Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

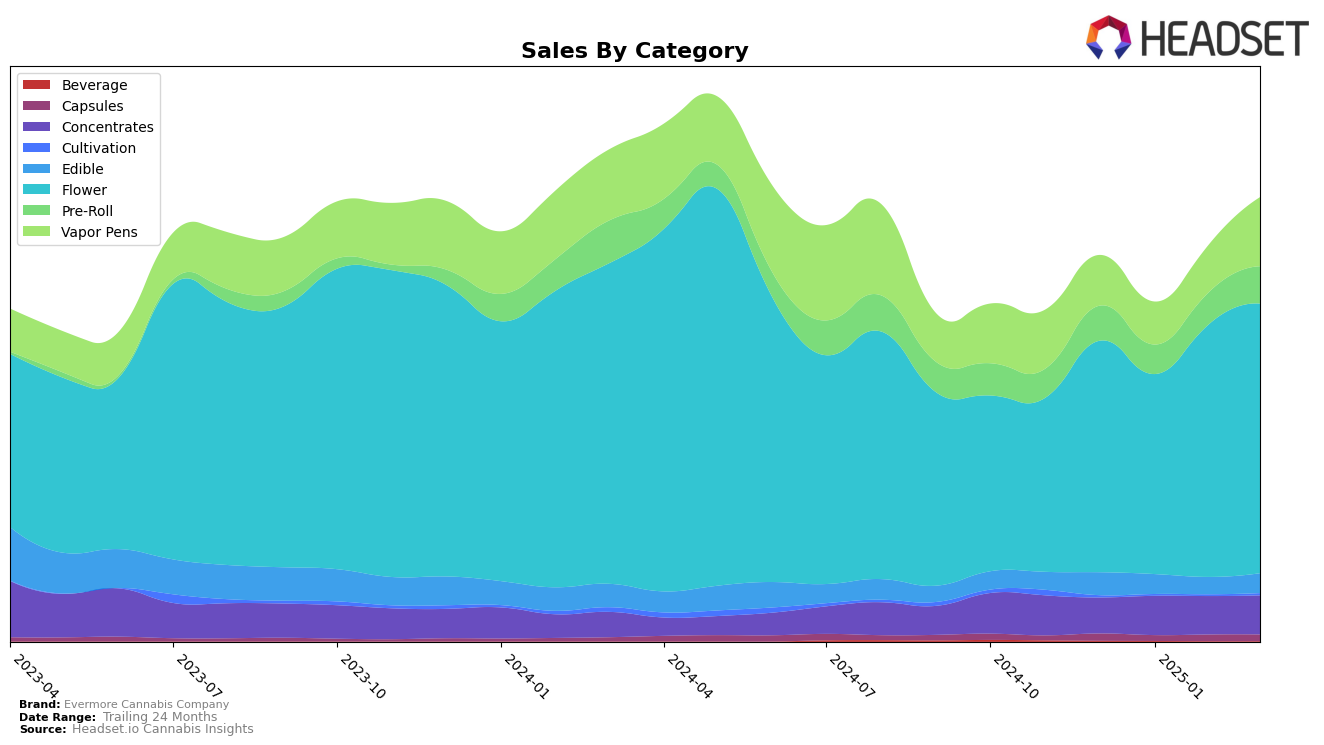

Evermore Cannabis Company has demonstrated noteworthy performance in the Maryland market, particularly in the Concentrates category, where it climbed from the 8th position in December 2024 to a solid 3rd place by March 2025. This upward movement indicates a strengthening presence and possibly an increasing consumer preference for their concentrate products. In the Flower category, Evermore has also shown impressive progress, moving from 11th to 6th place over the same period. This rise in ranking suggests a growing demand for their flower offerings, which might be attributed to product quality or effective distribution strategies. It's worth noting that in the Vapor Pens category, they made a significant leap from 16th to 11th place, showcasing their potential to capture more market share in this segment.

In contrast, the Edible category presents a different story for Evermore Cannabis Company in Maryland. The brand maintained a consistent rank of 19th place from December 2024 through March 2025, indicating a stable but less competitive position in this category. This could suggest a need for strategic adjustments or innovation to improve their standing. Meanwhile, in the Pre-Roll category, Evermore showed a slight improvement, moving from 13th to 11th place by March. While this is a positive trend, their performance across the categories highlights varying degrees of success, with some areas like Concentrates and Flower showing strong growth, while others like Edibles remain stagnant. Understanding these dynamics could be crucial for Evermore as they strategize future growth initiatives in Maryland's competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Evermore Cannabis Company has shown a notable upward trajectory in its rankings from December 2024 to March 2025. Initially ranked 11th in December 2024, Evermore improved its position to 6th by March 2025. This upward movement is significant, especially when compared to competitors like Curio Wellness, which maintained a relatively stable rank, fluctuating between 6th and 10th, and Savvy, which consistently hovered around the 6th to 7th positions. Meanwhile, Strane and SunMed have been leading the pack, with Strane maintaining a top 5 position and SunMed consistently ranking in the top 5 as well. Despite these strong competitors, Evermore's rise in rank suggests a positive trend in consumer preference and market penetration, which could be indicative of strategic marketing efforts or product innovations that resonate well with the Maryland consumer base.

Notable Products

In March 2025, Orange Drizzle (3.5g) emerged as the top-performing product for Evermore Cannabis Company, achieving the number one rank with sales of 6946 units. Midnight Circus (3.5g) maintained a strong position, holding steady at rank 2, showing consistent demand following its previous top ranking in December 2024 and January 2025. Sunset Octane (3.5g) climbed to rank 3, improving from its February position, indicating a positive sales trend. Funky Guava (3.5g), which was the leader in February, dropped to rank 4, suggesting a shift in consumer preference. Deadband #12 (3.5g) reappeared in the rankings at position 5, showing a slight decline from its December 2024 rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.