Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

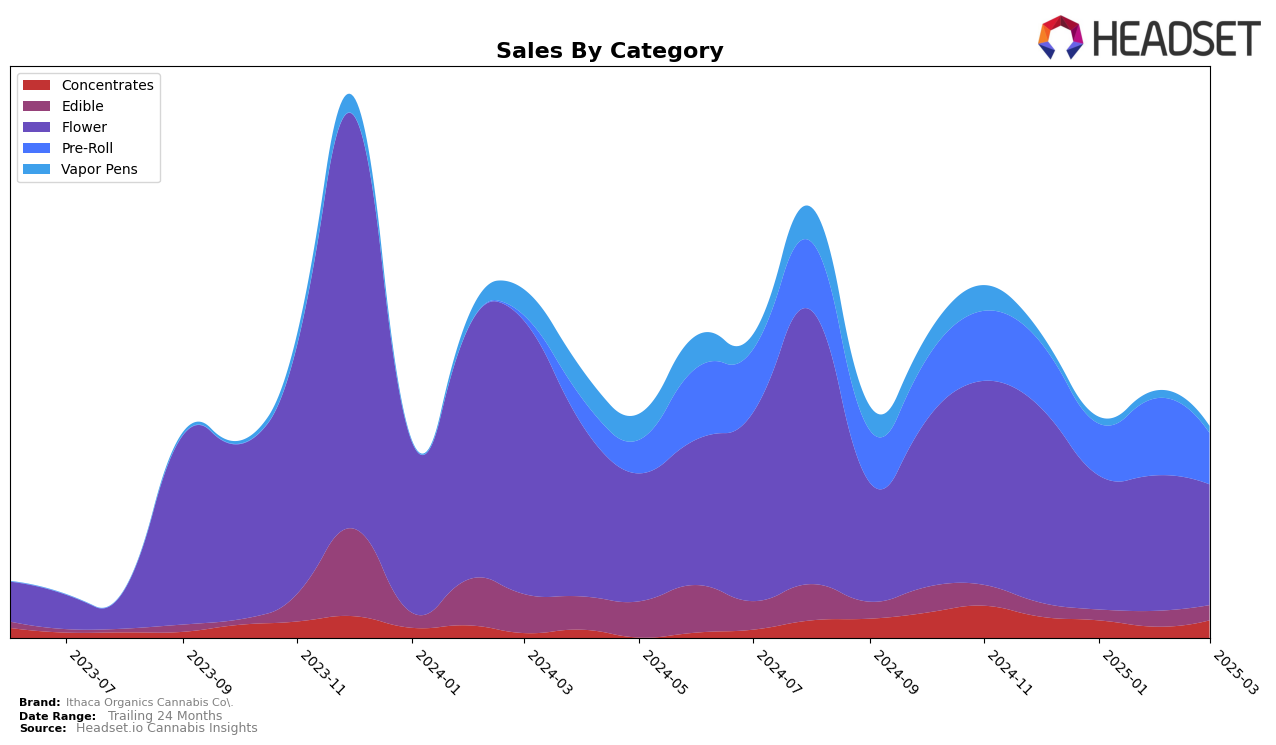

Ithaca Organics Cannabis Co. has shown varied performance across different product categories in New York. In the Concentrates category, the brand has maintained a relatively stable position, ranking within the top 30 brands for four consecutive months. However, there was a slight decline in March 2025, dropping from 20th in January to 24th by March. This consistent presence in the top rankings indicates a steady demand for their concentrates, despite some fluctuations. Conversely, their performance in the Edible category has been less consistent, with the brand failing to make the top 30 in January 2025. Nonetheless, they managed to climb back to 51st place by March, suggesting a potential recovery or strategic adjustment in their edible offerings.

The Flower category has seen a downward trend for Ithaca Organics Cannabis Co., with their ranking falling from 37th in December 2024 to 60th by March 2025. This indicates a significant challenge in maintaining a competitive edge in this highly contested category. Meanwhile, in the Pre-Roll category, the brand experienced a notable improvement in February 2025, jumping to 50th place from 64th in January, before falling back to 69th in March. This volatility suggests that while there are opportunities for growth, sustaining momentum in the Pre-Roll category remains a challenge. Overall, the brand's performance across these categories highlights areas of both resilience and potential concern, with varying success in maintaining top-tier rankings in the competitive New York market.

Competitive Landscape

In the competitive landscape of the New York flower category, Ithaca Organics Cannabis Co. has experienced fluctuations in its market position, notably dropping from a rank of 37 in December 2024 to 60 by March 2025. This decline in rank is mirrored by a decrease in sales over the same period, suggesting potential challenges in maintaining consumer interest or competitive pricing. Meanwhile, competitors like Packs (fka Packwoods) and Etain have shown varying performance, with Packs peaking at rank 38 in January 2025 before falling to 65 by March, and Etain maintaining a relatively stable presence, albeit with a slight dip in rank. Newer entrants like Ruby Farms and 1937 have emerged in the rankings, potentially capturing market share from established brands. These dynamics highlight the competitive pressures Ithaca Organics Cannabis Co. faces, emphasizing the need for strategic adjustments to regain and sustain its market position in New York's flower category.

Notable Products

In March 2025, the top-performing product for Ithaca Organics Cannabis Co. was Peach Maraschino Pre-Roll (1g), which climbed to the number one rank from the second place in February, achieving notable sales of 830 units. Citral Glue Pre-Roll (1g) dropped to the second position from its previous top rank in December and January, with sales slightly decreasing to 629 units. Sour Diesel Pre-Roll (1g) maintained a consistent performance, ranking third in March after leading in February with a significant drop to 551 units. Lilac Diesel GMO (3.5g) improved its standing to fourth place from a consistent fifth position in the previous months. Farmer's Blend Bubble Hash (1g) entered the top five for the first time in March, indicating a growing interest in concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.