Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

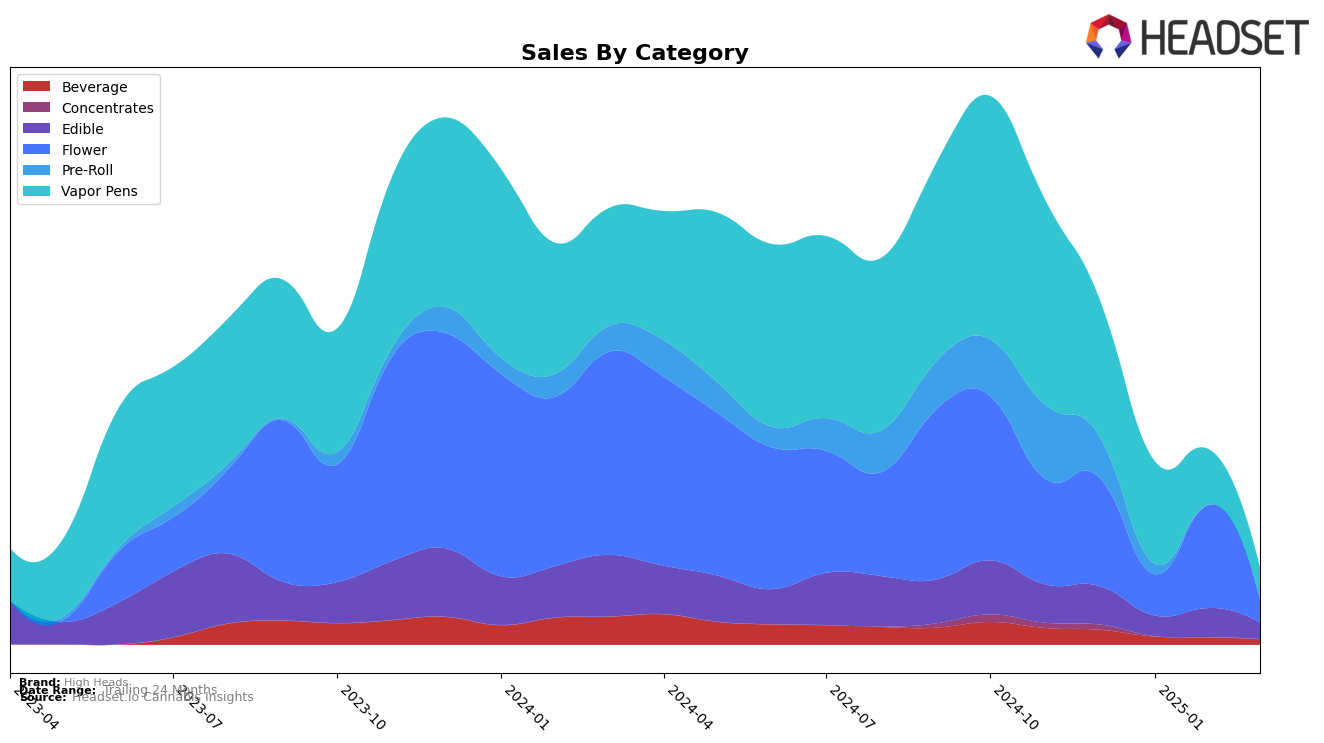

High Heads has demonstrated varied performance across different product categories in Nevada. In the Beverage category, their ranking has remained relatively stable, oscillating between the 6th and 7th positions from December 2024 to March 2025. However, sales have shown a declining trend over these months. In the Edibles category, High Heads maintained a strong presence, though their rank dropped from 13th to 17th by March 2025. This drop in rank is noteworthy given that sales figures show fluctuations, suggesting potential market volatility or increased competition. The brand's performance in the Concentrates category is particularly concerning as they were last ranked 25th in December 2024 and have since not appeared in the top 30, indicating a significant drop in market presence.

The Flower category has been another area of mixed results for High Heads in Nevada. Initially ranked 17th in December 2024, their position fell sharply to 58th by March 2025, showing a notable decline in market competitiveness. This movement is accompanied by a significant decrease in sales, which might be a signal of shifting consumer preferences or increased competition. The Vapor Pens category also reflects a downward trend in rank, from 12th in December 2024 to 30th by March 2025, with sales following a similar declining trajectory. In contrast, the Pre-Roll category saw High Heads drop from 17th to out of the top 30 by February 2025, highlighting a potential area for strategic reevaluation. These movements across categories suggest that while High Heads maintains strengths in certain areas, there are also significant challenges that need to be addressed to sustain and improve their market position.

Competitive Landscape

In the Nevada vapor pens category, High Heads has experienced notable shifts in rank and sales over recent months. Starting in December 2024, High Heads held a strong position at rank 12, but by March 2025, it had slipped to rank 30. This decline in rank is mirrored by a decrease in sales, indicating potential challenges in maintaining market share. In contrast, competitors such as Beboe and Locals Only Concentrates have shown upward trends, with Beboe improving its rank from 28 to 28 again after a brief climb, and Locals Only Concentrates rising significantly from rank 55 to 32. Meanwhile, CAMP (NV) and Boom Town Dabs have also seen fluctuations, with CAMP (NV) dropping from rank 15 to 33 and Boom Town Dabs improving from 41 to 29. These dynamics suggest a highly competitive landscape where High Heads may need to strategize effectively to regain its earlier standing and boost sales amidst the shifting ranks of its competitors.

Notable Products

In March 2025, the top-performing product for High Heads was Race Fuel OG Distillate Disposable (0.5g) from the Vapor Pens category, securing the number one rank with sales of 1,447 units. Trippy Berry Drink Puff Punch Drink (100mg) from the Beverage category rose to second place, showing a notable improvement from its third position in January 2025. Gelatti Distillate Disposable (0.5g) also saw an upward movement, climbing from fifth in February to third in March. Tropical Takeoff Gummies 10-Pack (100mg) maintained a steady performance, consistently holding the fourth rank from February to March. Mango Madness Puff Punch Drink (100mg) entered the top five for the first time, capturing the fifth rank in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.