Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

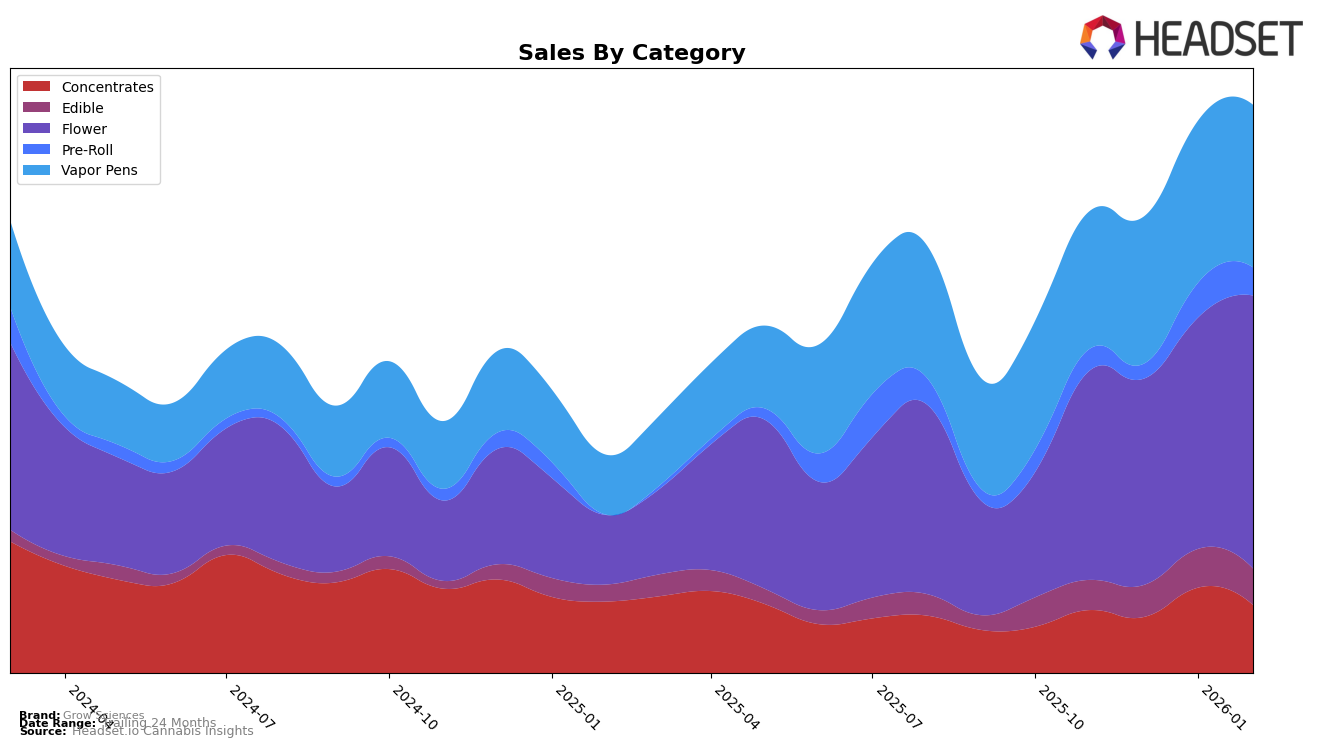

Grow Sciences has demonstrated a consistent presence in the Arizona market, particularly in the Concentrates category, where they maintained a stable rank of 5th from November 2025 to January 2026, before slipping slightly to 6th in February 2026. This indicates a strong foothold in this category, despite a slight dip in February. In the Flower category, the brand has shown upward momentum, climbing from 12th in November 2025 to 10th by February 2026, which suggests growing consumer preference or strategic improvements. Conversely, the Pre-Roll category has seen more volatility, with rankings fluctuating significantly, reaching as high as 27th in January 2026 but dropping to 36th in February. This inconsistency might point to challenges in maintaining a steady market position or varying consumer preferences.

In contrast, Grow Sciences is relatively new in the Illinois market, with limited category presence. Their performance in the Vapor Pens category shows a gradual improvement, moving from 66th in November 2025 to 54th by February 2026, indicating a positive trajectory and potential for growth. However, it is noteworthy that Grow Sciences did not make it into the top 30 brands in the Pre-Roll category until February 2026, when they debuted at 48th. This suggests that while there is room for growth, the brand faces significant competition and challenges in establishing itself as a leading player in Illinois. The absence of rankings in other categories also indicates that Grow Sciences may need to diversify its offerings or enhance its market strategies to gain a stronger foothold in this state.

Competitive Landscape

In the competitive landscape of the Arizona flower market, Grow Sciences has demonstrated a steady improvement in its rankings, moving from 12th place in November 2025 to 10th by February 2026. This upward trend is indicative of their growing market presence, although they still trail behind key competitors such as Dr. Greenthumb's, which consistently ranks higher, maintaining a position within the top 8. Meanwhile, Fade Co. experienced a drop from 6th to 11th place over the same period, suggesting potential vulnerabilities that Grow Sciences could capitalize on. Additionally, Abundant Organics and 22Red are also noteworthy, with the former showing a resurgence in sales and rank, and the latter climbing from 22nd to 12th, directly competing with Grow Sciences. These dynamics highlight the competitive pressures and opportunities for Grow Sciences to further enhance its market position.

Notable Products

In February 2026, the top-performing product from Grow Sciences was the Blueberry Hibiscus Rosin Fruit Chews 10-Pack (100mg) in the Edible category, maintaining its first-place rank from January with sales of 3206 units. Dante (3.7g) in the Flower category made a strong debut, securing the second rank. Trop Cherry (3.7g), also a Flower product, followed closely in third place. The Strawberry Tangerine Rosin Fruit Chews 10-Pack (100mg) in the Edible category slipped slightly from third to fourth place. Banana Cream Cake x Jealousy (3.7g) saw a decline, moving from the first rank in December to fifth in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.