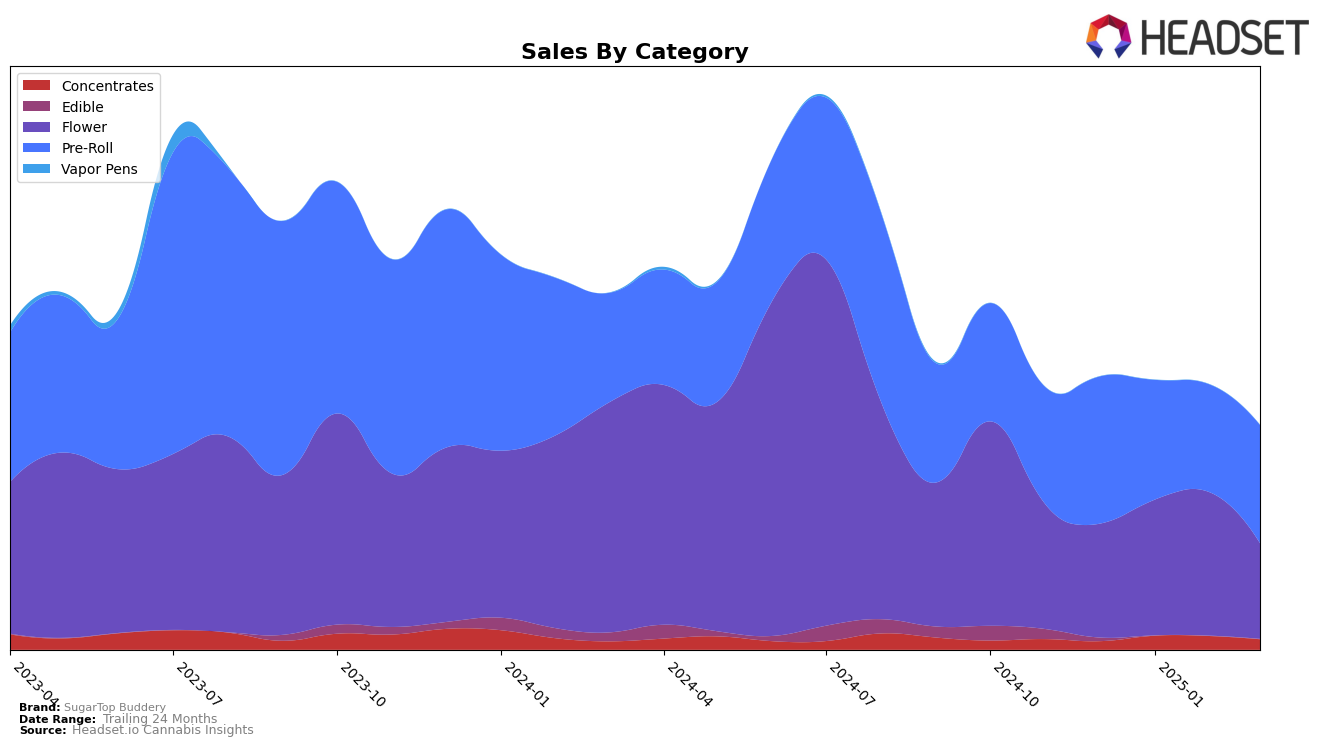

SugarTop Buddery has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand did not make it into the top 30 rankings from December 2024 through March 2025, indicating a potential area for growth or increased competition in this segment. Meanwhile, their Flower category performance has been more dynamic, with the brand climbing from 59th in December 2024 to a high of 36th in February 2025, before dropping to 65th in March 2025. This fluctuation suggests a volatile market presence and potential challenges in maintaining a consistent ranking.

In the Pre-Roll category, SugarTop Buddery has maintained a relatively stable position, ranging from 23rd in December 2024 to 27th in March 2025. This consistency, despite minor fluctuations, indicates a steady demand for their pre-roll products in Oregon. However, the decline in sales from December to February, with a slight recovery in March, suggests a need to investigate market trends or consumer preferences that could be influencing these changes. The brand's ability to maintain a top 30 position in this category is a positive indicator of their standing in the pre-roll market, despite the challenges faced in other categories.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, SugarTop Buddery has experienced a slight decline in rank from December 2024 to March 2025, moving from 23rd to 27th position. Despite this, SugarTop Buddery maintains a competitive edge with sales figures consistently higher than several competitors. For instance, while Grown Rogue and East Fork Cultivars have seen fluctuating ranks and lower sales, SugarTop Buddery has managed to keep its sales robust. Notably, Emerald Extracts has shown an upward trend, surpassing SugarTop Buddery in rank by March 2025, indicating a potential shift in consumer preference. Meanwhile, Altered Alchemy has also improved its position, suggesting increased competition. These dynamics highlight the importance for SugarTop Buddery to innovate and potentially adjust its marketing strategies to regain its competitive standing in the Oregon market.

Notable Products

In March 2025, the top-performing product from SugarTop Buddery was Cake Bomb (Bulk) in the Flower category, maintaining its number one rank from February 2025 with sales of 2089 units. Following closely in the Pre-Roll category, Mondo Bat - Blackberry Gelato Pre-Roll (1g) secured the second spot, while Mondo Bat - Grape Sour Creme Pre-Roll (1g) took third place. Twin Bats - White Runtz Pre-Roll 2-Pack (1g) and Mondo Bat - Reign Man Pre-Roll (1g) ranked fourth and fifth respectively, both showing strong performances without prior rankings in earlier months. Notably, Cake Bomb (Bulk) demonstrated consistent dominance, while the Pre-Roll products emerged as new top contenders in March. These rankings highlight a shift in consumer preference towards Pre-Roll products compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.