Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

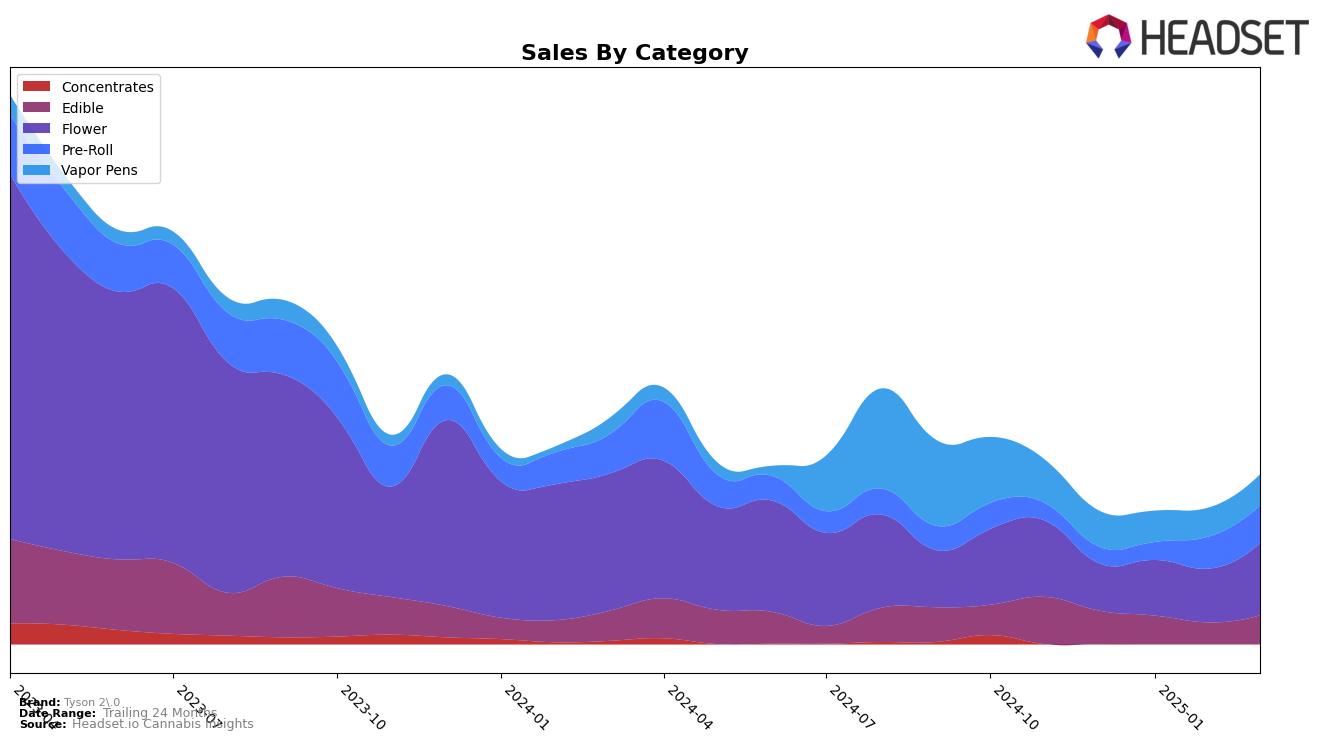

Tyson 2.0 has demonstrated varied performance across different states and categories. In Arizona, the brand's presence in the Flower category did not make it into the top 30, signaling potential challenges in capturing market share. However, in the Pre-Roll category, Tyson 2.0 showed a gradual upward trajectory, moving from 48th in January to 43rd in February before settling at 46th in March. This indicates a consistent demand, albeit fluctuating, which could be a focus area for growth. Meanwhile, in Illinois, their Edible category saw a steady decline in ranking from 48th to 50th over the months, suggesting increased competition or shifting consumer preferences.

In Nevada, Tyson 2.0 experienced notable success in the Edible category, improving from 24th in February to 15th in March, which reflects a significant gain in market position. The Flower category also saw positive movement from 65th to 56th over the quarter, highlighting a strengthening foothold. Conversely, in New York, the brand's Edible products experienced a decline from 32nd to 39th, indicating potential challenges or market saturation. Despite these fluctuations, Tyson 2.0's performance in the Vapor Pens category in Michigan showed improvement, moving up from 93rd to 84th, suggesting a growing acceptance and market presence in this segment.

Competitive Landscape

In the competitive landscape of Nevada's Pre-Roll category, Tyson 2.0 has shown a promising upward trend in early 2025. By February, Tyson 2.0 secured the 16th rank, indicating a strong market presence, though it slightly dipped to 17th in March. This performance is noteworthy considering brands like Hustler's Ambition and Greenway Medical have fluctuated more significantly, with ranks ranging from 14th to 26th and 10th to 23rd respectively. Tyson 2.0's consistent sales growth, as evidenced by its steady rank, contrasts with the more volatile sales patterns of competitors like Remedy and Hippies, which have experienced more dramatic shifts in both rank and sales. This stability positions Tyson 2.0 as a reliable choice for consumers and a formidable competitor in the Nevada Pre-Roll market.

Notable Products

In March 2025, Gelato 44 (3.5g) from Tyson 2.0 maintained its top position in the Flower category with impressive sales reaching 2654 units, demonstrating consistent growth from previous months. Pound for Pound Cake (3.5g) and Punch Pie (3.5g) also held steady in the second and third positions, respectively, showing a strong performance in the Flower category. Knockout OG Distillate Cartridge (1g) climbed to fourth place in the Vapor Pens category, marking a significant improvement from its previous rank. Despite a drop from the top spot in December 2024, Mike Bites - Green Apple Gummies 10-Pack (100mg) retained a solid fifth place in the Edible category. Overall, these products from Tyson 2.0 have demonstrated notable resilience and growth in their respective categories over the recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.