Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

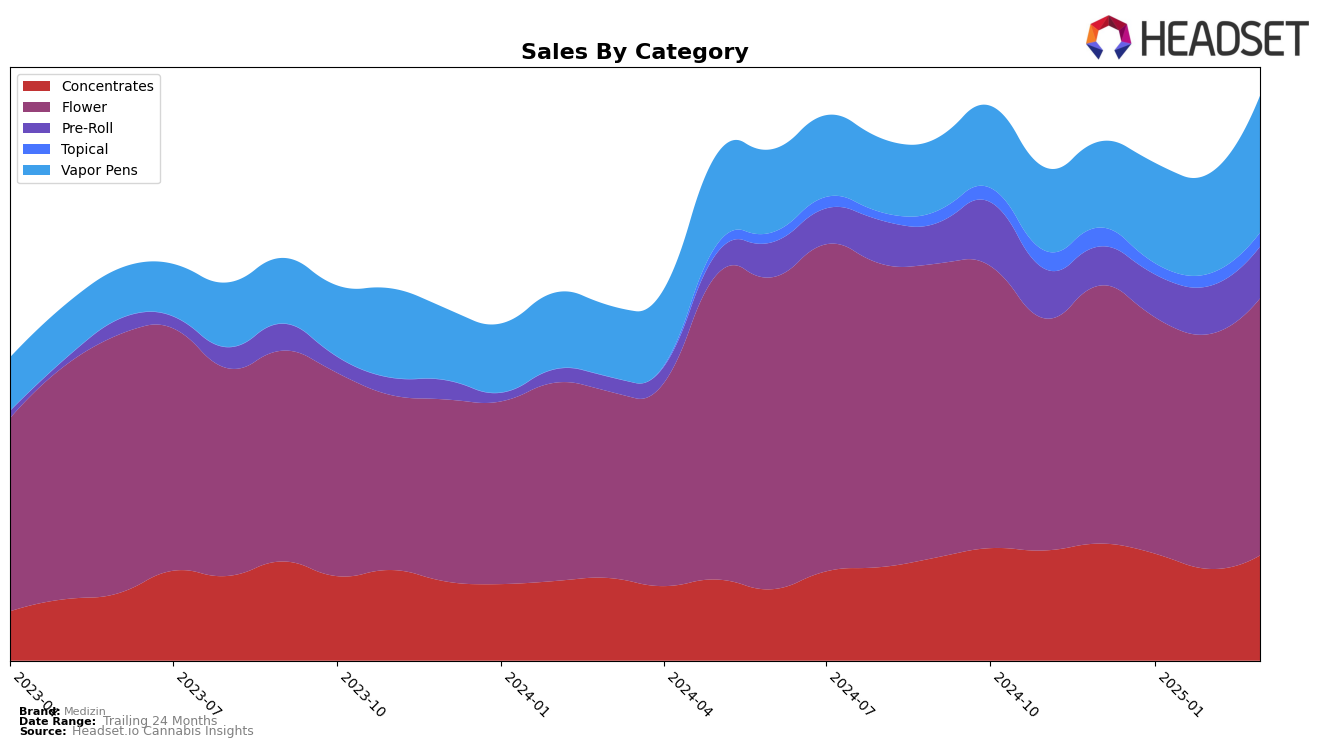

In the state of Nevada, Medizin has shown a strong performance across several cannabis categories. Notably, the brand has maintained its top position in the Concentrates category from December 2024 through March 2025, despite some fluctuations in sales figures. This consistent ranking demonstrates a robust market presence and consumer preference. In the Topical category, Medizin regained its top rank in March 2025 after a brief dip to second place in January and February. This rebound suggests resilience and a successful strategy to reclaim the leading position. Meanwhile, in the Pre-Roll category, the brand has steadily held the sixth rank since January 2025, indicating a stable performance in this segment.

Medizin's performance in the Vapor Pens category in Nevada is particularly noteworthy, as the brand climbed from ninth place in December 2024 to an impressive fifth place by March 2025. This upward trajectory suggests a growing consumer interest and possibly effective marketing or product enhancements. However, the Flower category has seen Medizin maintain a consistent fourth-place ranking, which, while stable, indicates room for growth to break into the top three. The absence of rankings in other states or provinces implies that Medizin is not yet a top 30 brand outside of Nevada, pointing to potential opportunities for expansion or increased market penetration in new regions.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Medizin has maintained a consistent presence, ranking 4th in December 2024, dropping slightly to 3rd in January 2025, and then stabilizing back at 4th through February and March 2025. This stability in ranking suggests a solid market position, although it faces stiff competition from brands like Rythm, which not only surpassed Medizin in February 2025 by climbing to 2nd place but also maintained that position in March 2025. Meanwhile, Alternative Medicine Association / AMA consistently held a higher rank than Medizin, securing the 2nd position for most of the observed period. Despite these challenges, Medizin's sales figures indicate resilience, with a notable uptick in March 2025, aligning closely with its December 2024 sales, suggesting a potential rebound. This competitive dynamic highlights the importance for Medizin to innovate and strategize effectively to climb higher in the ranks amidst strong competitors.

Notable Products

In March 2025, Cap Junky (3.5g) maintained its position as the top-selling product for Medizin, continuing its dominance from previous months with sales of $4,299. Silver Reserve Infused Pre-Roll (1g) climbed significantly to secure the second spot, up from fifth in February. GMO (3.5g) experienced a slight drop, moving from second to third place. Oreoz (3.5g) entered the rankings for the first time in March, taking the fourth position. Tropicana Cookies (3.5g) also made its debut, rounding out the top five products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.