Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

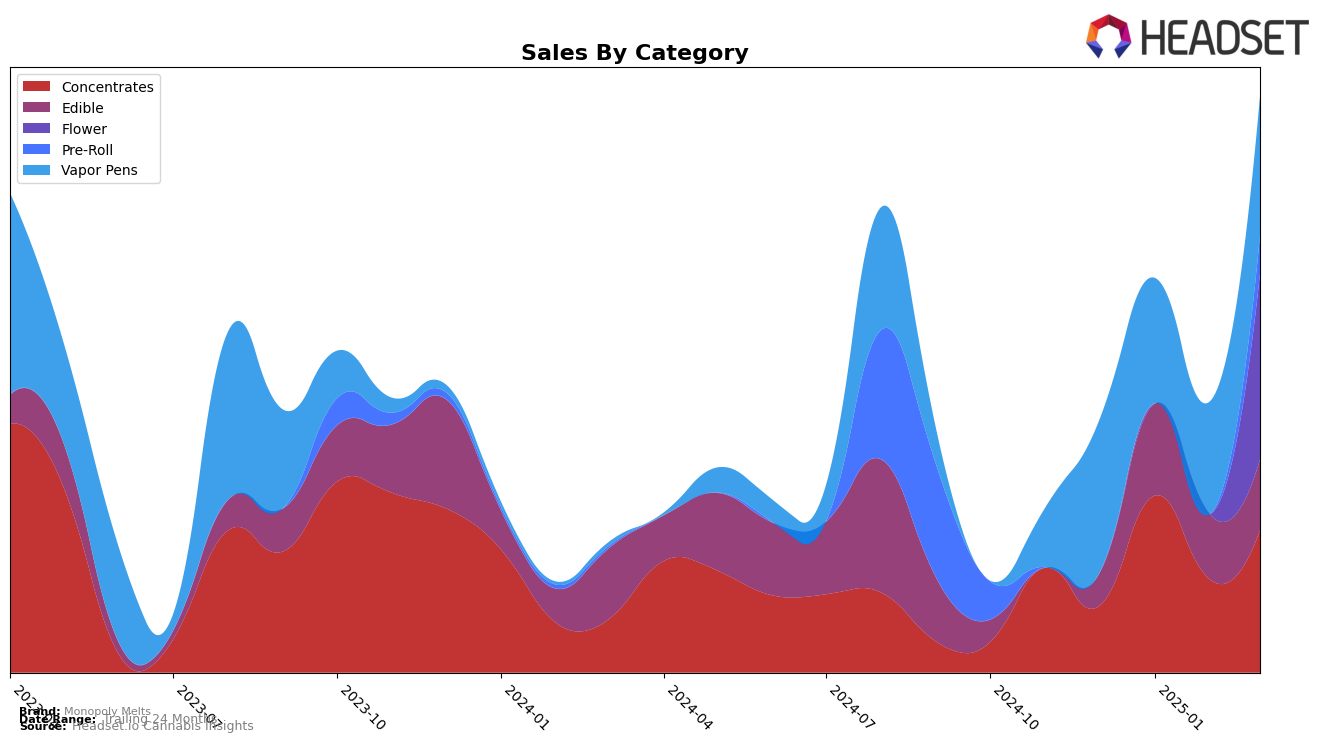

Monopoly Melts has shown notable performance in the Concentrates category in Missouri. The brand improved its ranking from 37th in December 2024 to 25th in January 2025, although it slightly dropped to 30th in February before climbing back to 26th in March. This fluctuation indicates a competitive landscape, but the brand's ability to maintain a position within the top 30 for three consecutive months is commendable. The sales figures reveal a substantial increase in January, suggesting a strong market presence during that period. However, it's worth noting that Monopoly Melts did not make it into the top 30 for the Flower and Pre-Roll categories, which could be seen as an area for potential growth or concern.

In the Edible category, Monopoly Melts has not yet broken into the top 30 in Missouri, with rankings hovering around the 40s. This consistent position outside the top 30 might suggest challenges in competing with other brands or a need for strategic adjustments. Meanwhile, in the Vapor Pens category, Monopoly Melts maintained a steady position around the mid-50s from December to March. The slight fluctuations in rank, coupled with varying sales figures, indicate a stable yet competitive performance. The brand's consistency in this category could serve as a foundation for future improvements, but it also highlights the intense competition within the market.

Competitive Landscape

In the Missouri flower category, Monopoly Melts made its first appearance in the rankings in March 2025, debuting at rank 53. This entry is notable given the competitive landscape, where brands like Willie's Reserve and Cubano have maintained a presence, with Willie's Reserve showing a fluctuating but generally higher rank, peaking at 36 in January 2025. Meanwhile, Lost in Translation (LIT) and Lush Labs have also been active, with Lush Labs showing a notable improvement from rank 60 in January to 54 in February. Despite these competitors, Monopoly Melts' entry into the top 60 suggests a potential upward trend, especially as it surpasses LIT's rank in March. This indicates a positive trajectory for Monopoly Melts, potentially driven by strategic market positioning or product differentiation within Missouri's flower market.

Notable Products

In March 2025, the top-performing product for Monopoly Melts was Tropicana Cookies (3.5g) in the Flower category, securing the number one rank with sales of 552 units. Following closely was Motorbreath #15 (3.5g), also in the Flower category, ranked second. Black Cherry Limeade Live Rosin Gummies 10-Pack (250mg) in the Edible category dropped to third place, despite previously holding the top rank in January and February 2025. Blumosa (3.5g) maintained a strong presence in the Flower category, landing in fourth place. Notably, Blumosa Live Rosin Disposable (0.5g) in the Vapor Pens category fell from a second-place rank in December and January to fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.