Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

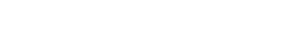

Bedford Grow has demonstrated varied performance across different cannabis product categories in Illinois. In the Concentrates category, Bedford Grow showed a strong presence, consistently ranking within the top three from December 2024 to March 2025. This indicates a robust market position, although a slight dip in March suggests potential competitive pressures or seasonal fluctuations. Conversely, in the Edible category, Bedford Grow's rankings hovered around the 30th position, with a notable improvement in March 2025. This marginal upward movement could signal a positive response to strategic adjustments or new product introductions, but it's clear that there's still room for growth in this segment.

The Flower category also presented an interesting trend for Bedford Grow in Illinois. While the brand's ranking slightly fluctuated, returning to the 12th position in March 2025, sales figures indicate a recovery from a January low. This suggests a resilience in the Flower category, potentially driven by consumer loyalty or successful marketing efforts. In the Pre-Roll category, Bedford Grow has shown significant progress, improving its rank from 32nd in December 2024 to maintaining the 21st position by March 2025. This steady climb highlights the brand's growing acceptance in this category, possibly due to product innovations or effective distribution strategies. However, the absence of top 30 rankings in other states or provinces underscores the brand's current geographic limitation, suggesting opportunities for expansion beyond Illinois.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Bedford Grow has experienced notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 12 in December, Bedford Grow saw a dip to rank 15 in January, only to recover slightly to rank 14 in February and further improve to rank 12 by March. This recovery is significant as it indicates a resilience in market presence despite a challenging competitive environment. Notably, Midweek Friday showed a strong upward trajectory, moving from rank 15 in December to rank 11 by March, suggesting a potential threat to Bedford Grow's market share. Meanwhile, Grassroots also demonstrated a positive trend, climbing from rank 14 in December to rank 10 in March, further intensifying competition. In contrast, Aeriz experienced a decline, dropping from rank 9 in December to rank 14 in March, which might have provided Bedford Grow with an opportunity to regain some ground. Overall, while Bedford Grow has managed to maintain a stable position, the competitive dynamics suggest a need for strategic initiatives to sustain and improve its rank amidst rising competitors.

Notable Products

In March 2025, the top-performing product for Bedford Grow was Michelin Star Live Badder (1g) in the Concentrates category, securing the number one rank with sales of $4,745. It was followed by Romie Live Resin (1g), also in the Concentrates category, which took the second spot. Pumpkin Pie Caramels 5-Pack (100mg) in the Edible category ranked third, showing a strong performance. Big Body Gelati Live Sauce (1g) and Mecha Chem Diesel Pre-Roll (1g) rounded out the top five, ranking fourth and fifth, respectively. Compared to previous months, these products have maintained strong positions, with Michelin Star Live Badder and Romie Live Resin consistently leading the sales charts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.