Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

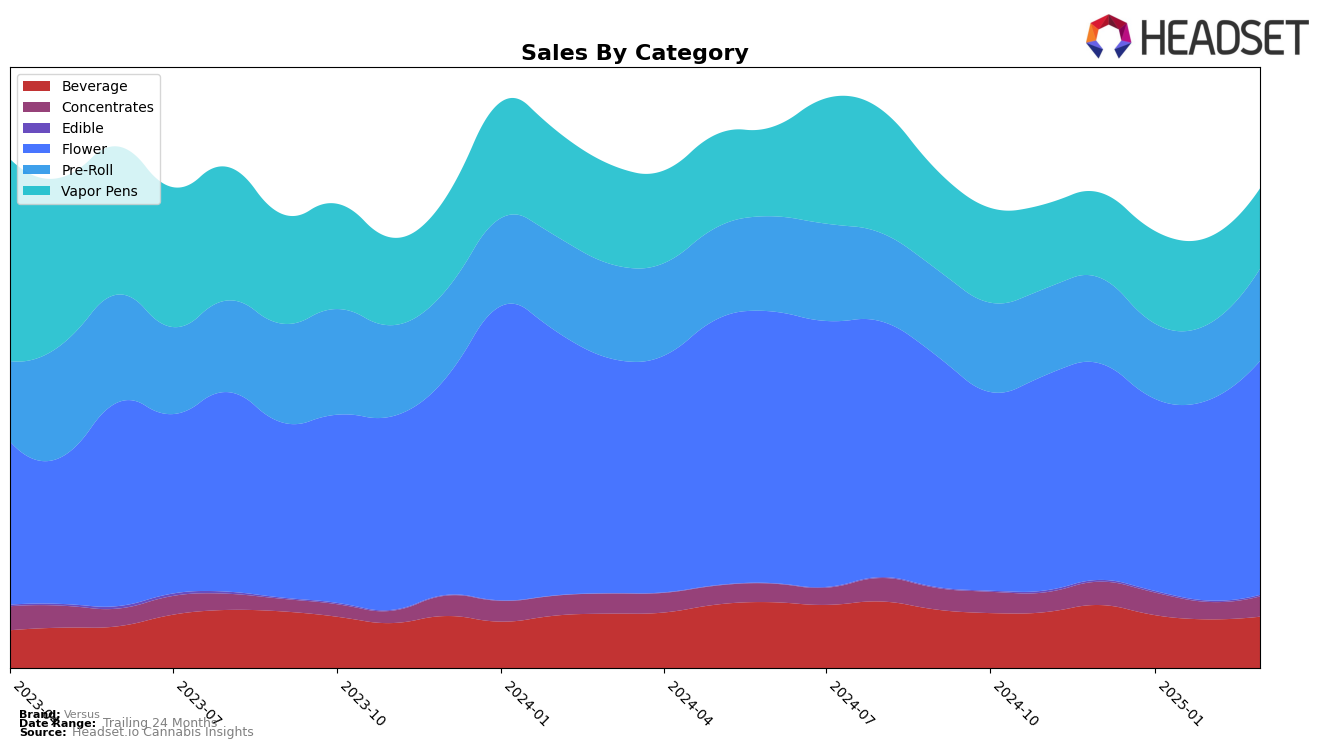

In Alberta, Versus demonstrated a notable upward trend in the Flower category, climbing from the 26th position in December 2024 to 15th in February 2025, before settling at 16th in March 2025. This positive movement is indicative of a strong market presence and growing consumer preference. However, the brand's performance in the Pre-Roll category, despite improving from 61st to 40th over the same period, still remains outside the top 30, highlighting potential areas for growth. In the Vapor Pens category, Versus maintained a steady presence, moving slightly from 30th to 25th, signaling consistent consumer demand.

In Ontario, Versus held a strong position in the Beverage category, consistently ranking 2nd from December 2024 through March 2025, underscoring its dominance in this segment. The Flower category also saw a notable improvement, where Versus rose from 14th to 11th, indicating a strengthening market foothold. Conversely, the brand's absence from the top 30 in the Concentrates category after December suggests a decline in consumer interest or competitive pressures. Meanwhile, in Saskatchewan, Versus experienced a drop in the Flower category rankings from 5th in December to falling out of the top 30 by March, which may call for strategic reassessment in this market.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Versus has demonstrated a notable upward trend in rankings from December 2024 to March 2025. Starting at 14th place in December, Versus improved to 11th by March, indicating a positive trajectory in market presence. This rise in rank is particularly significant when compared to competitors like Big Bag O' Buds and The Loud Plug, both of which experienced fluctuations and a general decline in their rankings during the same period. Meanwhile, Pepe maintained a stable position within the top 10, and Pure Laine saw a drop from 9th to 13th. Versus's sales figures also reflect an upward trend in March, surpassing its January and February numbers, suggesting effective marketing strategies or product offerings that resonate well with consumers. This competitive analysis highlights Versus's potential to continue climbing the ranks and capturing a larger share of the Ontario Flower market.

Notable Products

In March 2025, the top-performing product from Versus was the CBD/THC 1:1 Neon Rush Carbonated Soda, maintaining its first-place ranking consistently since December 2024, with sales reaching 32,547 units. The Black Cherry Rapid Seltzer held the second position, showing stable performance over the past months. Key Lime Rapid Seltzer secured the third spot, climbing back from a fourth-place position in January 2025. Notably, the Blueberry Pomegranate Rapid Seltzer made a significant leap to fourth place in March, up from fifth in February, reflecting a growing consumer interest. Meanwhile, Neon Rush - Cali Blast Soda dropped to fifth place, indicating a slight decline in its popularity compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.