Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

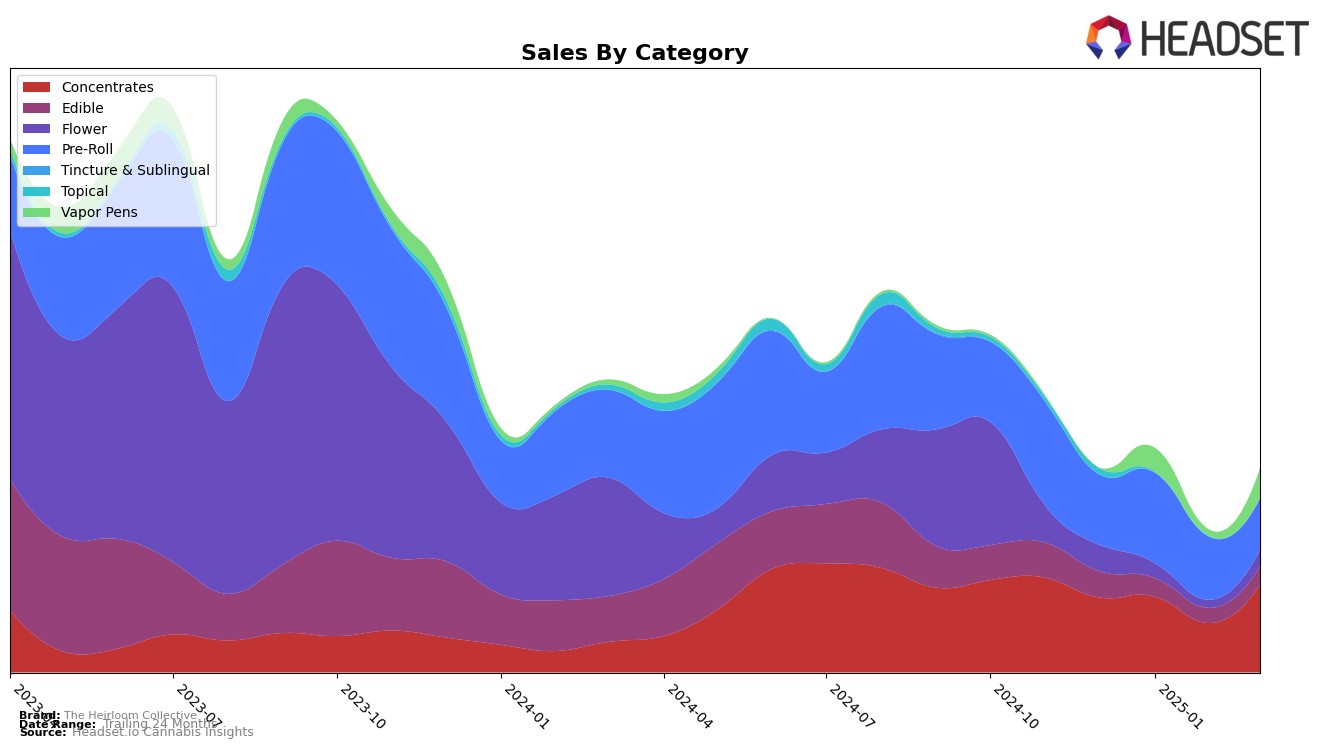

The Heirloom Collective has demonstrated a dynamic performance in the Massachusetts market, particularly within the Concentrates category. The brand maintained a steady position at 10th place in both December 2024 and January 2025, before experiencing a slight dip to 12th in February. However, March 2025 saw a notable recovery with a rise to 9th place, indicating a positive trajectory. This movement is underscored by a significant increase in sales from February to March, suggesting a strong rebound in consumer demand. In contrast, their performance in the Edible category reflects a struggle to break into the top 30, with rankings hovering just outside at 49th to 46th over the months, which could indicate a need for strategic adjustments in this segment.

In other categories, The Heirloom Collective's performance has been varied. The brand's Pre-Roll category started strong in January 2025 with a ranking of 45th, but subsequent months saw a decline, culminating in a 75th place in March. This downward trend might reflect increased competition or shifting consumer preferences. Meanwhile, in the Vapor Pens category, The Heirloom Collective was absent from the top 30 in December and February, only appearing in the rankings in January at 74th and improving to 68th in March. This sporadic presence suggests potential volatility or emerging opportunities within the Vapor Pens market segment. Overall, while The Heirloom Collective shows resilience and potential in certain categories, there are clear areas where strategic focus could enhance their market position.

Competitive Landscape

In the Massachusetts concentrates market, The Heirloom Collective has experienced notable fluctuations in its ranking over the past few months, reflecting shifts in competitive dynamics and consumer preferences. Starting at rank 10 in December 2024, The Heirloom Collective maintained its position in January 2025 but slipped to rank 12 in February, before recovering to rank 9 in March. This pattern suggests a competitive landscape where brands like Cloud Cover (C3) and Local Roots have shown resilience, with Local Roots notably improving from rank 17 in December to rank 8 by March. Meanwhile, Cultivators Classic consistently outperformed others, maintaining a top 5 position until March. The Heirloom Collective's sales trajectory mirrored its ranking volatility, with a dip in February followed by a significant rebound in March, indicating potential for recovery and growth amidst strong competition.

Notable Products

In March 2025, the top-performing product from The Heirloom Collective was the Mana Pre-Roll (1g), which climbed to the number one rank from fifth place in February, achieving notable sales of 2026 units. The Kitchen Sink Pre-Roll (1g), previously holding the top rank for three consecutive months, moved to second place with 1445 units sold. The Orange Crush Pre-Roll (0.75g) maintained a consistent presence, securing the third position in March with 878 units sold. Kitchen Sink Diamonds in Sauce (1g) emerged in fourth place, marking its first appearance in the rankings. The THC/CBN 1:1 Sleep Cube Gummies 20-Pack (100mg THC, 100mg CBN) rounded out the top five, indicating a growing interest in edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.