Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

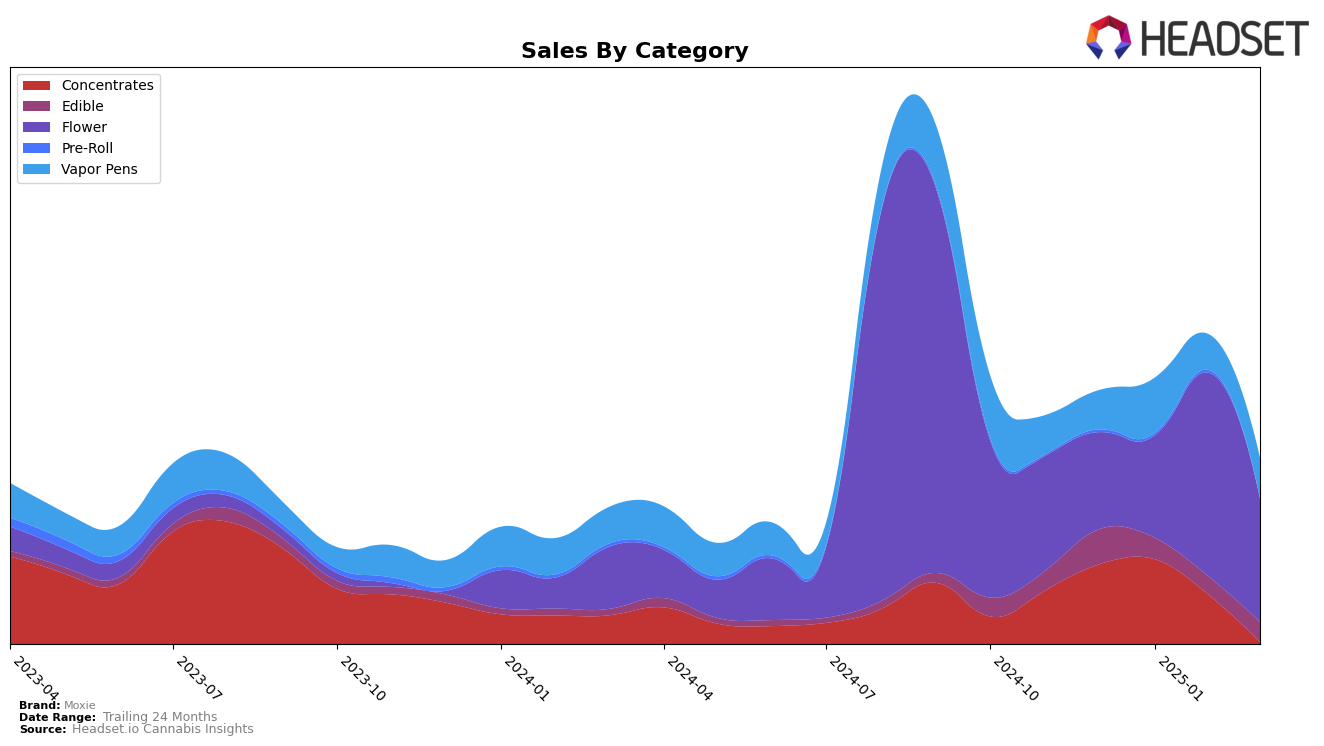

In the state of Ohio, Moxie has shown varied performance across different cannabis categories. In the Concentrates category, Moxie began strong with a ranking of 7 in December 2024, improved slightly to 6 in January 2025, but then saw a decline to 10 by February, eventually dropping out of the top 30 by March. This indicates a concerning downward trend for Moxie in the Concentrates category. Conversely, in the Flower category, Moxie demonstrated a positive trajectory, moving from 32 in December to a peak of 21 in February, although it slightly declined to 27 in March. This suggests a competitive positioning in the Flower category, highlighting a potential area for growth.

The Edible category presented a different story for Moxie, where the brand struggled to maintain a strong foothold. Starting at rank 27 in December, Moxie fell out of the top 30 by January and remained outside this range through February and March, indicating a challenging landscape in this category. Meanwhile, in Vapor Pens, Moxie showed some fluctuations, beginning at rank 42 in December and improving to 33 in January, but settling at 37 in February and March. This suggests a need for strategic adjustments to regain momentum in the Vapor Pens market. Overall, Moxie's performance across these categories in Ohio highlights both opportunities and challenges that the brand faces in maintaining and improving its market position.

Competitive Landscape

In the competitive landscape of the flower category in Ohio, Moxie has demonstrated notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 32 in December 2024, Moxie improved its position to 21 by February 2025, before slightly dropping to 27 in March 2025. This upward trend in February suggests a significant increase in sales, positioning Moxie competitively against brands like Willie's Reserve, which saw a decline from rank 15 in January to 28 in March, and Classix, which experienced rank volatility, peaking at 14 in December but dropping to 29 by March. Meanwhile, Curaleaf showed a notable recovery to rank 25 in March after being outside the top 20 in previous months. Pure Ohio Wellness maintained a relatively stable presence, hovering around the mid-20s. Moxie's performance, especially its peak in February, indicates a robust competitive stance in the Ohio flower market, although maintaining this momentum amidst fluctuating ranks of competitors will be crucial for sustained growth.

Notable Products

In March 2025, the top-performing product from Moxie was Humboldt's Most Wanted Live Resin Cartridge (0.84g) in the Vapor Pens category, which climbed to the number one rank from third place in February 2025. This product achieved notable sales of 1853 units. Lemonade Gummies 11-Pack in the Edible category debuted impressively at second place. Strawberry Banana Gummies 11-Pack followed closely, securing the third position. Raspberry Hibiscus Gummies 11-Pack improved its ranking to fourth place from fifth in February, indicating a positive trend in consumer preference for Moxie's edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.