Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

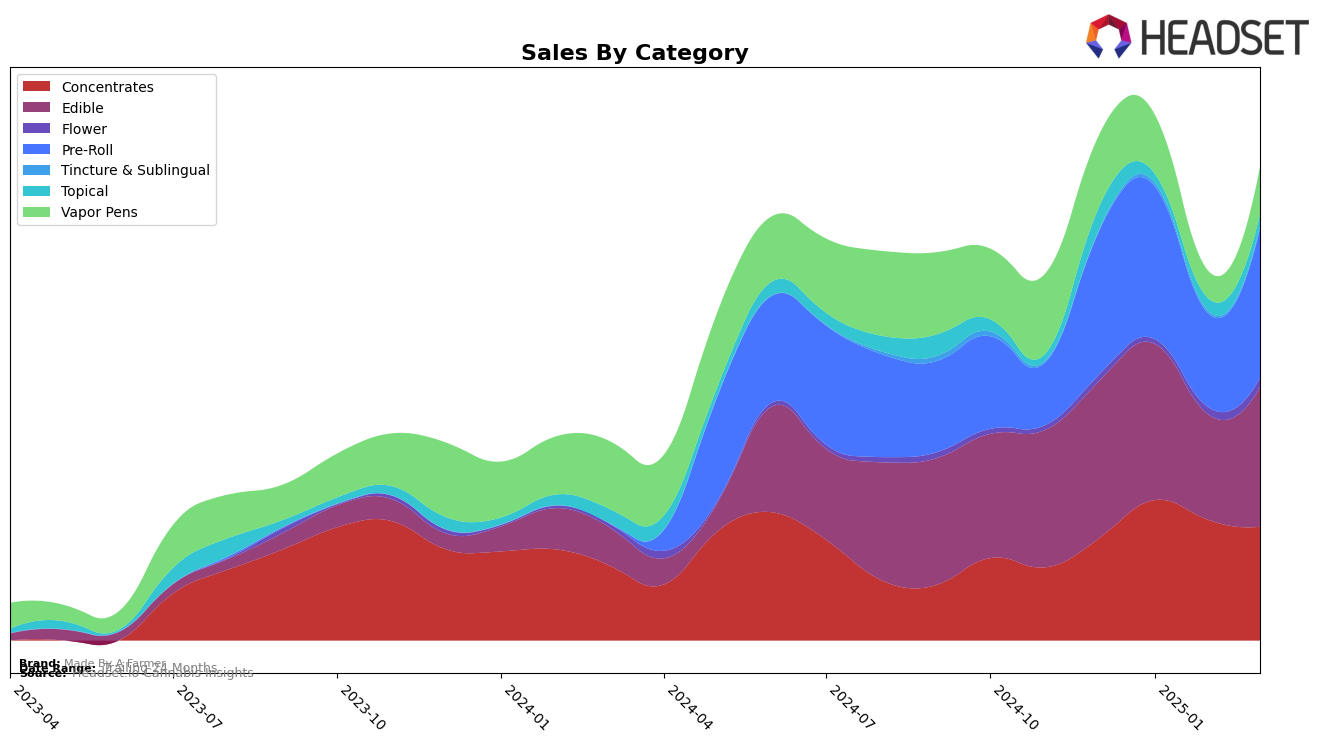

Made By A Farmer has shown varied performance across different product categories in Michigan. In the Concentrates category, the brand has consistently hovered around the 50s in ranking, showing a slight improvement over the months from December 2024 to March 2025. This indicates a stable position in the market, although they haven't broken into the top 30. In contrast, their performance in the Edible category has been more volatile, with rankings fluctuating between the 50s and 60s. This fluctuation suggests a competitive market landscape where Made By A Farmer is striving to maintain its footing.

In the Pre-Roll category, Made By A Farmer's rankings have been less stable, with a significant dip in February 2025, but they managed to recover by March. This indicates a potential challenge in maintaining consistent sales in this category. Notably, the brand has not been able to maintain a top 30 position in the Topical and Vapor Pens categories beyond December 2024, which could be a point of concern for their market presence. The absence of rankings in these categories for the subsequent months highlights areas where the brand might need to focus on strategic improvements to enhance their market share.

Competitive Landscape

In the competitive landscape of Michigan's pre-roll category, Made By A Farmer has demonstrated a fluctuating yet resilient presence. Over the period from December 2024 to March 2025, the brand experienced a dip in rank from 82nd to 99th in February, before rebounding to 79th in March. This recovery suggests a potential stabilization in their market strategy or consumer engagement. Meanwhile, competitors like MKX Oil Company maintained a relatively higher rank, fluctuating between 51st and 73rd, indicating stronger market traction. GreenCo Ventures also showed a notable comeback in March, surpassing Made By A Farmer by climbing to 74th. The absence of Traphouse Cannabis Co. and Euphoria from the top 20 in earlier months, with their appearance in March, highlights the dynamic shifts within this competitive space. These fluctuations in rankings and the sales trends of competitors underscore the challenges and opportunities for Made By A Farmer to enhance its market position in Michigan's pre-roll sector.

Notable Products

In March 2025, the top-performing product for Made By A Farmer was Sour Diesel Bubble Hash Infused Pre-Roll (1g), reclaiming its top spot with sales of 2440 units. The CBG Gummy Bears Bubble Hash Infused Pre-Roll (1g) followed closely in second place, marking a notable return to the rankings after being absent in February. Grape Breath Hash Rosin Vegan Gummies 10-Pack (200mg) secured the third position, maintaining a consistent presence in the top three from January onwards. The Aunt Gemima Bubble Hash Infused Pre-Roll (1g) entered the rankings for the first time, taking fourth place, while Green Apple Fast Acting Gummies 10-Pack (200mg) rounded out the top five. These rankings highlight a strong preference for pre-rolls, with Sour Diesel showing a significant rebound from its February dip.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.