Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

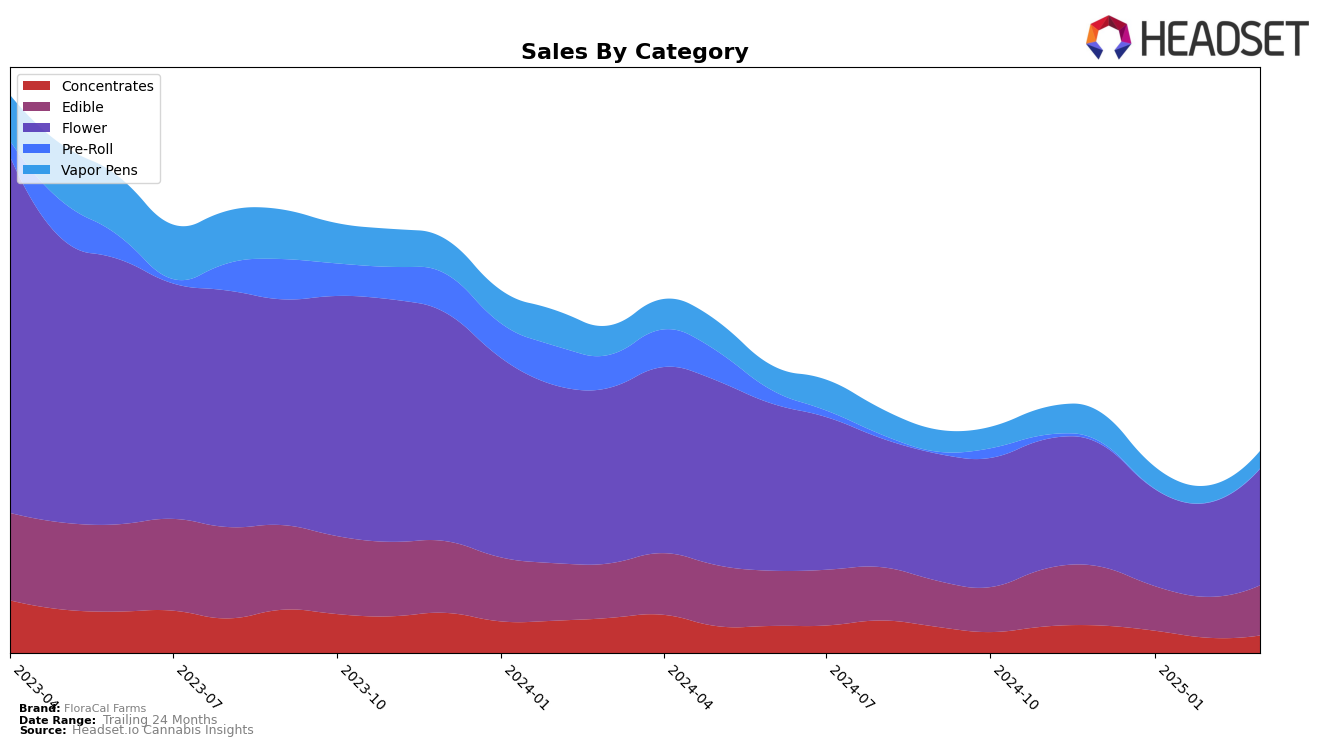

In Illinois, FloraCal Farms has demonstrated a varied performance across different product categories. Notably, their ranking in the Concentrates category has seen some fluctuations, starting at 15th in December 2024, dropping to 20th in February 2025, and then recovering to 16th by March 2025. This indicates a potential rebound in consumer interest or strategic adjustments by the brand. In contrast, their presence in the Vapor Pens category has not been as strong, with rankings consistently outside the top 30, peaking at 39th in December 2024 and further slipping to 44th by March 2025, suggesting challenges in gaining traction in this segment. The Flower category also reflects a similar pattern of fluctuation, with a dip outside the top 30 in January and February 2025, before returning to 27th position in March 2025.

Meanwhile, in Massachusetts, FloraCal Farms has shown a stable yet improving performance in the Edible category. They maintained a steady 34th position from December 2024 through February 2025, before climbing to 28th in March 2025, indicating a positive trend in consumer acceptance or market penetration. However, in Michigan, the brand's presence in the Edible category is less pronounced, with a ranking of 77th in December 2024 and no subsequent rankings in the following months, suggesting either a strategic withdrawal or an inability to sustain competitive positioning in that market. This highlights the varied challenges and opportunities FloraCal Farms faces as it navigates different state markets and product categories.

Competitive Landscape

In the competitive landscape of the Illinois flower category, FloraCal Farms has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked at 27th in December 2024, FloraCal Farms saw a dip to 32nd and 33rd in January and February 2025, respectively, before rebounding to its original 27th position in March 2025. This volatility in ranking is contrasted by the steady ascent of Binske, which improved its rank from 40th to 29th over the same period, indicating a consistent upward trend. Meanwhile, IC Collective maintained a relatively stable presence, hovering around the mid-20s, except for a slight dip in March. Interstate 420 also showed a positive trajectory, moving from 31st to 25th. The competitive pressure from these brands, particularly those with upward momentum, suggests that FloraCal Farms may need to strategize effectively to maintain and improve its market position amidst dynamic shifts in consumer preferences and competitive strategies.

Notable Products

In March 2025, the top-performing product for FloraCal Farms was Pink Lemonade Live Rosin Gummies 10-Pack (100mg), which rose to the number one spot with sales of $7,335. Purple Plague (3.5g), previously holding the top rank from December 2024 through February 2025, moved to the second position. Wild Berry Live Rosin Gummies 10-Pack (100mg) maintained a strong presence, ranking third, showing a slight decline from its second position in February 2025. Tropical Punch Live Rosin Gummies 10-Pack (100mg) remained stable in the fourth position for March 2025. Kush Mints (3.5g) re-entered the rankings at fifth, mirroring its position from December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.