Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

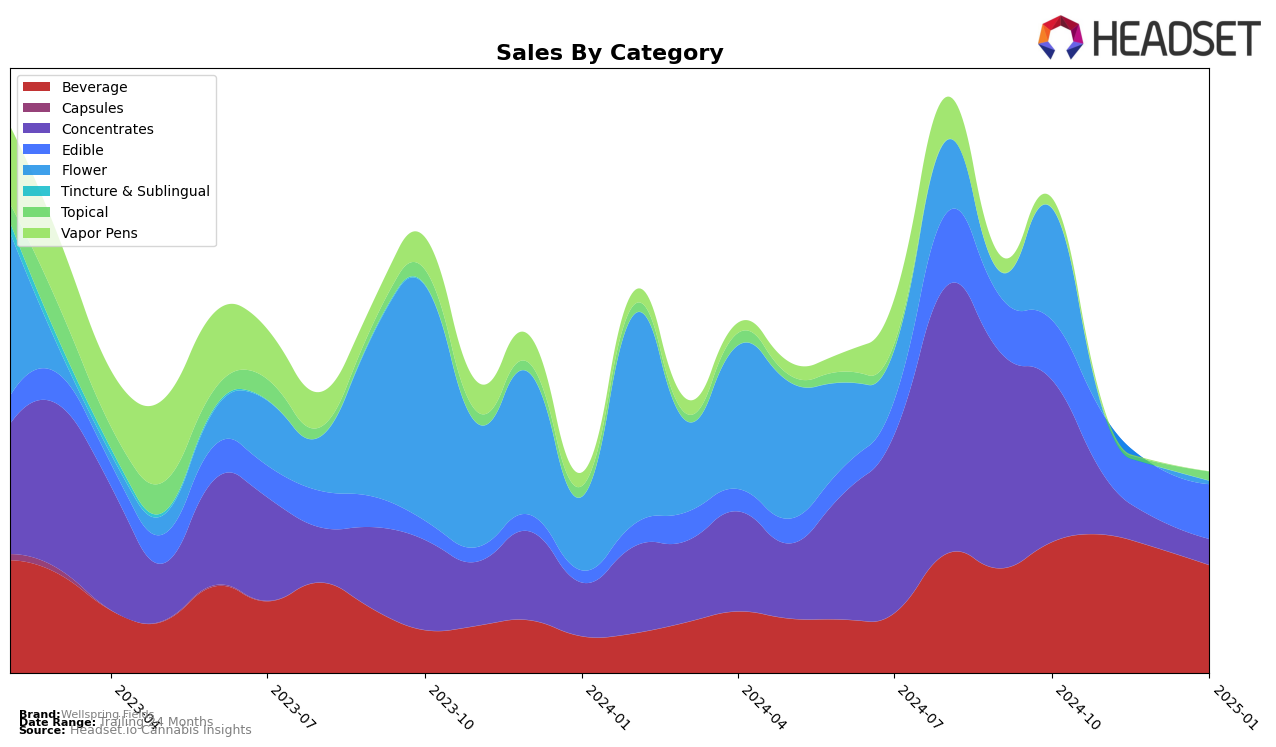

Wellspring Fields has shown a dynamic performance across various categories in Ohio. In the Beverage category, the brand maintained a strong presence, consistently ranking in the top 4 over the four-month period, with a slight dip in sales from October 2024 to January 2025. This stability in rank suggests a solid customer base and brand loyalty in the beverage sector. Conversely, the Concentrates category reflects a more volatile performance, with Wellspring Fields dropping from 11th place in October to 28th place by January. This decline indicates potential challenges in maintaining market share or possibly increased competition in the concentrates space.

In the Edible category, Wellspring Fields hovered around the 40th position, with a brief drop to 50th in December, before rebounding slightly in January. This fluctuation suggests a struggle to break into the top tier of edible brands in Ohio. The Flower category, however, presents a more concerning picture as Wellspring Fields did not appear in the top 30 after October, indicating a significant drop in visibility and possibly sales. This absence from the rankings could point to either a strategic shift away from this category or a need for increased marketing efforts to regain traction. Overall, while Wellspring Fields shows strength in certain areas, there are clear opportunities for growth and improvement in others.

Competitive Landscape

In the Ohio beverage category, Wellspring Fields has maintained a consistent presence in the top 5 brands from October 2024 to January 2025, indicating stable market performance. Despite fluctuations in sales, Wellspring Fields held its rank at 4th place in both October 2024 and January 2025, with a brief rise to 3rd in November 2024. This suggests resilience amidst competitive pressures. Notably, Certified (Certified Cultivators) consistently held the top position from November 2024 to January 2025, showcasing a strong market lead. Butterfly Effect - Grow Ohio also demonstrated strong performance, maintaining 2nd place from November 2024 through January 2025. In contrast, Major experienced a significant drop from 1st in October 2024 to 5th by January 2025, highlighting potential volatility. Meanwhile, Revive appeared in the rankings only in November 2024 and January 2025, indicating sporadic visibility. These dynamics suggest that while Wellspring Fields is holding steady, there is intense competition, particularly from Certified and Butterfly Effect, which may influence strategic decisions moving forward.

Notable Products

In January 2025, the top-performing product for Wellspring Fields was Dr. Feel Better's - Orange Soda Extra Strength Elixir 2-Pack, which ascended to the number one rank from third in December 2024, achieving sales of 574 units. Dr. Feel Better's - Purple Nurple Elixir maintained a strong performance, though it slipped from first to second place, with sales slightly increasing from 381 to 400 units. Dr. Feel Better's - Root Beer Elixir, which was also previously ranked first, moved to third place with sales of 372 units. The Mr. Better Live Resin Chocolate 10-Pack debuted in the rankings at fourth place, while Dr. Feel Better's - Purple Nurple High Dose Elixir 2-Pack dropped from fourth in December to fifth in January, with sales decreasing to 243 units. This shift in rankings highlights the growing popularity of the Orange Soda Extra Strength Elixir within the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.