Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

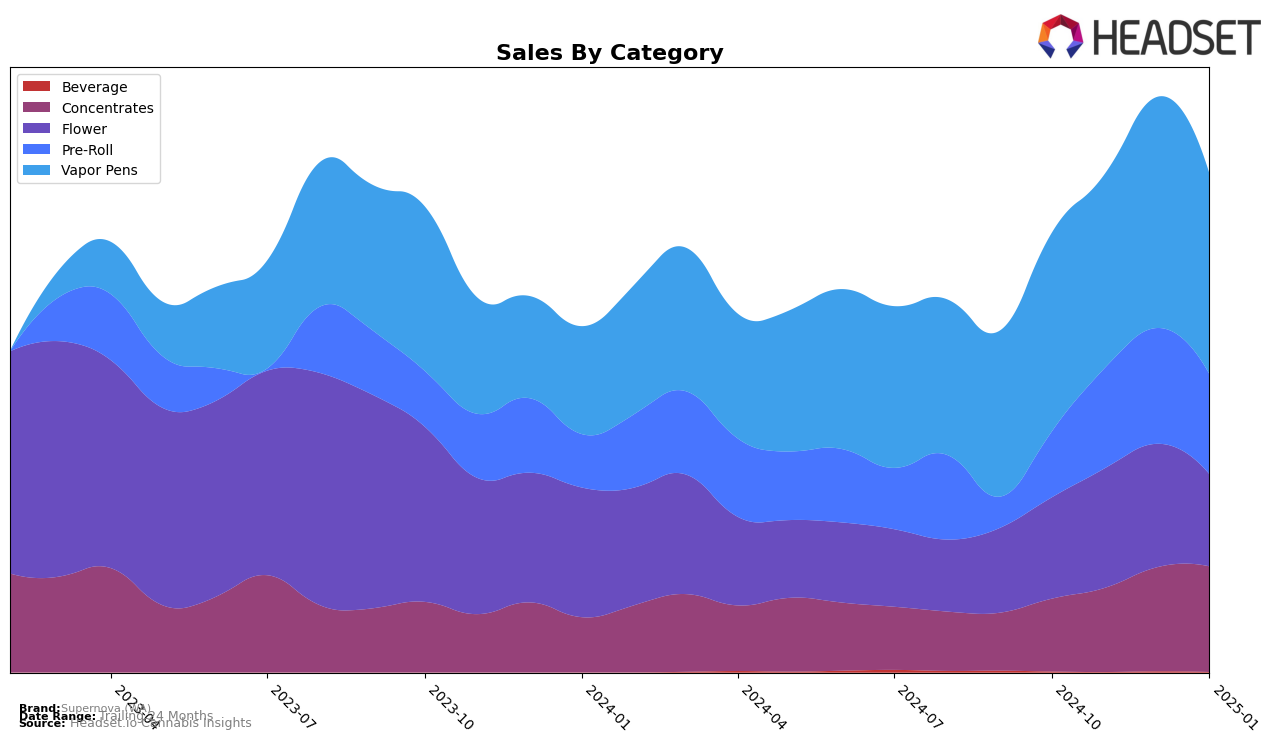

Supernova (WA) has shown notable progress in the Concentrates category within Washington, moving from a rank of 31 in October 2024 to 21 by January 2025. This upward trajectory indicates a strengthening market presence and suggests that their product offerings in this category are resonating well with consumers. In contrast, their performance in the Flower category has not been as robust, as they were not ranked in the top 30 in October 2024 and have seen fluctuating positions, ending at 94 in January 2025. This suggests potential challenges in maintaining competitive edge or consumer interest in this particular category.

The Pre-Roll category also reflects a positive trend for Supernova (WA), with a significant leap from rank 80 in October 2024 to 41 by January 2025 in Washington. This improvement points to effective strategies or product enhancements that have captured consumer attention. However, the Vapor Pens category presents a mixed picture; while there was an improvement from rank 45 to 34 by December 2024, a slight decline to 39 in January 2025 suggests some volatility or competitive pressure in this segment. Understanding these dynamics can provide insights into the brand's strategic focus and areas for potential growth or reevaluation.

Competitive Landscape

In the Washington vapor pens market, Supernova (WA) has demonstrated a dynamic performance in recent months, with notable fluctuations in its ranking. Starting at 45th place in October 2024, Supernova (WA) climbed to 34th in December 2024, showcasing a positive trend before slightly declining to 39th in January 2025. This movement indicates a competitive positioning amidst strong contenders like Hitz Cannabis, which consistently maintained a higher rank, peaking at 28th in November 2024. Meanwhile, Tasty Terps showed resilience, ending January 2025 at 31st, suggesting a robust market presence. Despite these challenges, Supernova (WA)'s sales trajectory suggests potential for growth, especially given its December 2024 peak, which surpassed its October 2024 sales figures. This indicates that while Supernova (WA) faces stiff competition, it has the capacity to enhance its market position with strategic initiatives.

Notable Products

In January 2025, the top-performing product for Supernova (WA) was Alien Rock Candy Wax (1g) in the Concentrates category, maintaining its number one rank from the previous months with sales reaching 1445 units. First Class Funk Wax (1g) climbed back to the second position from fourth place in December 2024, showing a significant increase in sales to 1309 units. Pink Certz Wax (1g) held steady in the third position, although it had previously been second in December 2024. Pineapple Fruz Wax (1g) made a notable entry into the rankings at fourth place, having not been ranked in December 2024. Jealousy Wax (1g) emerged in the fifth position, marking its debut in the rankings for January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.