Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

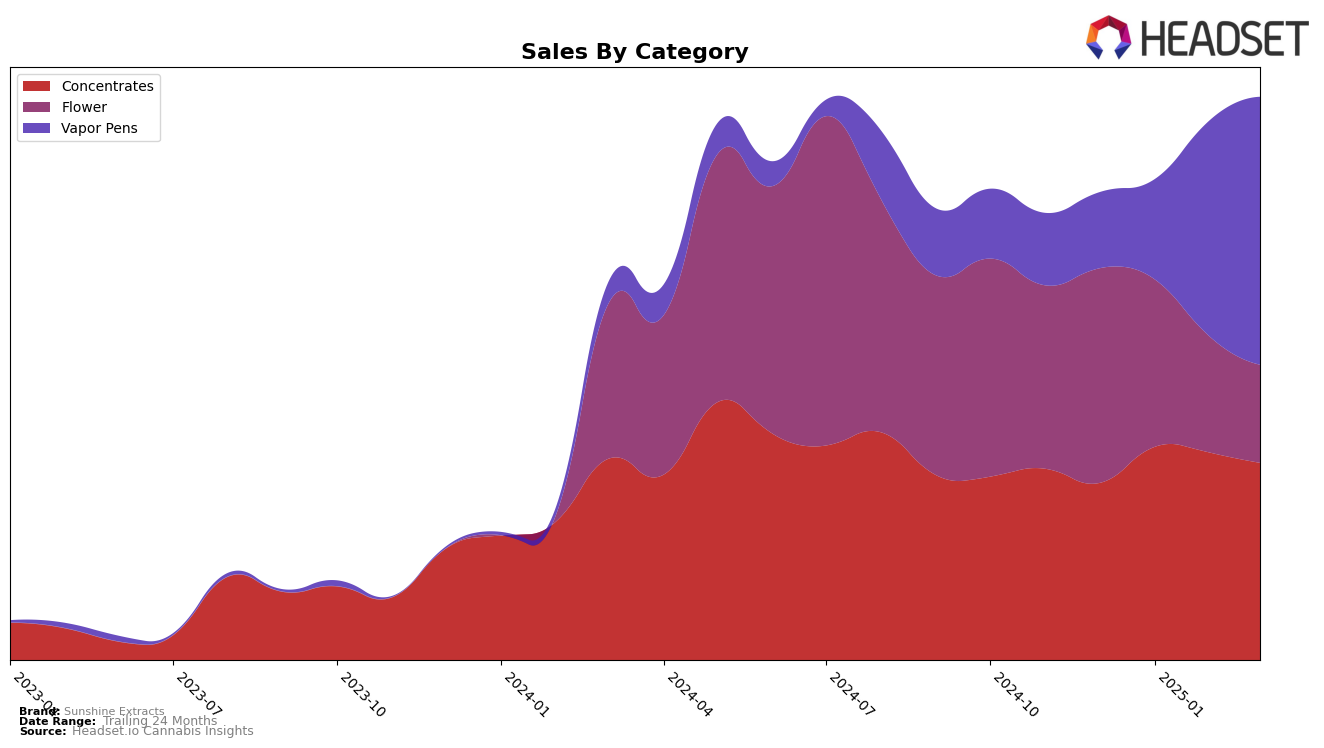

Sunshine Extracts has shown a notable performance in the Colorado market, particularly in the Concentrates category, where they have consistently improved their ranking from 15th in December 2024 to 10th by March 2025. This upward trend is accompanied by a steady sales performance, although there was a slight dip in March compared to January. On the contrary, their presence in the Flower category has not been as strong, with rankings falling outside the top 30 in recent months. This indicates a need for strategic adjustments to regain market presence in this category.

In the Vapor Pens category, Sunshine Extracts has made significant strides, climbing from the 59th position in December 2024 to 28th by March 2025 in Colorado. This improvement is mirrored by a substantial increase in sales, suggesting that their efforts in this category are gaining traction. However, the absence from the top 30 in the Flower category highlights a potential area for growth and a need to reassess their strategy to capture a larger share of the market. These dynamics underline the importance of diversifying their product offerings and enhancing their competitive edge across all categories.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Sunshine Extracts has shown a dynamic shift in its market position from December 2024 to March 2025. Initially ranked 59th in December 2024, Sunshine Extracts made significant strides, climbing to 28th by March 2025. This upward trajectory indicates a positive reception and growing market presence. In contrast, competitors like 710 Labs and Sano Gardens have experienced fluctuating ranks, with 710 Labs peaking at 17th in February 2025 before dropping to 26th in March, and Sano Gardens consistently declining from 19th to 30th over the same period. Meanwhile, Dutch Botanicals has maintained a relatively stable rank, slightly improving from 33rd to 27th. Sunshine Extracts' ability to surpass brands like Haze (CO), which ended March 2025 at 29th, highlights its competitive edge and potential for continued growth in the Colorado vapor pen market.

Notable Products

In March 2025, Sunshine Extracts' top-performing product was Pink Zugar Live Rosin Disposable (0.5g) in the Vapor Pens category, securing the number one spot with sales of 843 units. Gakolina Live Rosin Disposable (0.5g) followed closely in the second position. Garlic Drip Live Rosin Disposable (0.5g) experienced a slight drop from first place in February to third in March. Gelonade (3.5g) in the Flower category improved its rank from fifth in February to fourth in March. Meanwhile, Rainbow Belts Live Rosin Disposable (0.5g) maintained a steady performance, ranking fifth in March as it did in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.