Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

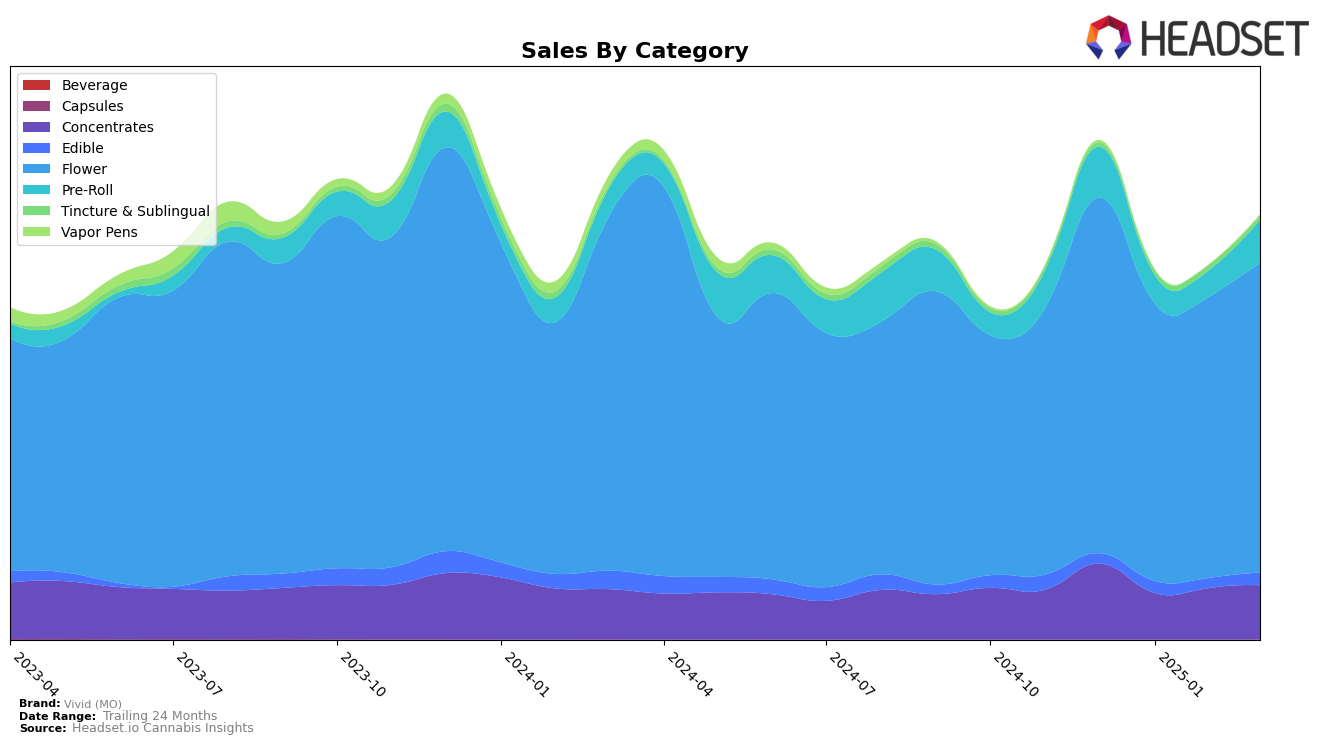

Vivid (MO) has demonstrated consistent dominance in the Concentrates category within Missouri, where it has maintained the top rank from December 2024 through March 2025. This sustained leadership position highlights the brand's strong market presence and consumer loyalty in this category. However, in the Edibles category, Vivid (MO) has managed to stay within the top 30, with rankings fluctuating between 27th and 29th place. While they have not broken into the top 20, maintaining a position within the top 30 signifies a stable foothold in this competitive segment.

In the Flower category, Vivid (MO) consistently ranked 4th or 5th from December 2024 to March 2025, indicating a solid performance in one of the most competitive areas of the cannabis market. This stability can be seen as a testament to their product quality and brand recognition. On the other hand, the Pre-Roll category has shown more variability, with rankings ranging from 7th to 15th place over the same period. Although there was a dip in January and February, Vivid (MO) managed to rebound to the 10th spot by March, suggesting a potential recovery or strategic adjustment in this category. Such fluctuations underscore the dynamic nature of consumer preferences and market competition in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Vivid (MO) has maintained a steady position at rank 5 from January to March 2025, despite a slight dip from rank 4 in December 2024. This stability in ranking contrasts with the dynamic movements of competitors such as Amaze Cannabis, which improved its rank from 5 to 3 over the same period, indicating a significant upward trend in sales. Meanwhile, Illicit / Illicit Gardens experienced a minor decline, dropping from rank 3 to 4, yet it still maintains higher sales figures than Vivid (MO). Additionally, Sinse Cannabis and Vibe Cannabis (MO) have shown improvements in their rankings, suggesting a competitive push in the market. These shifts highlight the need for Vivid (MO) to strategize effectively to enhance its market position and capitalize on growth opportunities in the evolving Missouri flower market.

Notable Products

In March 2025, the top-performing product for Vivid (MO) was Florida Kush (3.5g) from the Flower category, maintaining its position as the number one ranked product since December 2024, despite a decrease in sales to 15,403 units. Alien Mintz Pre-Roll (1g) showed a notable rise, moving from fifth place in February to second place in March, with significant sales growth. Fruit Gusherz (3.5g) re-entered the rankings at third place, indicating a resurgence in popularity. Alien Mintz (3.5g) experienced a decline, dropping from second place in February to fourth in March. Florida Kush Pre-Roll (0.75g) remained steady, ranking fifth in March, mirroring its position from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.