Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

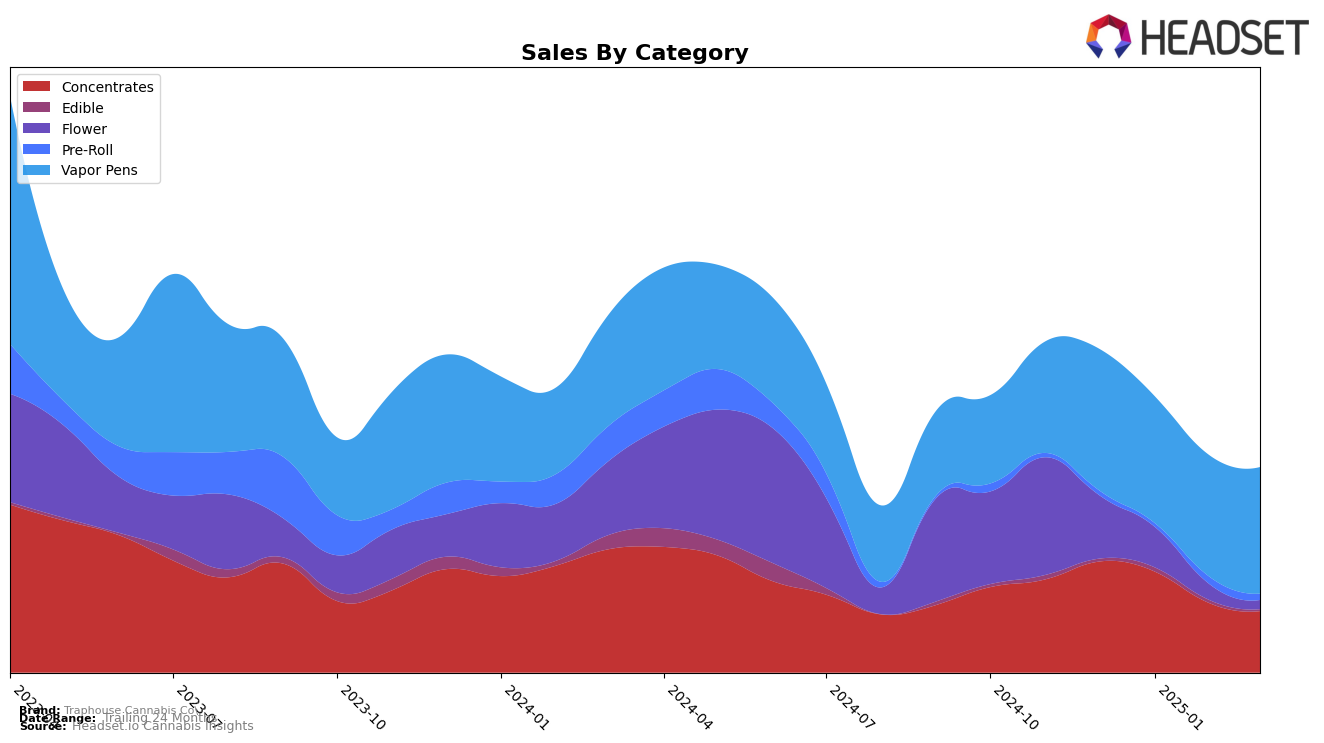

Traphouse Cannabis Co. has shown a varied performance across different product categories in Michigan. In the Concentrates category, the brand began strong in December 2024 with a rank of 3rd, but experienced a decline over the subsequent months, dropping to 11th by March 2025. This downward trend is notable, as it could indicate increased competition or shifts in consumer preferences. In contrast, their performance in the Vapor Pens category has been relatively stable, maintaining a position within the top 20 throughout the observed period, although it did see a slight dip from 12th in December 2024 to 16th in March 2025. This consistency suggests a steady demand for their vapor pen products despite the competitive market.

In other categories, such as Edibles and Flower, Traphouse Cannabis Co. did not manage to break into the top 30 rankings consistently in Michigan. For instance, their Flower products, which were ranked 73rd in December 2024, dropped to 99th by January 2025 and did not appear in the top rankings for February and March. Similarly, although their Edibles saw slight improvement from 71st in December to 66th in January, they did not maintain a top 30 position in March. The Pre-Roll category saw the brand entering the rankings in February at 86th, but slipping to 97th by March. These fluctuations highlight potential challenges in these segments, possibly due to market saturation or evolving consumer tastes.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Traphouse Cannabis Co. has experienced a slight decline in its ranking from December 2024 to March 2025, moving from 12th to 16th place. This shift is indicative of a competitive market where brands like Sauce Essentials and Ozone have shown resilience, with Sauce Essentials even surpassing Traphouse Cannabis Co. in January 2025. Despite a decrease in sales from December 2024 to February 2025, Traphouse Cannabis Co. saw a slight recovery in March 2025, although it wasn't enough to regain its previous rank. Meanwhile, Pro Gro and Bossy have been climbing the ranks, with Bossy showing a notable improvement from 25th to 17th place over the same period. This competitive pressure suggests that Traphouse Cannabis Co. may need to innovate or enhance its marketing strategies to maintain and improve its position in the Michigan vapor pen market.

Notable Products

In March 2025, the top-performing product from Traphouse Cannabis Co. was Purple Urkle Distillate Cartridge (1g) in the Vapor Pens category, which ascended to the number one rank with sales of 11,471. Sweet Island Punch Distillate Cartridge (1g) closely followed, moving up to second place from fourth in February. Strawberry Shortcake Distillate Cartridge (1g) dropped slightly to third position after previously holding the top spot in February. Sour Tangie Distillate Cartridge (1g) maintained a strong presence, finishing fourth despite fluctuating rankings in earlier months. Notably, Pineapple Express Distillate Cartridge (1g) made its debut in the rankings, securing fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.