Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

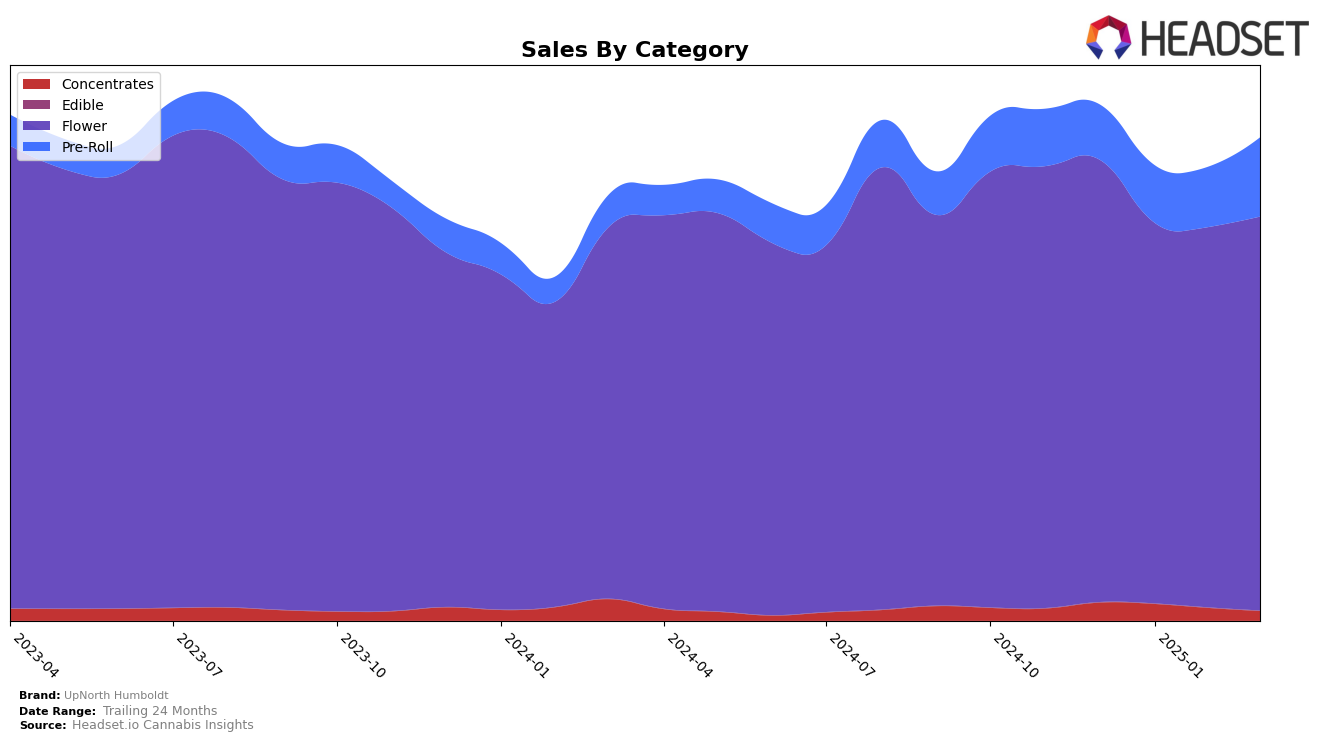

UpNorth Humboldt has shown a dynamic performance in the California market, particularly in the Flower category. The brand maintained a relatively stable presence, with rankings fluctuating slightly from 10th in December 2024 to 11th in February 2025, before climbing back to 10th in March 2025. This indicates a consistent demand for their Flower products, although the sales figures suggest a slight dip in January and February, followed by a recovery in March. In the Pre-Roll category, UpNorth Humboldt improved its ranking from 26th to 23rd between January and February, maintaining this rank into March, which could suggest a growing consumer interest in their Pre-Roll offerings.

In Illinois, UpNorth Humboldt's performance varied across categories. In the Flower category, the brand's ranking saw fluctuations, improving to 16th in February before dropping back to 19th in March, reflecting a volatile market position. Meanwhile, in the Concentrates category, UpNorth Humboldt was ranked 22nd in February but did not feature in the top 30 in March, which could be a point of concern for the brand's market penetration in this category. This absence might indicate challenges in maintaining a competitive edge or a shift in consumer preferences within the state.

Competitive Landscape

In the competitive landscape of California's flower category, UpNorth Humboldt has demonstrated resilience despite fluctuating ranks and sales. From December 2024 to March 2025, UpNorth Humboldt's rank varied between 9th and 11th, indicating a stable presence in the top tier, though it faced challenges from competitors like Gramlin, which consistently held the 8th position. Notably, Pacific Stone showed a positive trend, surpassing UpNorth Humboldt in March 2025 by climbing to 9th place, while UpNorth Humboldt maintained its position at 10th. Meanwhile, Fig Farms showed a dynamic shift, briefly overtaking UpNorth Humboldt in February 2025. Although UpNorth Humboldt's sales saw a slight decline from December 2024 to February 2025, they rebounded in March 2025, reflecting a potential recovery. This competitive analysis highlights the importance of strategic positioning and adaptability for UpNorth Humboldt in maintaining its market share amidst strong competition in California's flower market.

Notable Products

In March 2025, the top-performing product from UpNorth Humboldt was NF1 (3.5g) in the Flower category, achieving the number one rank with sales of 10,344 units. This product showed a consistent upward trend, moving from third place in December 2024 to first place by March 2025. GMO (3.5g) entered the rankings for the first time in March 2025, securing the second position. Durban Poison (3.5g), previously holding the top spot from December 2024 to February 2025, dropped to third place in March. Sour Diesel (3.5g) maintained a stable presence in the top five, ranking fourth in March 2025, following a gradual decline from its second-place position in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.