Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

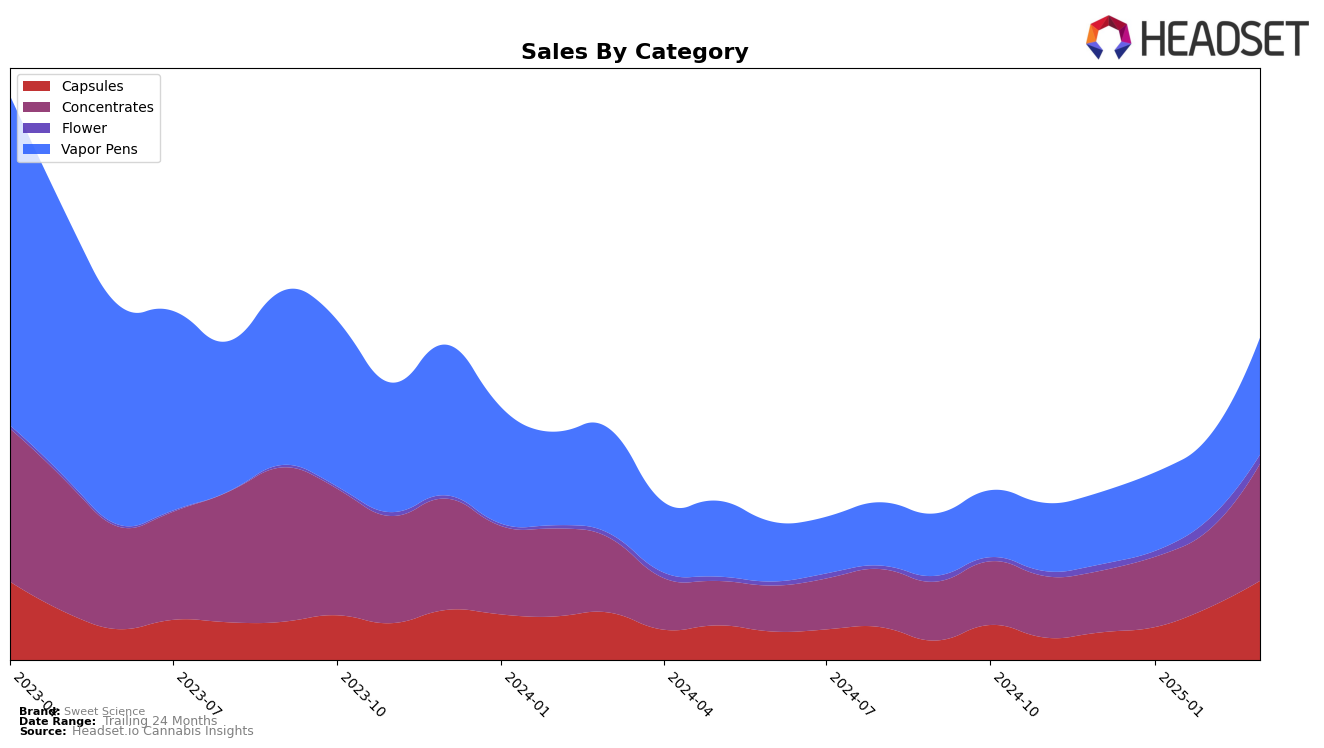

Sweet Science has shown a consistent and impressive performance in the Arizona cannabis market, particularly in the Capsules category where it has maintained a solid second place ranking from December 2024 through March 2025. This stability in ranking is matched by a significant upward trend in sales, with figures more than doubling from December to March. In the Concentrates category, Sweet Science has demonstrated a positive trajectory, climbing from 24th place in December to 12th place by March, indicating a growing consumer preference for their products in this segment. However, in the Flower category, Sweet Science has not yet broken into the top 30, suggesting potential areas for growth and improvement.

In the Vapor Pens category, Sweet Science has maintained a steady presence, holding onto the 40th spot in February and March 2025. Despite not breaking into the top rankings, the brand has experienced a consistent increase in sales, signaling a steady demand for their vapor pen products in Arizona. The absence of a top 30 ranking in the Flower category for the months of December, January, and March indicates a challenge for Sweet Science to capture more market share in this competitive segment. This mix of stable performance in some categories and room for growth in others paints a nuanced picture of Sweet Science's market positioning and potential strategies for future success.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, Sweet Science has shown a notable upward trajectory in its rankings from December 2024 to March 2025. Initially ranked 24th in December, Sweet Science improved its position to 12th by March. This positive trend suggests a significant increase in consumer preference and market penetration, as evidenced by a steady rise in sales figures over the same period. In contrast, Shango experienced fluctuations, dropping out of the top 20 in February before rebounding to 13th in March. Meanwhile, High Grade maintained a relatively stable position, hovering around the top 10, though it saw a slight decline from 8th in January to 11th in March. Tru Infusion and Achieve also demonstrated competitive stability, with Achieve notably climbing to 10th place in March. Sweet Science's ascent in rank and sales highlights its growing influence and competitiveness in the Arizona concentrates market, positioning it as a brand to watch closely in the coming months.

Notable Products

In March 2025, Gelato Shatter (Half Gram) emerged as the top-performing product for Sweet Science, leading the sales with a significant figure of 2022.0. GSC Shatter (0.5g) followed closely in second place, showcasing a strong presence in the Concentrates category. THC Capsules (70mg), previously holding the top rank in January and February 2025, fell to third place, indicating a shift in consumer preference towards concentrates. Skywalker OG Distillate Cartridge (1g) climbed to fourth position from its consistent fifth place in earlier months, suggesting a growing interest in vapor pens. Tigers Blood Distillate Cartridge (1g) held steady in the top five, moving from third in February to fifth in March, maintaining its appeal in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.