Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

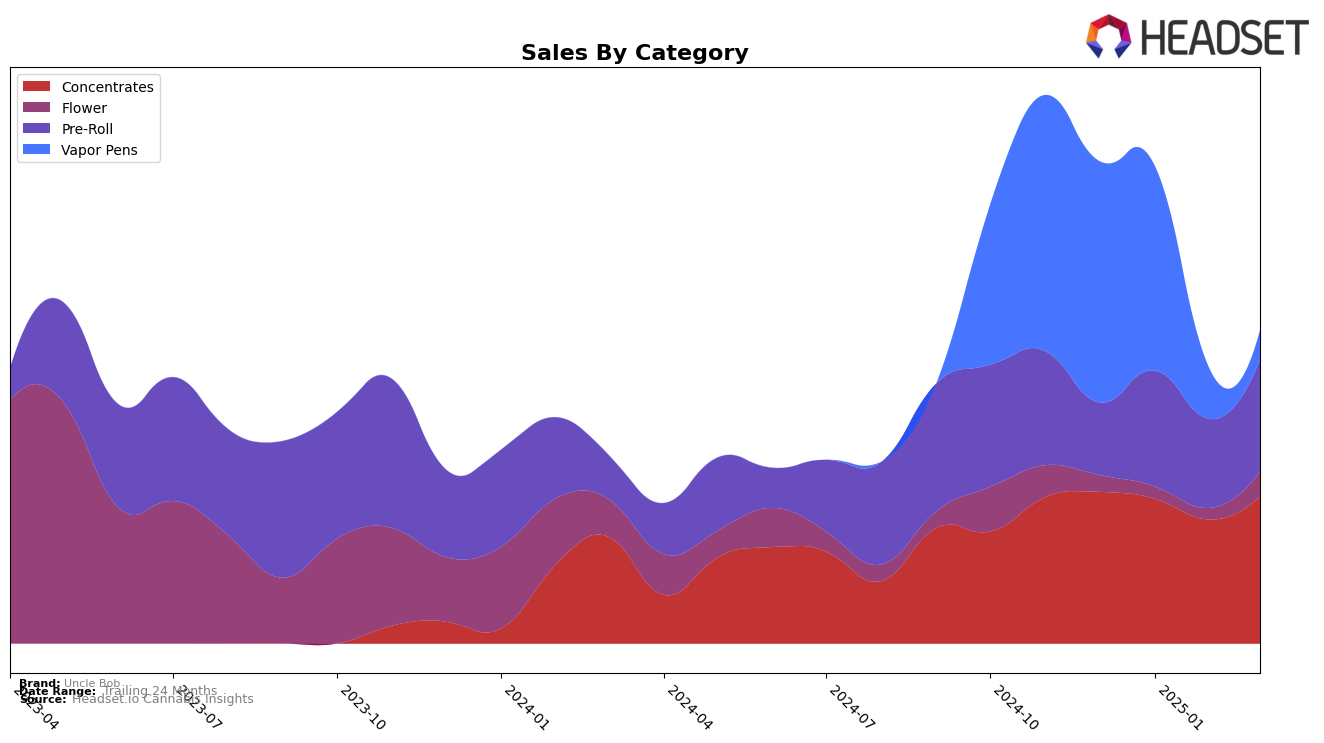

In British Columbia, Uncle Bob's performance has shown a dynamic shift across different categories over the first quarter of 2025. In the Concentrates category, the brand improved its ranking from 16th in December 2024 to 12th by March 2025, indicating a solid upward trend despite a slight dip in February. For Pre-Rolls, Uncle Bob made significant strides, moving from the 97th position in December to 78th by March, suggesting a growing consumer interest in their offerings. However, the Vapor Pens category tells a contrasting story, with rankings falling from 25th in December to 54th in March, which could be indicative of increased competition or shifts in consumer preferences.

Meanwhile, in Saskatchewan, Uncle Bob's presence is less consistent across categories. The brand was ranked 17th in the Concentrates category in December 2024, but there are no subsequent rankings for early 2025, suggesting they did not maintain a top 30 position, which might be a concern for market presence. Interestingly, Uncle Bob entered the Flower category in March 2025, debuting at the 48th position, which could signal a strategic expansion or diversification effort. In the Pre-Roll category, they appeared at 58th in January 2025 but did not maintain a top 30 ranking in the following months, highlighting potential challenges in sustaining momentum.

Competitive Landscape

In the British Columbia concentrates market, Uncle Bob has shown a notable improvement in its competitive standing from December 2024 to March 2025. Initially ranked 16th in December, Uncle Bob climbed to 12th by March, indicating a positive trend in market presence. This upward movement is significant when compared to competitors like Stigma Grow, which fluctuated between ranks 13 and 16 during the same period, and Adults Only, which maintained a relatively stable position around the 14th and 15th ranks. Meanwhile, Phant experienced a slight decline, dropping from 6th to 10th place. Notably, RAD (Really Awesome Dope) made a significant leap from being unranked in January to 9th in March, showcasing a remarkable sales surge. Uncle Bob's consistent improvement in rank, coupled with its sales recovery in March, suggests a strengthening brand presence amidst a competitive landscape, positioning it favorably against both stable and fluctuating competitors.

Notable Products

In March 2025, Uncle Bob's top-performing product was Day Trippin Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one position from January, with impressive sales of 4313 units. Following closely, Devil's Lettuce Pre-Roll (0.5g) secured the second spot, consistent with its February ranking. Indica Shatter (1g) held steady in third place within the Concentrates category, showing stable performance over the past few months. Big Orange Blunt (1g), a relatively new entrant, maintained its fourth position from February to March. Meanwhile, Sativa Shatter (1g) debuted in March at fifth position in the Concentrates category, indicating a promising start.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.