Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

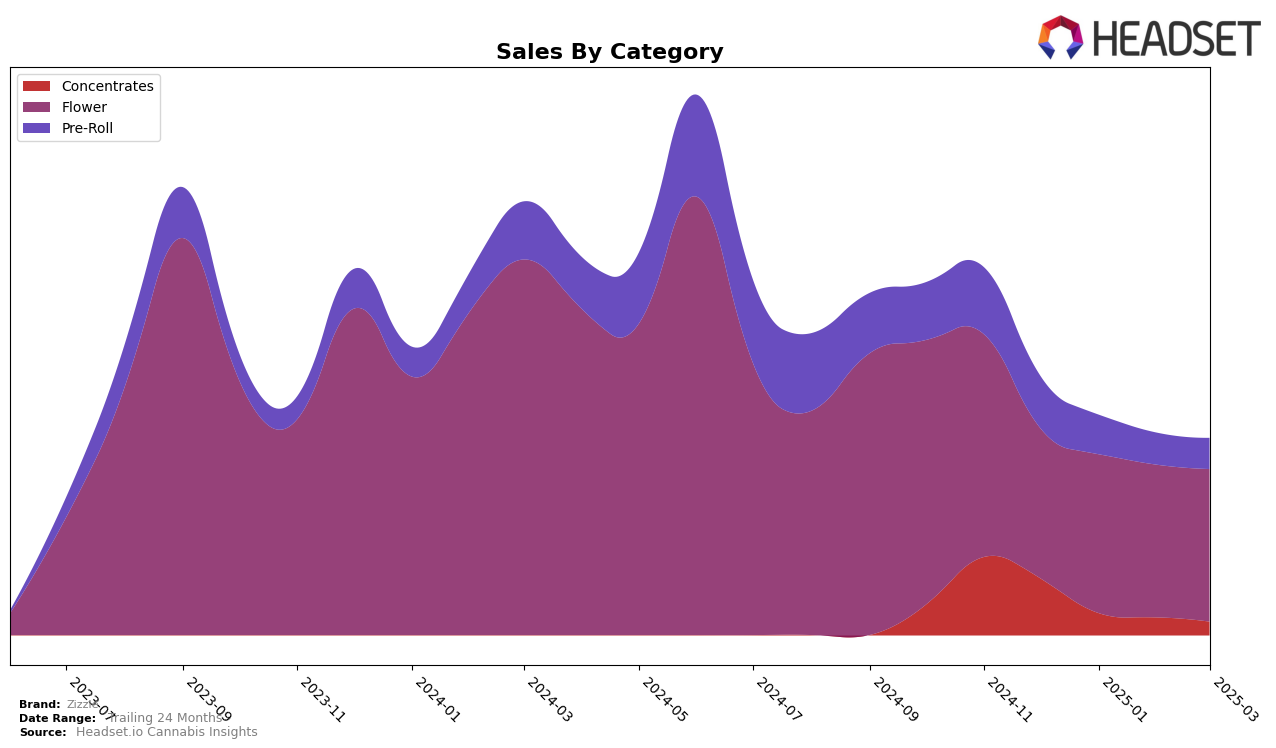

Zizzle's performance across various categories and regions shows a mixed bag of results. In New York, the brand's Flower category has experienced slight fluctuations in its rank, moving from 33rd in December 2024 to 30th in January 2025, before slipping back to 38th by March 2025. This indicates a somewhat unstable position in the market, though maintaining a spot within the top 40 suggests a persistent presence. In contrast, the Pre-Roll category in New York has seen a decline, with rankings dropping from 53rd in December to 75th by March, highlighting a need for strategic adjustments in this segment.

Meanwhile, in Saskatchewan, Zizzle has shown noteworthy performance in the Concentrates category. The brand started strong, holding the top position in December 2024, but has since seen a gradual decrease in rank, settling at 9th by March 2025. Despite this decline, maintaining a position within the top 10 signifies a robust foothold in the Saskatchewan concentrates market. The initial high ranking suggests a strong brand reception, though the downward trend may indicate increasing competition or shifting consumer preferences. Overall, Zizzle's varied performance across different states and categories underscores the dynamic nature of the cannabis market.

Competitive Landscape

In the competitive landscape of the New York flower category, Zizzle has maintained a relatively stable position, though it experienced a slight decline in rank from December 2024 to March 2025, moving from 33rd to 38th place. This shift is notable when compared to competitors like High Falls Canna New York, which improved its rank significantly from 44th to 33rd during the same period, indicating a potential threat to Zizzle's market position. Meanwhile, Good Green and Her Highness NYC have shown fluctuations, with Her Highness NYC entering the top 20 by March 2025, suggesting a competitive edge in sales growth. Despite these shifts, Zizzle's sales figures have remained relatively consistent, suggesting a loyal customer base, but the brand may need to innovate or adjust strategies to counteract the upward momentum of its competitors and regain a stronger foothold in the market.

Notable Products

In March 2025, Triangle Mints (3.5g) maintained its top position in the Flower category for Zizzle, with sales reaching 1059 units. Sour Diesel (3.5g) followed closely as the second-ranked product, showing a steady rise from its fourth position in January. Wet Dream (3.5g) debuted in March, securing the third rank in the Flower category. Sour Diesel Pre-Roll 3-Pack (1.5g) experienced a decline, dropping to fourth place after being the top product in January. Silver Haze (3.5g) remained consistently in fifth place, showing slight sales improvement from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.