Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

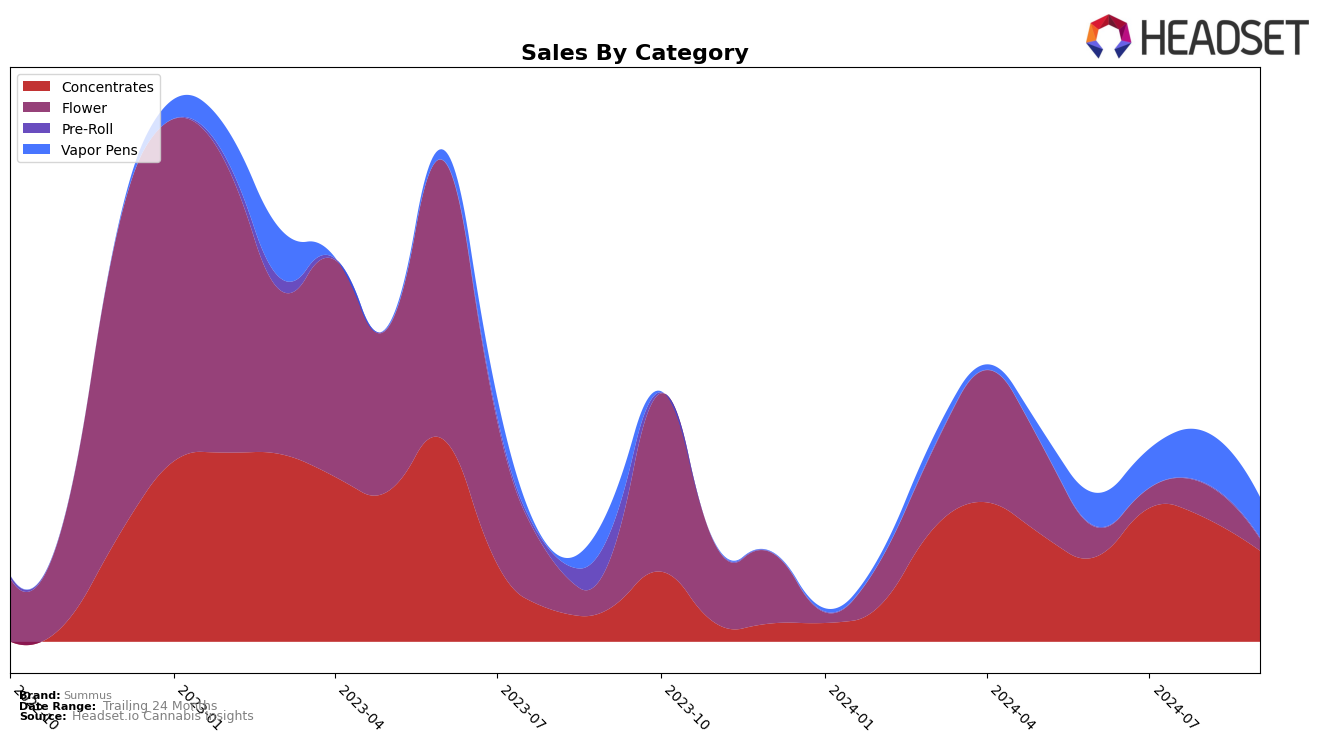

In the state of Arizona, Summus has shown some interesting movement across different cannabis product categories. In the Concentrates category, Summus has consistently maintained a presence within the top 30 brands, with rankings fluctuating slightly from 32nd in June 2024 to 29th by September 2024. This indicates a relatively stable performance in this category, despite a noticeable dip in sales from July to September. Meanwhile, in the Flower category, Summus struggled to break into the top 30, with rankings missing for July and September, suggesting challenges in gaining a foothold in this highly competitive segment.

Conversely, the Vapor Pens category has seen Summus maintain a steady position, consistently ranking 66th in June and July before slightly improving to 64th in August, and then returning to 66th in September. This suggests a stable but limited market presence in this category. The sales trajectory for Vapor Pens shows an increase from June to August, followed by a decline in September, which could indicate seasonal variations or competitive pressures. Overall, the brand's performance in Arizona highlights both areas of strength and opportunities for growth, particularly in categories where they have yet to break into the top 30.

Competitive Landscape

In the competitive landscape of concentrates in Arizona, Summus has shown a dynamic performance over recent months, reflecting its resilience and adaptability in a fluctuating market. Despite a slight dip in rank from 26th in July 2024 to 29th in September 2024, Summus has maintained a strong presence, outperforming brands like Abundant Organics and Big Bud Farms, which have seen more volatile rankings. Notably, Lumen has made significant strides, climbing from 48th in June to 27th in September, potentially posing a future challenge to Summus. However, Summus's sales figures indicate a robust performance, with a peak in July, suggesting effective marketing strategies or product offerings that resonate well with consumers. As the market continues to evolve, Summus's ability to sustain its sales momentum will be crucial in maintaining or improving its competitive position.

Notable Products

In September 2024, SuperBoof Live Hash Rosin (1g) emerged as the top-performing product for Summus, climbing from its consistent second-place position in June and August to first place, with a notable sales figure of 500 units. Orange Smoothie Live Hash Rosin (1g) made a significant leap to the second position from its fifth-place debut in August. The Apple Tartz Live Hash Rosin Disposable (0.5g) and Blueberry Sunset Live Hash Rosin Disposable (0.5g) both entered the rankings for the first time, sharing the third position. Strudel Kush Live Hash Rosin Disposable (0.5g) closely followed in fourth place. This shift indicates a growing consumer preference for vapor pens in addition to traditional concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.