Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

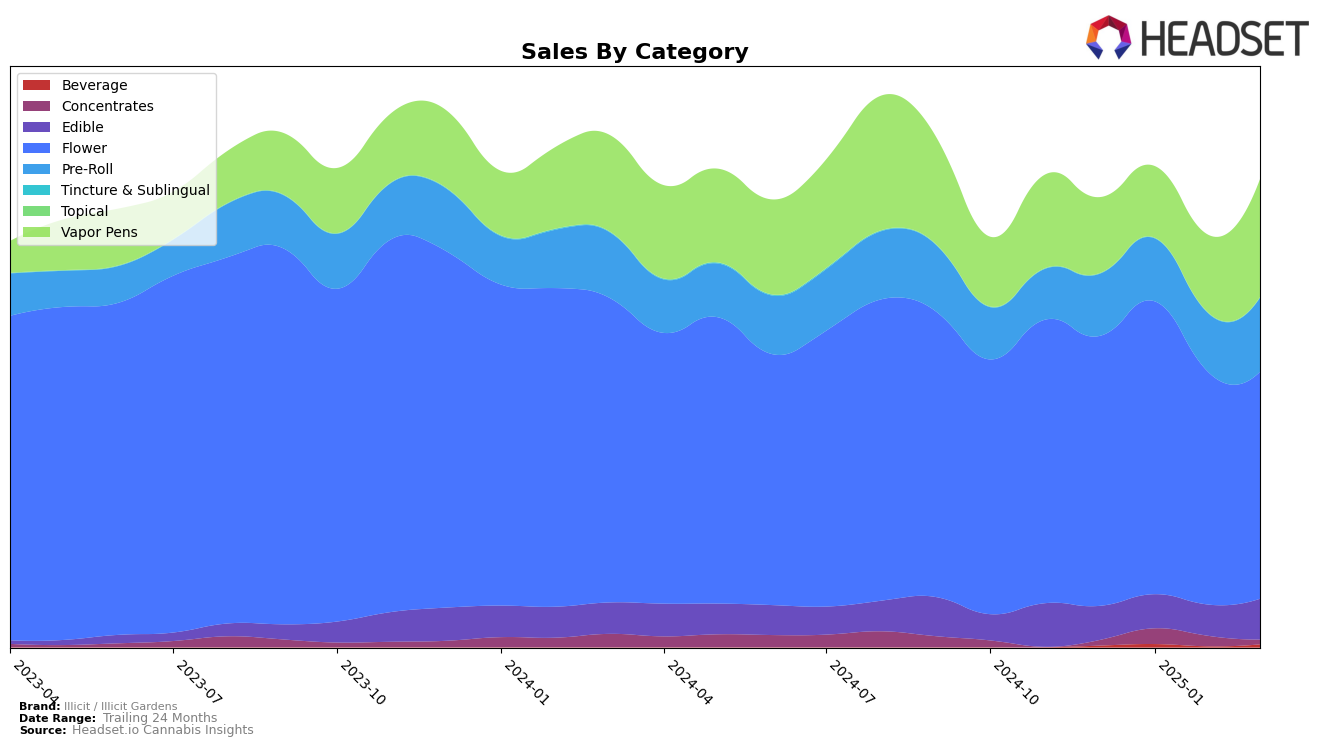

Illicit / Illicit Gardens has demonstrated a varied performance across different categories and states. In Missouri, the brand has maintained a strong presence in the Edible category, consistently holding the 8th position from December 2024 through March 2025. This stability contrasts with their performance in the Concentrates category, where they were not in the top 30 in December 2024 but achieved the 11th rank by January 2025, only to drop to 14th by February, with no ranking data for March. Such fluctuations indicate a dynamic market presence that could be influenced by various factors including product innovation or market competition. Meanwhile, in the Vapor Pens category, Illicit / Illicit Gardens showed significant upward momentum, climbing from 15th in December 2024 to a commendable 3rd place by March 2025.

In New Jersey, Illicit / Illicit Gardens experienced more challenges, particularly in the Flower category where they slipped from 17th in December 2024 to 25th by March 2025. This downward trend suggests possible competitive pressures or shifting consumer preferences. The brand's presence in the Pre-Roll category was not recorded in December 2024, but they entered the rankings at 15th in January 2025, indicating a potential entry strategy or product launch that gained initial traction. However, their performance in the Vapor Pens category remained relatively stable, albeit at lower ranks, fluctuating slightly between 18th and 21st over the same period. This suggests a need for strategic adjustments to improve market positioning and capture a larger share in the New Jersey market.

Competitive Landscape

In the Missouri flower category, Illicit / Illicit Gardens has experienced some fluctuations in its competitive standing, maintaining a strong presence despite facing stiff competition. From December 2024 to March 2025, Illicit / Illicit Gardens consistently ranked within the top five brands, although it saw a slight dip from third to fourth position in February 2025. This change in rank was primarily due to the rising performance of Amaze Cannabis, which climbed from fifth to third place by March 2025, showcasing a notable increase in sales. Meanwhile, CODES maintained its second-place position with consistently high sales figures, indicating a robust market presence. Despite these shifts, Illicit / Illicit Gardens has managed to retain a competitive edge, although the brand may need to strategize to counter the upward momentum of its competitors like Vivid (MO), which, despite a drop in rank, showed resilience in sales recovery by March 2025.

Notable Products

In March 2025, the top-performing product for Illicit / Illicit Gardens was the CBD/CBN/THC 2:2:1 Peaches & Dreams Nighttime Gummies 10-Pack, reclaiming its number one rank from December 2024 and achieving sales of 6,354 units. Violet Fog emerged in the rankings, securing the second position among flower products. Chem Butter, which held the top spot in February, experienced a drop to third place. Gorilla Pie maintained its consistency, ranking fourth in March after a slight decline from February. GMO Cookies entered the rankings for the first time in March, capturing the fifth position in the flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.