Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

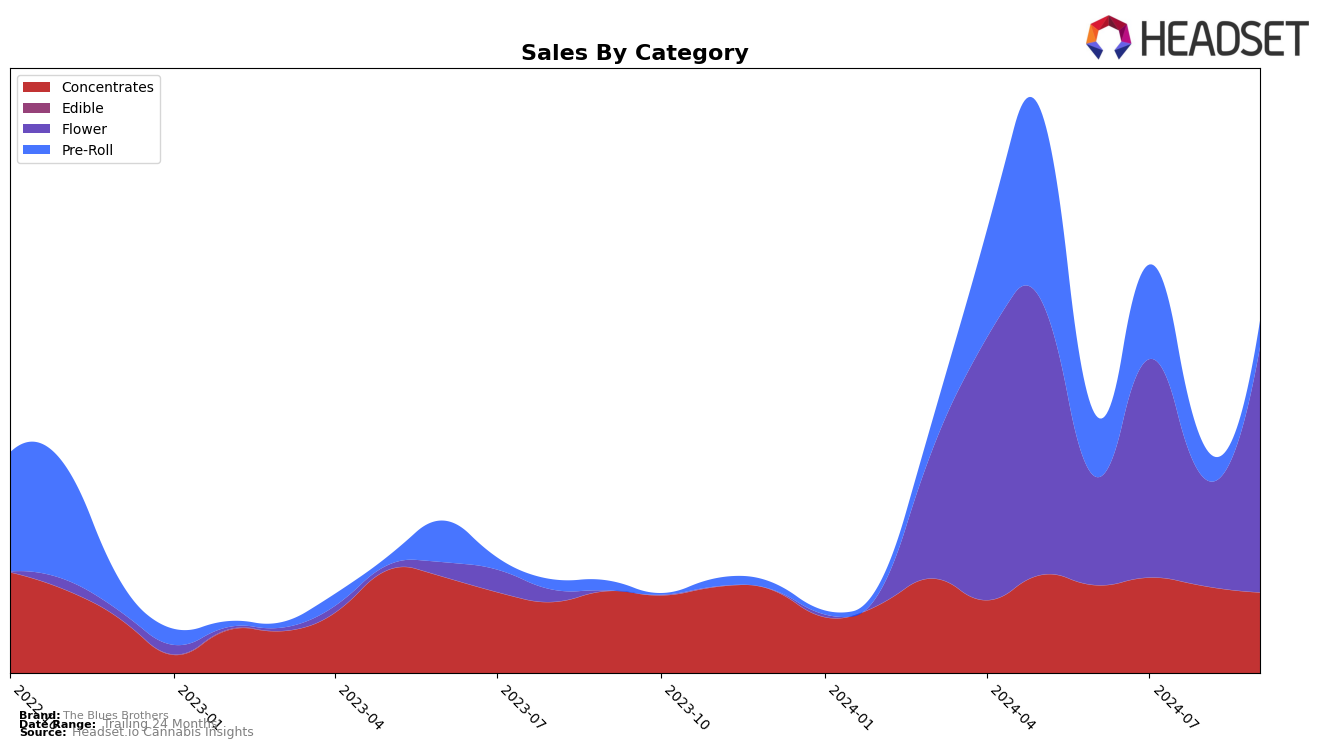

The Blues Brothers brand has shown varied performance across different states and product categories. In Massachusetts, the brand maintains a consistent presence in the concentrates category, ranking 29th from July to September 2024. Despite a slight drop in sales from $34,752 in July to $29,339 in September, their ability to stay within the top 30 is notable. This consistency could indicate a loyal consumer base or effective marketing strategies within the state. However, the brand's position in this category suggests room for growth, as they remain at the lower end of the top 30 rankings.

In Maryland, The Blues Brothers brand has a more dynamic performance. Within the flower category, the brand's ranking fluctuated from the 38th position in July to 40th in September 2024, with a significant increase in sales from $79,494 in July to $89,301 in September. This upward sales trend, despite not breaking into the top 30, indicates growing consumer interest or expanded distribution. Conversely, in the pre-roll category, the brand was ranked 34th in July but failed to maintain a top 30 position in subsequent months, suggesting potential challenges in this segment.

Competitive Landscape

In the Maryland flower category, The Blues Brothers have experienced a fluctuating presence in the rankings from June to September 2024, with their rank moving from 43rd to 40th. Despite this modest improvement, they remain outside the top 30, indicating a need for strategic adjustments to gain more market share. Competitors like Verano and House of Kush have consistently outperformed The Blues Brothers, maintaining ranks in the low 30s and high 30s, respectively. Notably, Verano saw a significant sales spike in August, while House of Kush showed a strong recovery in September. Meanwhile, Grass dropped out of the top 20 after July, suggesting potential volatility in the market. For The Blues Brothers to enhance their competitive edge, focusing on consistent sales growth and strategic market positioning could be crucial, especially as they face strong competition from brands with higher sales figures and more stable rankings.

Notable Products

In September 2024, Blue Dream (3.5g) maintained its position as the top-performing product for The Blues Brothers, with sales reaching 1,115 units. Black Ice (3.5g) emerged as a strong contender, securing the second rank with impressive sales figures. Oreoz (3.5g) dropped to third place, showing a decline from its second position in August. Baby Blues - Blue Dream Pre-Roll 6-Pack (1.5g) entered the rankings at fourth place, highlighting its growing popularity. Calicouture (3.5g) fell to fifth place, a notable decline from its peak position in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.