Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

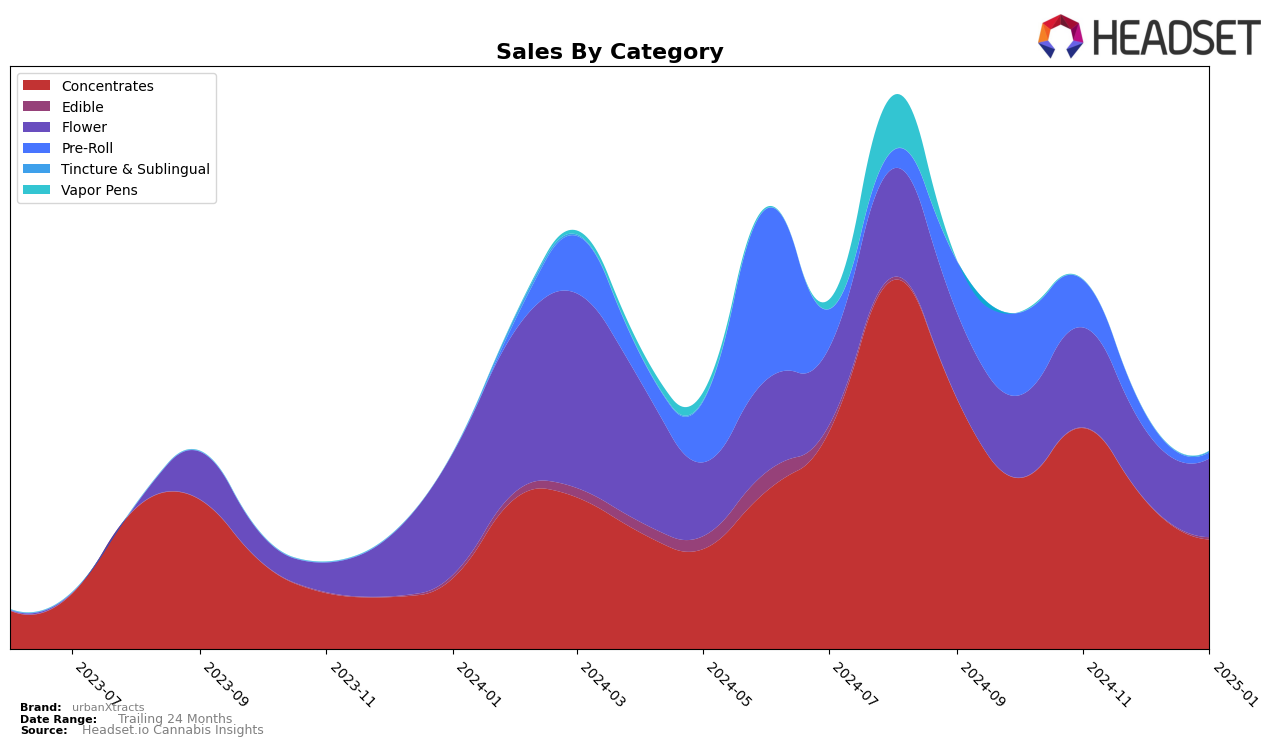

UrbanXtracts has shown a mixed performance across different product categories in New York. In the Concentrates category, the brand maintained a steady presence within the top 20, ranking 14th from October to December 2024, before dropping slightly to 16th in January 2025. This suggests a consistent consumer interest, although the dip in January might warrant further exploration. Meanwhile, in the Flower category, urbanXtracts struggled to break into the top 30, with rankings of 91st and 98th in October and November 2024, respectively, before dropping off the chart entirely in subsequent months. This indicates a potential area for growth or a need to reassess their offerings in this category.

The Pre-Roll category also saw urbanXtracts failing to make a significant impact, as they only appeared in the rankings in October 2024, at 82nd place, and did not maintain a presence in the following months. This absence from the top 30 in later months highlights a challenge for urbanXtracts in establishing a strong foothold in this segment. The sales figures in the Concentrates category saw a notable decline from November to January, which might reflect broader market trends or seasonal variations. Overall, urbanXtracts' performance is a blend of stability in Concentrates and challenges in Flower and Pre-Roll, offering both opportunities and areas for strategic focus.

Competitive Landscape

In the New York concentrates market, urbanXtracts has experienced a dynamic shift in its competitive positioning over the past few months. While maintaining a consistent rank of 14th from October to December 2024, urbanXtracts saw a decline to 16th place by January 2025, indicating a potential challenge in maintaining its market share. This drop in rank coincides with a decrease in sales during the same period, suggesting increased competition and market pressures. Notably, Critical Concentrates and American Hash Makers have shown resilience, with the latter maintaining a steady 13th position throughout these months, possibly attracting consumers with consistent offerings. Meanwhile, Lobo and Ithaca Organics Cannabis Co. have remained in the lower ranks, indicating a less aggressive threat to urbanXtracts. As urbanXtracts navigates this competitive landscape, understanding these dynamics can be crucial for strategic adjustments to regain and enhance its market position.

Notable Products

In January 2025, the top-performing product for urbanXtracts was A Train (3.5g) in the Flower category, which rose to the number one rank with sales of 345 units. Scribbler Solventless Hash (1g) maintained a strong position, ranking second in the Concentrates category, although its sales slightly decreased compared to previous months. Ayo Cold Cure Live Rosin (1g) emerged in third place, making its debut in the rankings. Screwdriver Live Resin Badder (1g) saw a decline in its rank to fourth place, continuing its downward trend from previous months. Concrete Jungle (3.5g) entered the rankings in fifth place, indicating a new interest in this Flower product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.