Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

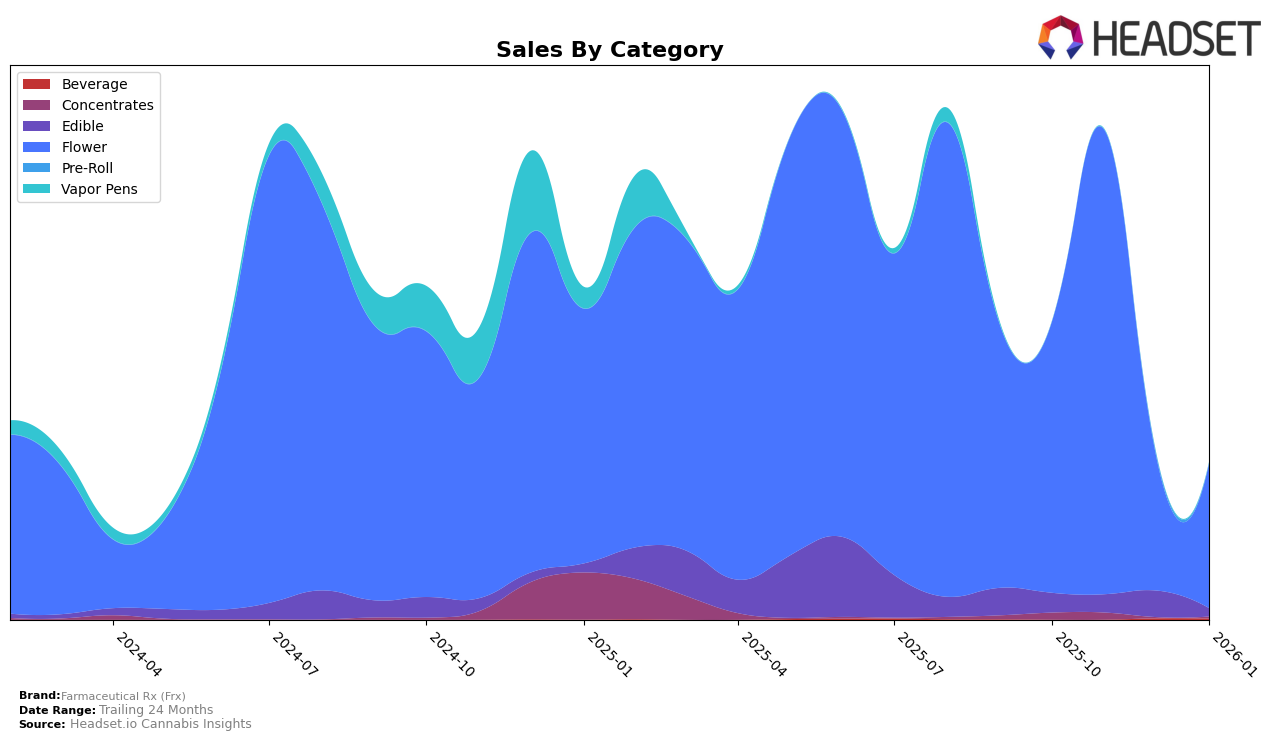

In examining the performance of Farmaceutical Rx (Frx) in the Ohio market, notable fluctuations can be observed across different product categories. In the Edible category, Farmaceutical Rx (Frx) did not rank within the top 30 brands from October 2025 through January 2026, with a significant dip in sales noted in January 2026. This indicates a challenging market position and suggests potential areas for strategic improvement. On the other hand, the Flower category presents a more dynamic picture, where Farmaceutical Rx (Frx) managed to stay within the top 40, peaking at rank 21 in November 2025. This upward trend in November, followed by a slight decline, highlights a competitive edge that could be further leveraged.

The Flower category in Ohio demonstrates a particularly interesting trajectory for Farmaceutical Rx (Frx). While the brand's rank fluctuated from 31 to 39 before stabilizing at 35 by January 2026, the sales figures reveal a more nuanced story. Despite the rank fluctuations, the brand experienced a substantial sales increase in November 2025, suggesting a strong market reception during that period. This performance could be indicative of successful marketing strategies or product launches that resonated well with consumers. The ability to maintain a presence in the top 40 suggests that while there are challenges, there is also a foundation for potential growth in the Ohio market.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Farmaceutical Rx (Frx) has experienced notable fluctuations in its ranking over the last few months. Starting from October 2025, Farmaceutical Rx (Frx) was ranked 31st, improving to 21st in November, before dropping to 39th in December, and slightly recovering to 35th in January 2026. This volatility in ranking reflects the brand's struggle to maintain a consistent position amidst strong competition. Notably, Modern Flower also showed a similar pattern, starting at 25th in October, dropping to 30th in November, and further declining to 50th in December, before climbing back to 31st in January. Meanwhile, Firelands Scientific maintained a more stable presence, with rankings fluctuating between 28th and 33rd. The sales trends suggest that while Farmaceutical Rx (Frx) saw a significant sales increase in November, the subsequent months' decline indicates challenges in sustaining that momentum. This competitive environment highlights the need for Farmaceutical Rx (Frx) to strategize effectively to capitalize on market opportunities and stabilize its ranking and sales performance.

Notable Products

In January 2026, the top-performing product for Farmaceutical Rx (Frx) was Banana Kush (2.83g) in the Flower category, securing the first rank with sales of 1142 units. Animal Face (2.83g) maintained its strong performance, holding steady in the second position from December 2025 to January 2026. Wedding Cake (2.83g) climbed to the third rank, showing an improvement from its absence in the rankings in the previous months. Banana Platinum OG (2.83g) entered the top five, achieving fourth place, while White Truffle (2.83g) slightly dropped from fourth to fifth place. These shifts indicate a dynamic market where consumer preferences for specific Flower products are evolving over time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.