Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

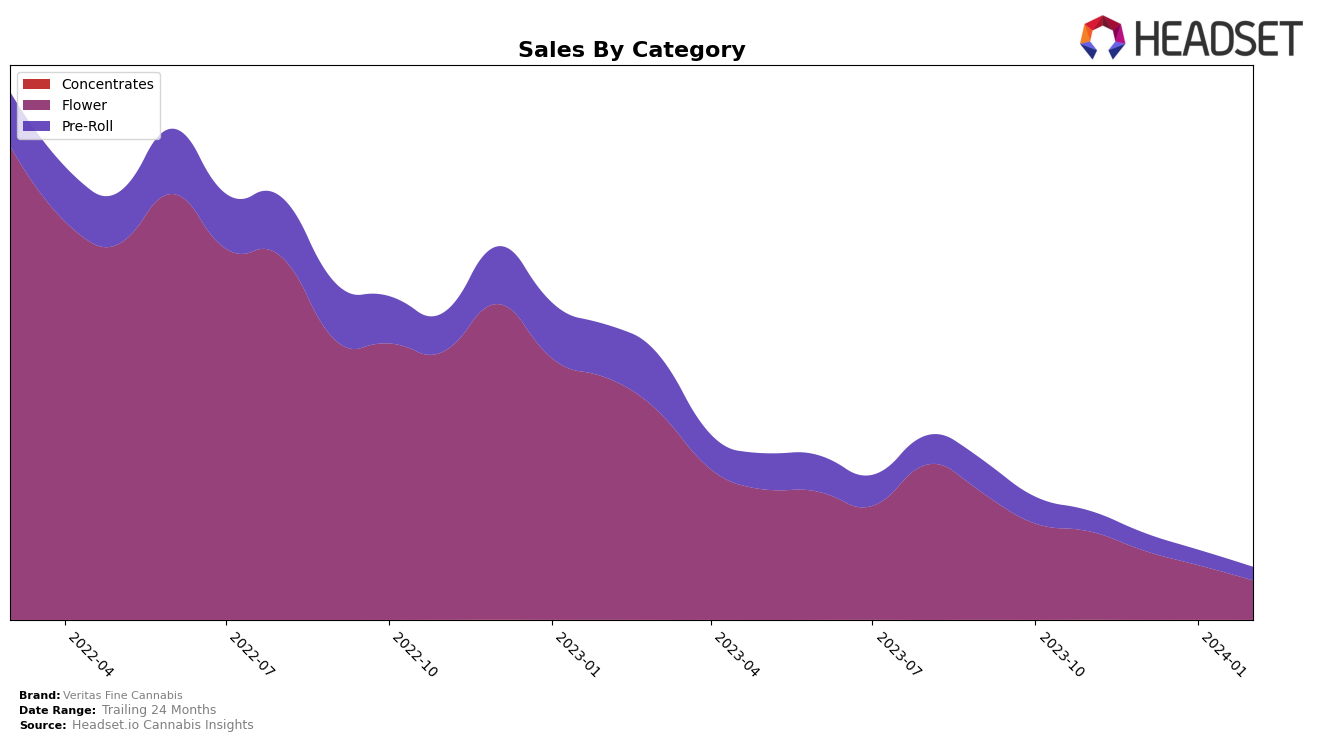

In the competitive cannabis market of Colorado, Veritas Fine Cannabis has shown varied performance across different product categories. In the Flower category, their ranking has seen a gradual decline, moving from 15th position in November 2023 to 27th by February 2024. This downward trend is noteworthy, especially considering their sales in the same period dropped from approximately $496,525 to $220,663, indicating a significant decrease in market share. Conversely, in the Pre-Roll category, Veritas Fine Cannabis maintained a relatively stable position, albeit with a slight decline, moving from 16th to 23rd position over the same months. This suggests a more resilient performance compared to their Flower category, although the decrease in sales from $114,931 to $74,709 could point to broader challenges facing the brand.

Interestingly, Veritas Fine Cannabis has ventured into the Concentrates category only recently, with rankings being recorded from January 2024. Starting at 95th position in January and maintaining it into February 2024 indicates a challenging entry into this market segment within Colorado. The initial sales figure in January 2024 was noted at $123, which, while modest, marks the brand's foray into a new category, suggesting strategic diversification efforts. This move into Concentrates, despite its slow start, could represent an attempt by Veritas Fine Cannabis to capture new market segments and consumer interests. However, the effectiveness of this strategy and its impact on the brand's overall performance across categories remains to be seen, as they navigate the competitive landscape and consumer preferences in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Veritas Fine Cannabis has experienced a notable decline in rank and sales over the recent months, moving from 15th in November 2023 to 27th by February 2024. This trend is contrasted by the remarkable ascent of Equinox Gardens, which wasn't in the top 20 in November but surged to 29th by February, showing significant sales growth. Similarly, Boulder Built and Cannabis Brothers have shown resilience and improvement in their standings, with Boulder Built moving up to 25th and Cannabis Brothers to 26th by February 2024, both surpassing Veritas Fine Cannabis. Vera, on the other hand, saw a peak in January as the 17th ranked brand but experienced a slight decline to 28th by February, closely trailing Veritas. These movements highlight a competitive and dynamic market where brand positions can shift rapidly, underscoring the importance of staying informed on market trends and consumer preferences to maintain or improve market standing.

Notable Products

In February 2024, Veritas Fine Cannabis saw Yuck Mouth (3.5g) leading its sales, marking the top position with a significant figure of 1718 units sold, showcasing its popularity in the Flower category. Following closely, Peach Crescendo (3.5g) and Super Lemon G Pre-Roll (1g) secured the second and third spots, respectively, indicating a diverse consumer preference that spans both Flower and Pre-Roll categories. Strawberries 'n Cream (3.5g) and Sour Diesel Pre-Roll (1g) rounded out the top five, highlighting a balanced interest in both product types among consumers. Notably, the rankings for these products were not available in the previous months, suggesting either a remarkable surge in their popularity or a recent introduction to the market. This sudden prominence in the rankings underscores a dynamic shift in consumer preferences or strategic product introductions by Veritas Fine Cannabis.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.