Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

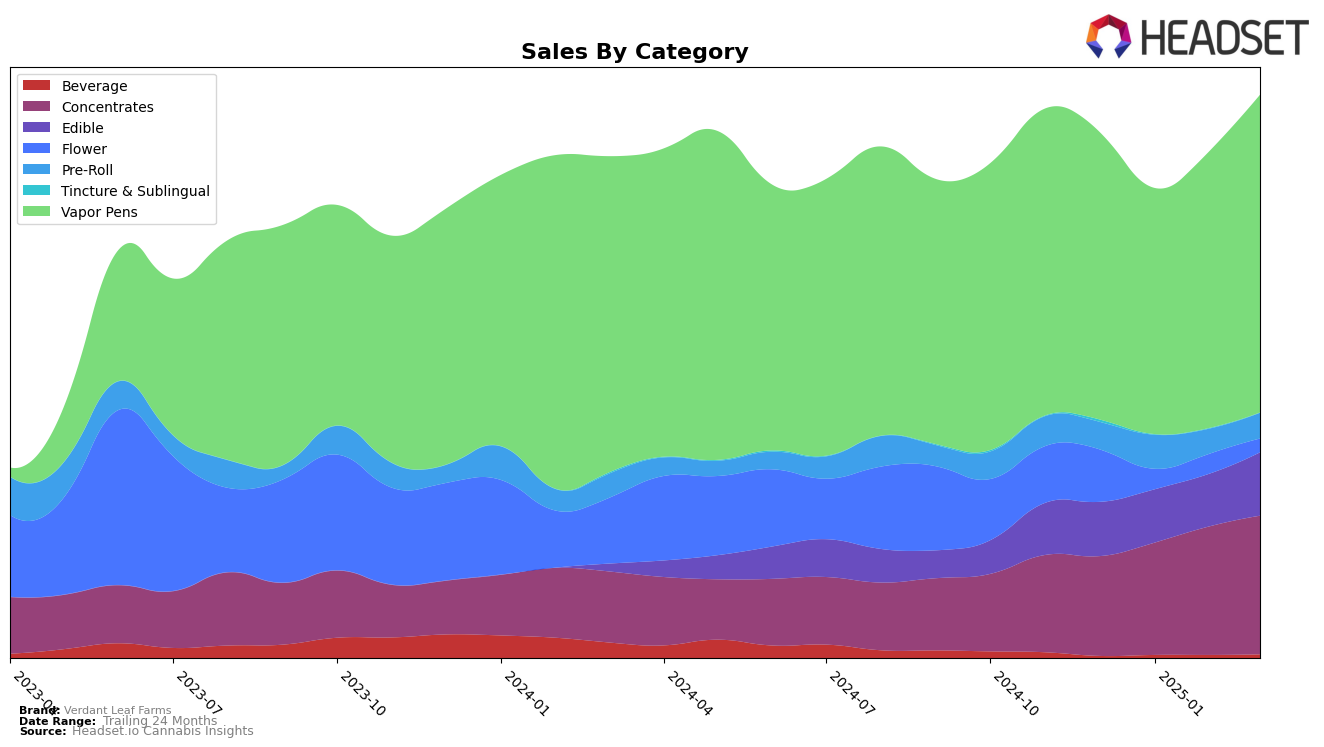

Verdant Leaf Farms has shown a noteworthy performance in the Oregon market, particularly in the Concentrates category. The brand maintained a stable position at rank 8 in December 2024 and January 2025, before moving up to rank 5 in February 2025 and slightly dropping to rank 6 in March 2025. This movement indicates a strong presence and growing consumer preference in this category. In the Edible category, Verdant Leaf Farms held steady at rank 13 for three months before improving to rank 12 in March 2025, suggesting a gradual increase in market share. However, in the Flower category, the brand did not break into the top 30, highlighting a potential area for growth or reconsideration of strategy.

The Vapor Pens category has been a strong suit for Verdant Leaf Farms, with rankings fluctuating but remaining within the top 20. The brand's rank improved from 17 in January 2025 to 13 in February 2025, before settling at 14 in March 2025. This category's performance suggests that Verdant Leaf Farms is successfully capturing consumer interest and could focus on consolidating this position further. On the other hand, in the Pre-Roll category, the brand's rank fluctuated between 45 and 54, indicating a more volatile performance. This inconsistency might reflect challenges in maintaining a competitive edge or changes in consumer preferences. Overall, Verdant Leaf Farms exhibits strengths in certain categories while facing challenges in others, providing a mixed but promising outlook in the Oregon market.

Competitive Landscape

In the competitive landscape of Oregon's vapor pen market, Verdant Leaf Farms has demonstrated notable fluctuations in its rankings over recent months. Starting from December 2024, Verdant Leaf Farms was positioned at 16th, experiencing a slight dip to 17th in January 2025, but then rebounding to 13th in February before settling at 14th in March. This upward movement in February suggests a positive reception to their offerings, potentially driven by strategic marketing or product innovation. In comparison, Oregrown maintained a relatively stable position, hovering around the 11th to 14th ranks, while Gem Carts consistently outperformed Verdant Leaf Farms, despite a slight decline from 9th to 13th place. Meanwhile, Boujee Blendz showed a stronger performance, peaking at 11th in February. The competitive dynamics indicate that while Verdant Leaf Farms is gaining traction, it faces stiff competition from these established brands, necessitating continued innovation and marketing efforts to climb higher in the ranks.

Notable Products

In March 2025, Verdant Leaf Farms saw Bubble Blast Live Rosin & Cured Resin Cartridge (1g) take the top spot in sales, with a notable figure of 3907 units sold, marking it as the leading product for the month. Phantom Punch Live Rosin & Cured Resin Cartridge (1g) secured the second position, followed by Pink Lemonade x Government Oasis Live Rosin Nanotech Gummy (100mg) in third place. Sticky Twilight Live Rosin & Cured Resin Cartridge (1g) and Amber Ascension Live Rosin & Cured Resin Cartridge (1g) rounded out the top five, ranking fourth and fifth, respectively. Notably, all these products did not hold a rank before March 2025, indicating a significant rise in popularity or a recent launch. The dominance of Vapor Pens in the top rankings reflects a strong consumer preference for this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.