Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

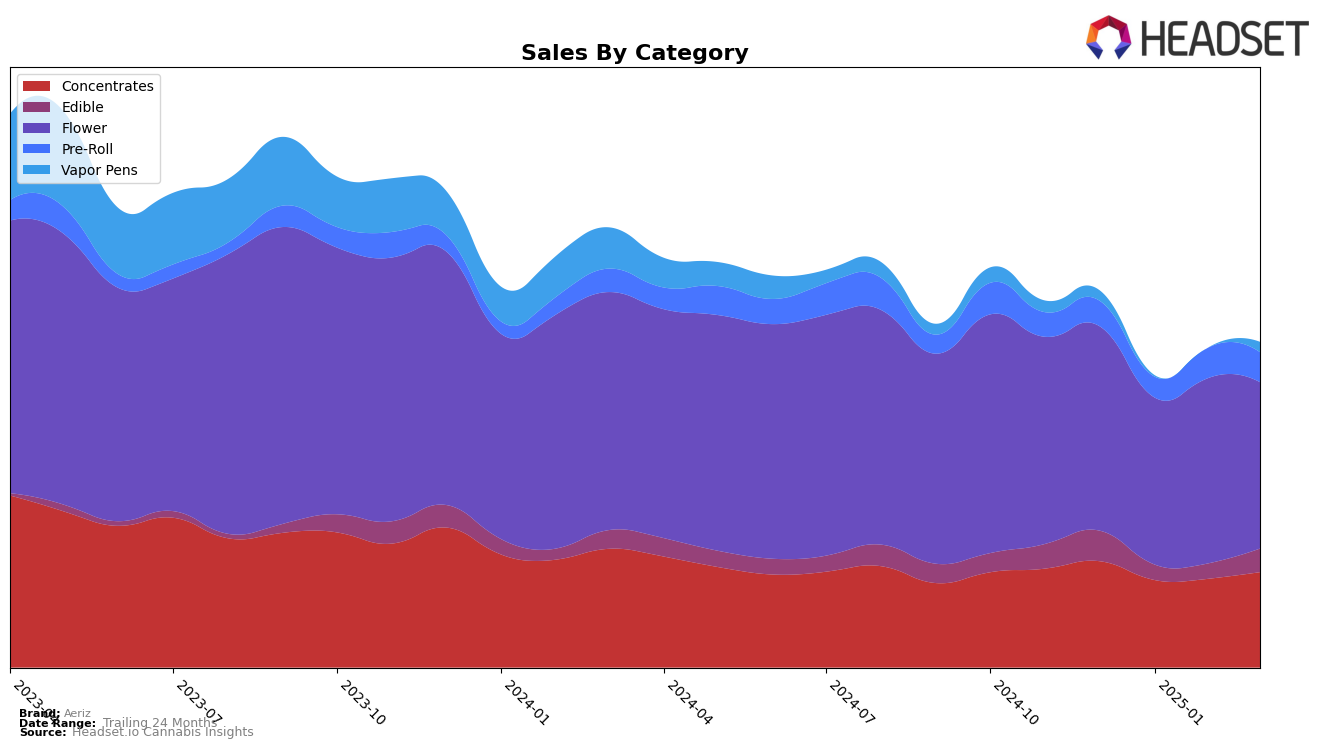

In Arizona, Aeriz has shown notable performance across the Flower and Pre-Roll categories. The Flower category experienced a significant upward trend, moving from a rank of 23 in December 2024 to an impressive rank of 11 by February 2025, before slightly dropping to 16 in March. This upward movement aligns with a steady increase in sales, peaking in February. On the other hand, the Pre-Roll category saw Aeriz climb from rank 29 in December to 22 in January, maintaining a relatively stable position until it fell out of the top 30 by March. This drop suggests potential challenges or increased competition in the Arizona Pre-Roll market.

In Illinois, Aeriz has maintained a dominant position in the Concentrates category, consistently holding the number one rank from December 2024 through March 2025. This consistency highlights Aeriz's strong foothold and brand loyalty in the Concentrates market. Meanwhile, in the Flower category, Aeriz experienced some fluctuations, starting at rank 9 in December, dropping to 14 by March, despite a generally high sales volume. The Edible category saw a moderate but steady performance, with ranks hovering around the mid-teens, indicating a stable presence. However, Aeriz's Vapor Pens category did not make it into the top 30, which may indicate an area for potential growth or reevaluation.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Aeriz has demonstrated a dynamic performance, experiencing fluctuations in its ranking over the months from December 2024 to March 2025. Aeriz started strong with a 9th place rank in December 2024, but saw a dip to 13th in January 2025, a slight recovery to 10th in February, and then a drop to 14th in March. Despite these changes, Aeriz maintained relatively robust sales figures, indicating a resilient market presence. Compared to competitors like Cresco Labs, which consistently ranked lower than Aeriz in February and March, Aeriz's sales performance suggests a competitive edge in consumer preference. Meanwhile, Revolution Cannabis maintained a slightly better rank than Aeriz in December and January but fell behind in sales by March. The fluctuating ranks of Bedford Grow and The Botanist further highlight the competitive volatility in this market, with Aeriz's sales remaining relatively stable despite these shifts. This analysis underscores the importance of strategic positioning and brand loyalty in maintaining sales momentum amidst competitive pressures.

Notable Products

In March 2025, Aeriz's top-performing product was the Jenny Kush Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its first-place ranking from the previous month with sales reaching 13,371. The Jenny Kush (3.5g) in the Flower category held steady at the second position, despite a slight decrease in sales. The GMO (3.5g), also in the Flower category, remained in third place, showing a consistent ranking over the past months. Jenny Kush Full Spectrum Hash Oil (1g) in the Concentrates category retained its fourth position, while the Pink Lemonade Full Spectrum Hash Oil Dablicator (1g) continued in fifth place. Overall, the top five products demonstrated stability in their rankings from February to March, with minor fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.