Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

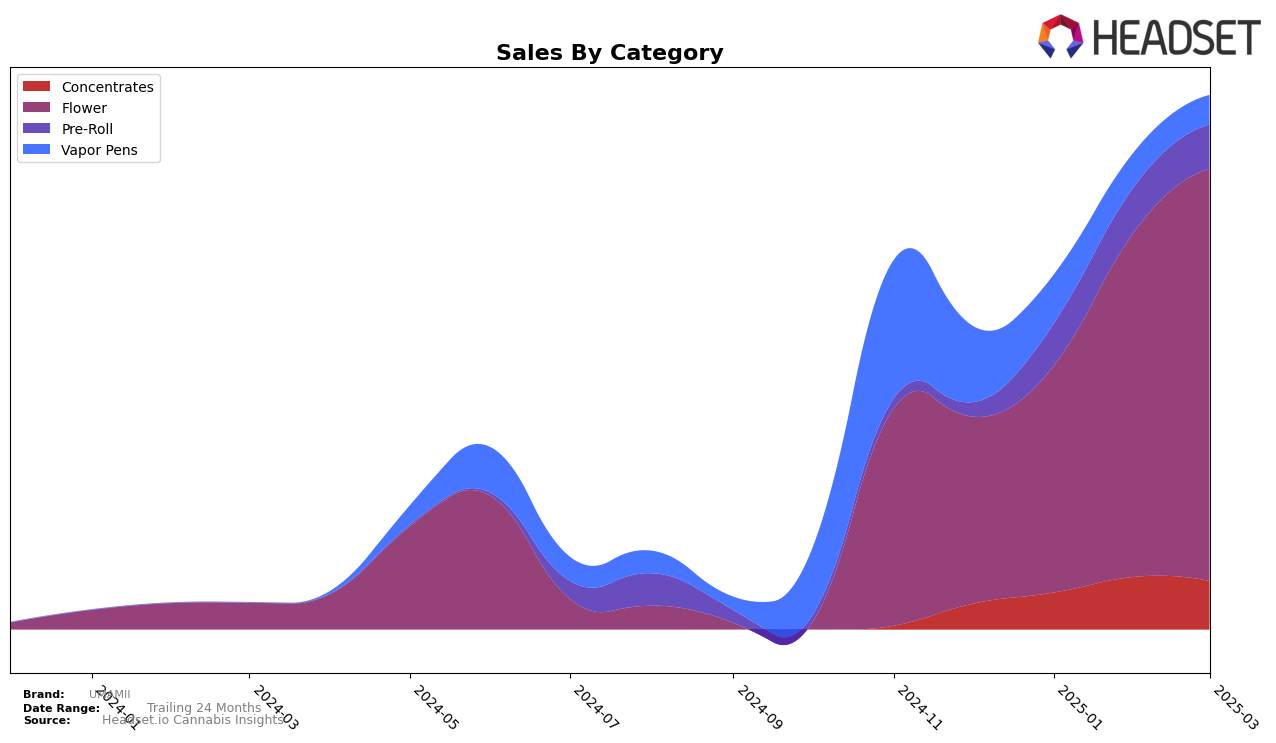

UMAMII has shown a varied performance across different categories in New York. In the Concentrates category, UMAMII made a notable entry into the top 30 rankings in January 2025, securing the 21st position and maintaining a steady presence in subsequent months, albeit with a slight dip to 22nd in March. This consistent presence in the top 30 is a positive indicator of the brand's growing influence and acceptance in this category. Meanwhile, the Flower category has seen a remarkable upward trajectory for UMAMII, moving from 76th position in December 2024 to an impressive 48th by March 2025. This steady climb suggests a strengthening market position and increased consumer preference for UMAMII's flower products.

In contrast, the Vapor Pens category presents a different narrative for UMAMII in New York. The brand's ranking has seen a downward trend, slipping from 73rd in December 2024 to 86th by February and March 2025. This decline indicates potential challenges in the Vapor Pens market, possibly due to increased competition or changing consumer preferences. Notably, UMAMII was absent from the top 30 rankings in this category throughout the mentioned period, highlighting an area that might require strategic focus for improvement. Overall, while UMAMII is making strides in some categories, there are clear opportunities for growth and repositioning in others.

Competitive Landscape

In the competitive landscape of the Flower category in New York, UMAMII has shown a promising upward trajectory in terms of rank and sales over the past few months. Starting from a rank of 76 in December 2024, UMAMII climbed to 48 by March 2025, indicating a significant improvement in market position. This positive trend is bolstered by a steady increase in sales, reflecting growing consumer interest and market penetration. In contrast, Old Pal experienced fluctuations, peaking at rank 31 in February 2025 before dropping to 44 in March, despite having higher sales than UMAMII. Meanwhile, House of Sacci and Bison Botanics both saw a decline in their rankings, with Bison Botanics falling from 28 in December to 45 in March, suggesting potential challenges in maintaining their market share. These dynamics highlight UMAMII's competitive edge and potential for continued growth in the New York Flower market.

Notable Products

In March 2025, the top-performing product for UMAMII was Poison Gushers (3.5g) in the Flower category, achieving the number 1 rank with sales of 487 units. Pancakes (3.5g) followed closely in the second position, showing a significant rise from its previous unranked status in February. Motorbreath 15 (3.5g) secured the third rank, improving from its fourth position in January. Lemon Cherry Gelato (3.5g) was ranked fourth, dropping from its second-place position in December 2024. Wedding Cake (3.5g) rounded out the top five, experiencing a decline from its second rank in both January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.