Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

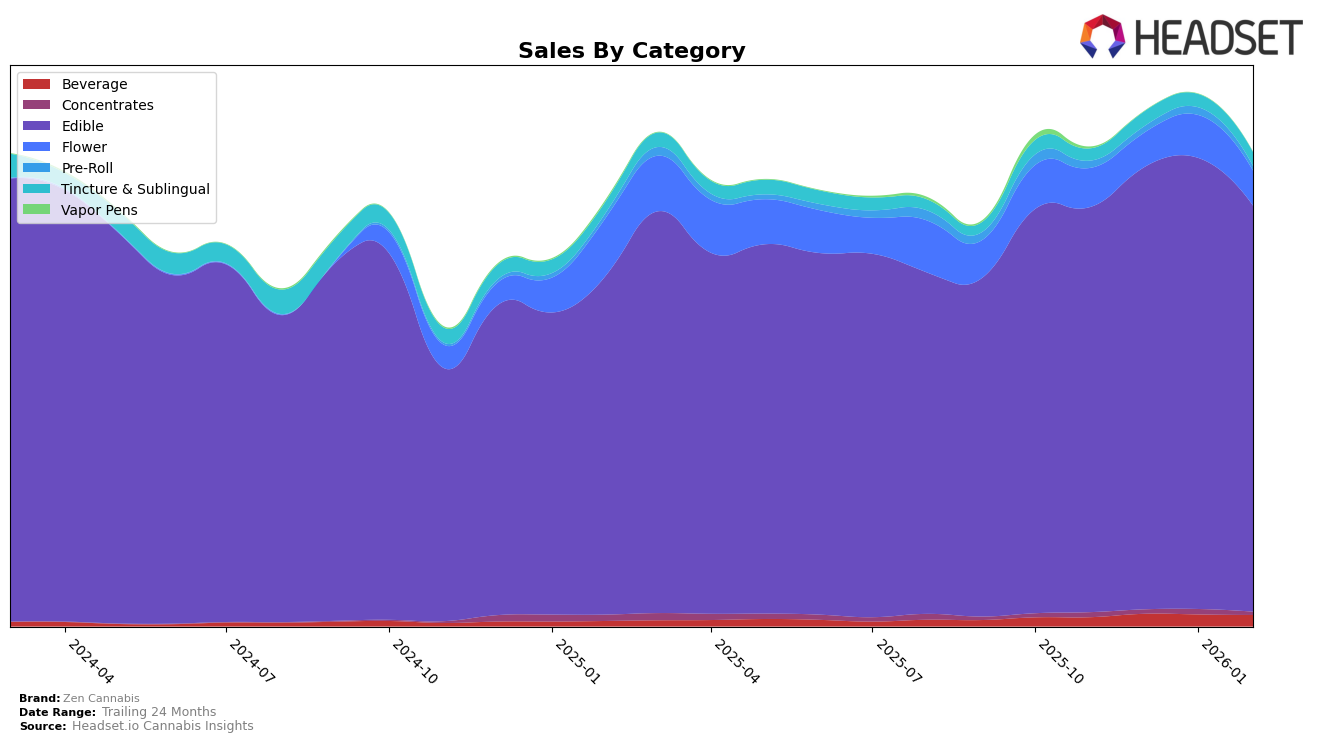

Zen Cannabis has shown varied performance across different states and product categories. In California, the brand maintained a consistent presence in the Edible category, holding the 19th rank from November 2025 through January 2026, before improving slightly to 17th in February. This upward movement is notable given the competitive nature of the California market. However, their sales figures in California saw a slight decline from December to February, indicating potential challenges despite the ranking improvement. The brand's stronghold appears to be in Missouri, where it consistently ranks in the top 10 for Edibles, maintaining the 7th position in January and February 2026. This stability suggests a solid consumer base in the state, particularly in the Edible category.

In the Tincture & Sublingual category in Missouri, Zen Cannabis maintained a strong position, ranking 2nd in November and December 2025, dipping slightly to 3rd in January 2026, and then returning to 2nd in February. This fluctuation indicates a competitive landscape, yet Zen Cannabis has managed to hold its ground effectively. Meanwhile, in Washington, the brand's performance in the Flower category did not make it into the top 30, with rankings in the high 60s and 80s across the months. This suggests that Zen Cannabis may face significant competition or challenges in gaining traction in Washington's Flower market. Overall, Zen Cannabis shows strong performance in certain niches and states, with room for growth in others.

Competitive Landscape

In the competitive landscape of the Missouri edible cannabis market, Zen Cannabis has shown a notable upward trend in its rankings and sales performance. From November 2025 to February 2026, Zen Cannabis improved its rank from 9th to 7th, indicating a positive trajectory in consumer preference and market penetration. This ascent is particularly significant given the competitive pressure from brands like Wana, which experienced a decline from 7th to 9th place, and Panda (MO), which fluctuated around the 8th and 9th positions. Meanwhile, Illicit / Illicit Gardens and Good Taste maintained stronger positions, consistently ranking in the top 6. Despite these challenges, Zen Cannabis's ability to climb the ranks suggests effective marketing strategies and product offerings that resonate well with Missouri consumers, setting a promising outlook for future growth in this category.

Notable Products

In February 2026, the top-performing product for Zen Cannabis was the CBD/THC 4:1 Grape NiteNite Gummies 10-Pack, maintaining its leading position from January with a sales figure of 8336. The Indica Mini Fruit Punch Gummies 25-Pack held steady in second place, consistent with its January ranking. The Sativa Mini Fruit Punch Gummies 25-Pack rose to third place, improving from its fourth-place position in January. Meanwhile, the Sativa Fruit Punch Gummies 10-Pack dropped to fourth place from third. Notably, the CBD/THC 4:1 Grape NiteNite Gummies 20-Pack re-entered the rankings in fifth place after missing the rankings in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.