Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

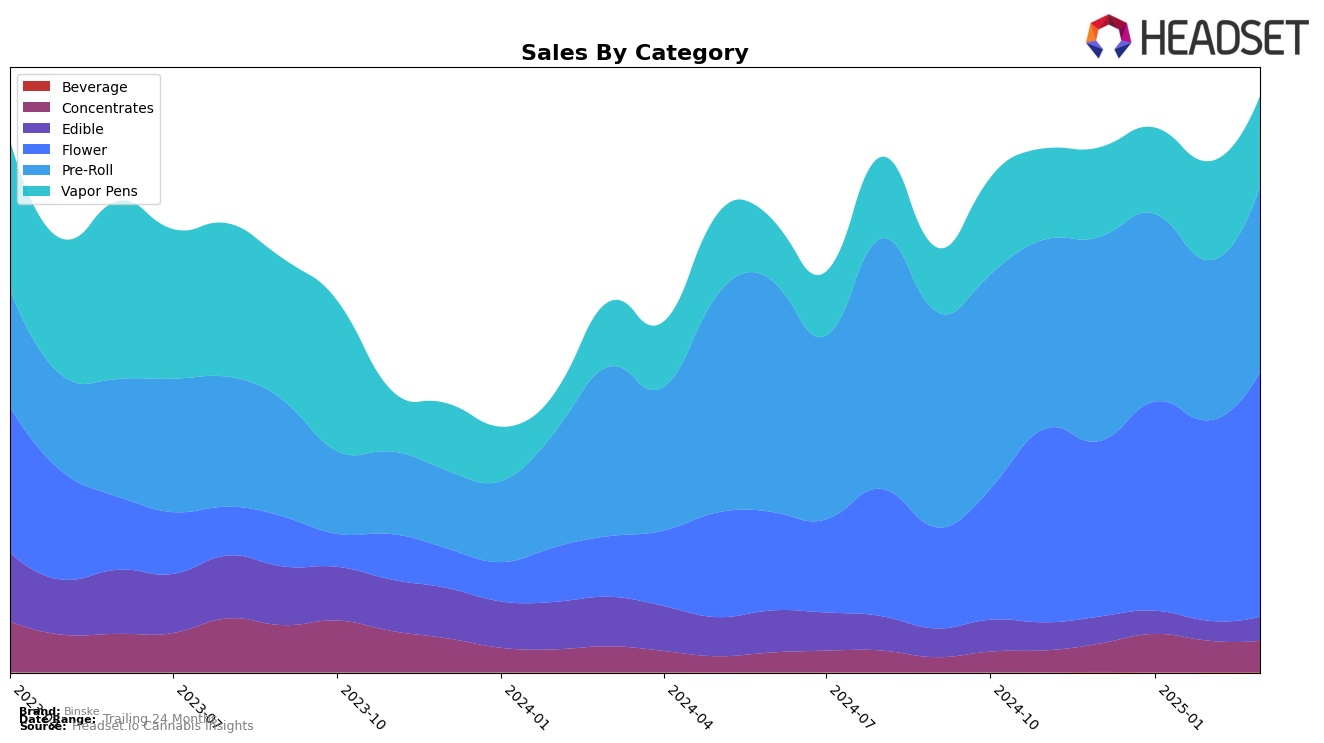

In the state of Colorado, Binske has demonstrated fluctuating performance across different cannabis categories. Notably, their Vapor Pens category saw a significant improvement, climbing from 27th position in December 2024 to a peak of 19th in February 2025, before settling at 21st in March. This upward trajectory in Vapor Pens is indicative of a positive trend, suggesting growing consumer preference or effective market strategies. However, Binske's presence in the Concentrates category did not make it into the top 30 ranks from February to March 2025, which might indicate challenges in maintaining competitiveness within this segment. Meanwhile, Binske's entry into the Edible category in March 2025 at 26th position could signal new opportunities for growth.

In Illinois, Binske's performance in the Flower category showed a consistent upward trend, moving from 40th in December 2024 to 29th by March 2025, highlighting a strengthening position in this competitive market. Conversely, their Pre-Roll category experienced a slight decline, maintaining a stable 14th position in December and January, but dropping to 17th in February and March. This shift could suggest a need to reassess strategies in the Pre-Roll segment. In Massachusetts, Binske did not reach the top 30 in any category by March 2025, which could point to significant competitive pressures or market entry challenges. Additionally, in New York, Binske's Flower category experienced a decline from 59th in January to 92nd by March, indicating potential difficulties in gaining traction in this market.

Competitive Landscape

In the competitive landscape of the flower category in Illinois, Binske has shown a promising upward trajectory in its rankings from December 2024 to March 2025, moving from 40th to 29th place. This improvement is notable when compared to competitors such as FloraCal Farms, which experienced fluctuations, ending at the same rank as Binske in March 2025, despite starting higher. Meanwhile, IC Collective maintained a relatively stable position, ending slightly ahead of Binske, yet experiencing a dip in March. Galaxy saw a decline, dropping to 30th place, which may have contributed to Binske's rise. Legacy Cannabis (IL) also saw a downward trend, further highlighting Binske's positive movement. This upward shift in rank for Binske, coupled with a consistent increase in sales, suggests a strengthening market presence and potential for continued growth in the Illinois flower market.

Notable Products

In March 2025, the top-performing product for Binske was Zest Zinger Pre-Roll (1g), securing the number one rank with sales of 7,587 units. The Prism Pre-Roll (1g) followed closely in second place, showcasing a strong performance in the pre-roll category. Jungle Pie (3.5g) maintained a steady presence in the top three, although it slipped from its previous second-place ranking in February. The Prism Pre-Roll 7-Pack (3.5g) entered the rankings at fourth place, while Tangerine Twist (3.5g) rounded out the top five. Notably, Jungle Pie (3.5g) experienced a slight resurgence in sales from the previous month, indicating a potential upward trend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.