Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

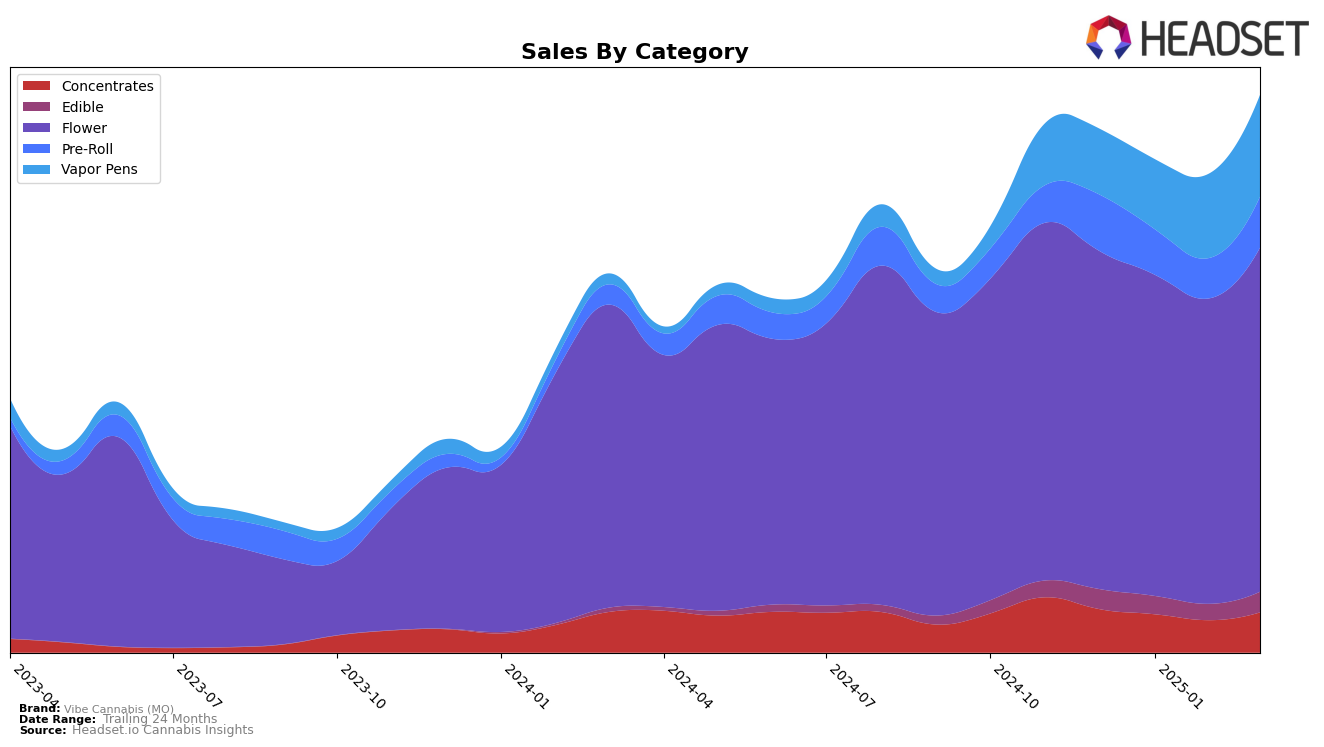

Vibe Cannabis (MO) has demonstrated notable performance across various product categories in the state of Missouri. In the Flower category, the brand has shown a consistent upward trajectory, improving its rank from eighth in December 2024 to sixth by March 2025, indicating strong consumer preference and market presence. Conversely, the Concentrates category saw a slight decline from sixth to eighth over the same period, suggesting potential challenges in maintaining market share. The Vapor Pens category, however, is a bright spot for Vibe Cannabis (MO), where the brand has climbed impressively from 21st to 16th, reflecting a growing consumer demand and possibly effective marketing strategies. It's worth noting that in the Pre-Roll category, the brand experienced a dip in rankings, moving from ninth to 12th, which could signal increased competition or a shift in consumer preferences.

In the Edible category, Vibe Cannabis (MO) has maintained a relatively stable position, with a slight fluctuation in rankings between 24th and 27th. This stability suggests a steady consumer base, even though the brand did not break into the top 20. Interestingly, the sales figures for Edibles show a resurgence in March 2025, which could indicate a seasonal trend or successful promotional activity. The overall sales trends reveal that while some categories like Concentrates experienced a decline in sales, others such as Vapor Pens saw significant growth, pointing to a diversification in consumer interests within Missouri. The ability of Vibe Cannabis (MO) to adapt and respond to these market dynamics will be crucial in sustaining its competitive edge in the coming months.

Competitive Landscape

In the Missouri flower category, Vibe Cannabis (MO) has demonstrated a steady improvement in its competitive positioning from December 2024 to March 2025. Starting at rank 8 in December, Vibe Cannabis (MO) climbed to rank 6 by February and maintained this position through March. This upward trend suggests a positive reception in the market, likely driven by strategic marketing or product enhancements. In contrast, Good Day Farm experienced a slight decline, dropping from rank 7 in December to rank 8 by February and March, indicating potential challenges in maintaining its market share. Meanwhile, Illicit / Illicit Gardens and Vivid (MO) consistently held higher ranks, with Illicit maintaining a strong position at rank 3 and 4, and Vivid at rank 4 and 5, respectively, throughout the period. Sinse Cannabis showed fluctuations, moving from rank 6 in December to 8 in January, and then stabilizing at rank 7. These dynamics highlight Vibe Cannabis (MO)'s successful efforts to enhance its market presence amidst fluctuating performances by its competitors.

Notable Products

In March 2025, Vibe Cannabis (MO) saw Mississippi Mud Pie Infused Pre-Roll (1g) rise to the top of the sales chart, securing the number one rank with sales of $4,336. Cake Mix (3.5g) followed closely, maintaining its strong performance by moving up to the second position from third in February. Tropical Runtz (3.5g) made an impressive debut, entering the rankings at third place. Blueberry Lemonade Live Rosin Gummies 10-Pack (250mg) also performed well, securing the fourth rank. Gastro Pop Popcorn (7g) remained consistent, holding onto the fifth rank, unchanged from its previous appearance in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.