Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

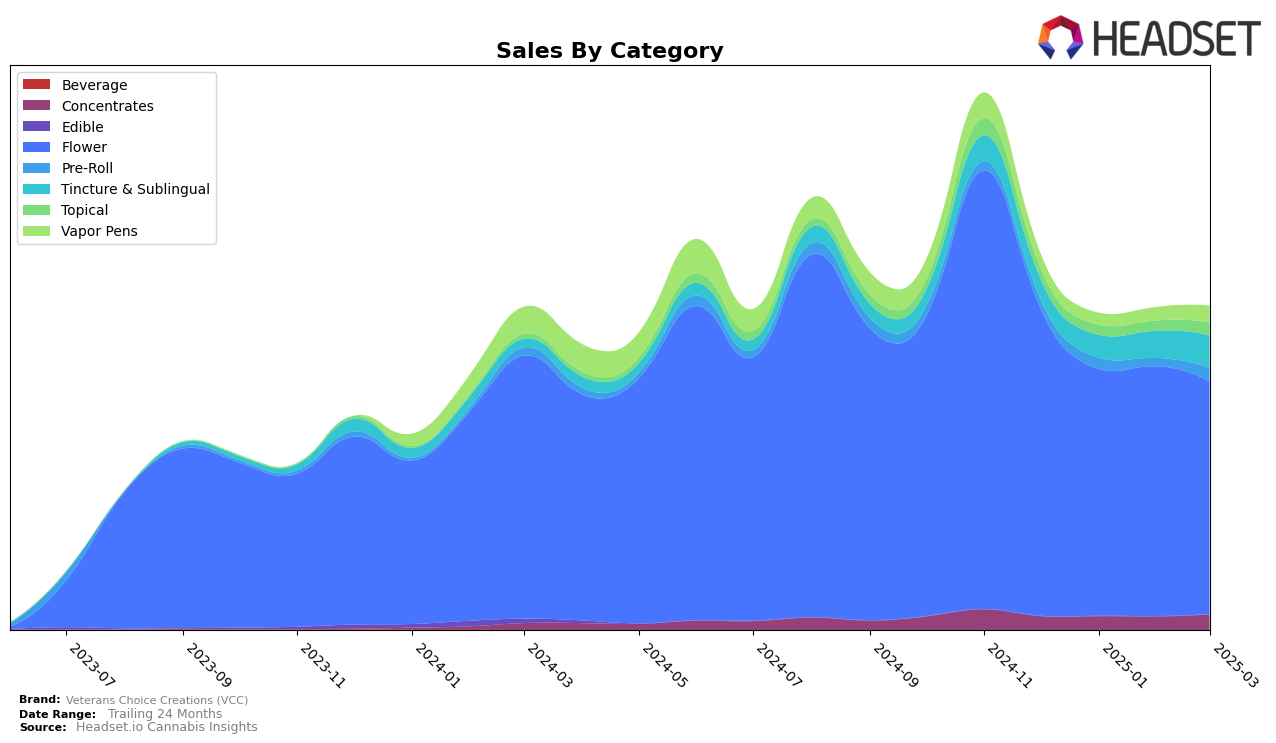

Veterans Choice Creations (VCC) has shown notable performance variations across different product categories in New York. Within the Concentrates category, VCC maintained a steady rank of 19th from January to March 2025, a slight improvement from December 2024 when it was ranked 21st. This consistency suggests a stable market presence in this category, supported by a sales increase in March 2025. In contrast, their Flower category performance saw a decline, dropping from 16th in December 2024 to 24th by February and March 2025, indicating potential challenges in maintaining their market share in this segment.

In the Tincture & Sublingual category, VCC experienced a positive trend, with their rank improving from 7th in January and February 2025 to 6th in March 2025, reflecting a growing consumer preference for their products. Their Topical products consistently held the 2nd position, underscoring their strong foothold in this category. However, it's worth noting that VCC's Vapor Pens ranked outside the top 30, with a rank of 63rd in March 2025, highlighting an area for potential growth or reevaluation of strategy. This diverse performance across categories suggests that while VCC is excelling in certain areas, there are opportunities for improvement and expansion in others.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Veterans Choice Creations (VCC) has experienced a challenging period from December 2024 to March 2025. Initially ranked 16th in December 2024, VCC saw a decline to 24th by March 2025, indicating a need for strategic adjustments to regain market position. During this time, Runtz showed a more stable performance, maintaining a presence within the top 20 until March 2025, when it slipped to 22nd. Meanwhile, FlowerHouse New York experienced a significant drop from 9th to 23rd, suggesting potential market volatility. Interestingly, ghost. demonstrated a remarkable rise from 57th in December 2024 to 26th by March 2025, highlighting a potential emerging competitor. To The Moon mirrored VCC's trajectory, dropping from 17th to 25th. These shifts underscore the dynamic nature of the New York Flower market and suggest that VCC may need to innovate or enhance its marketing strategies to improve its competitive standing.

Notable Products

In March 2025, Blueberry Muffin Moonrocks (4g) maintained its top position as the leading product from Veterans Choice Creations (VCC) in the Flower category, with sales reaching 3538 units. Strawberry Slushie Moonrocks (4g) also held steady at the second rank in the same category, showing consistent performance over the past months. Lil Buddies - GG Cookies Pre-Roll 10-Pack (5g) saw an improvement, climbing to the third rank from its previous fourth position in February. The CBD/THC/CBG/CBN High Octane Tincture (300mg CBD, 1000mg THC, 100mg CBG, 50mg CBN, 30ml) slipped to fourth place from its third rank in February. The CBD/THC 1:1 Warrior Balm (900mg CBD, 900mg THC, 30ml) remained stable at the fifth position, showing a slight increase in sales from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.