Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

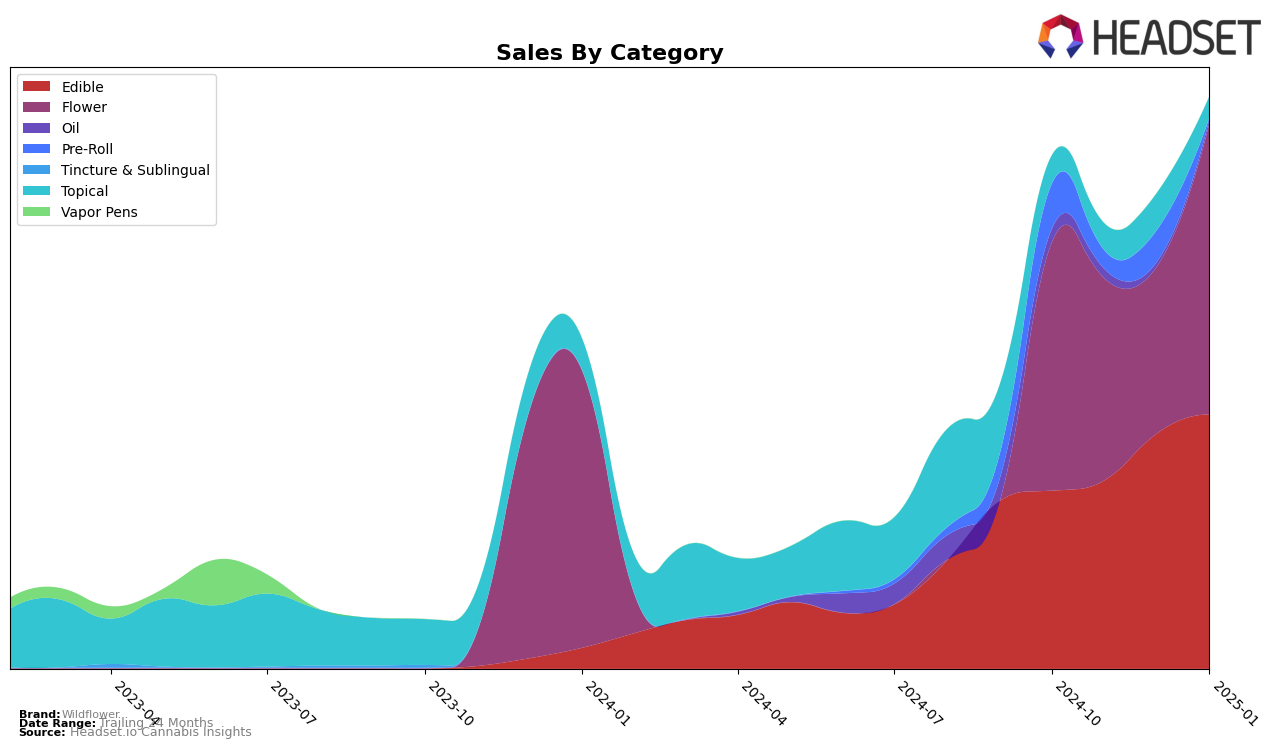

Wildflower has shown notable progress in the edible category in Alberta, climbing steadily from a rank of 17 in October 2024 to 12 by January 2025. This upward trend is matched by an increase in sales, indicating a growing consumer preference for their products. In contrast, the brand did not rank in the top 30 for the topical category in Alberta until January 2025, when it made a sudden appearance at rank 6, suggesting a potential breakthrough or strategic shift in that category. Meanwhile, in British Columbia, Wildflower's presence in the edible category was fleeting, as it ranked 22 in October 2024 but failed to maintain a top 30 position in subsequent months, which could reflect competitive pressures or market dynamics unique to that region.

In Maryland, Wildflower's performance in the flower category has been somewhat volatile, with rankings fluctuating between 40 and 46 over the observed period. Despite this inconsistency, there was a notable sales peak in January 2025, which could imply a seasonal demand spike or successful promotional activities. Conversely, in Nevada, Wildflower struggled to secure a stable position in the pre-roll category, only appearing in the rankings intermittently and never breaking into the top 30. This sporadic presence might indicate challenges in market penetration or consumer preference shifts. These variations across states and categories highlight the diverse challenges and opportunities Wildflower faces in different markets.

Competitive Landscape

In the Maryland Flower category, Wildflower has experienced fluctuations in its market position over the past few months, with its rank moving from 44th in October 2024 to 40th by January 2025. This improvement in rank is notable, especially considering the competitive landscape. Brands like Verano consistently maintained a higher rank, staying in the mid-30s, while Redemption also held a stronger position, despite a slight dip in November. Interestingly, Revelry Herb Company showed a similar pattern of rank fluctuation as Wildflower, although it ended slightly lower in January. Meanwhile, Gentlemen Smugglers, which entered the top 20 in November, remained behind Wildflower by January. These dynamics suggest that while Wildflower faces stiff competition, its ability to climb in rank indicates a positive trend in sales performance, potentially driven by strategic marketing efforts or product differentiation.

Notable Products

In January 2025, Wildflower's Sweet Dreams - CBD/CBN/THC 1:1:2 Goji Berry Chews 5-Pack (5mg CBD, 5mg CBN, 10mg THC) maintained its position as the top-performing product, with sales reaching 7491 units. The Cherry Chocolate Widow (7g) flower product climbed to the second spot, up from the third position in the previous months. Notably, Goat Piss (14g) entered the rankings for the first time, securing the third position. Cherry AK 47 (7g) and Angus (14g) also made their debut in the rankings, taking the fourth and fifth spots, respectively. This shift in rankings highlights a growing interest in Wildflower's flower products alongside their consistently popular edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.