Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

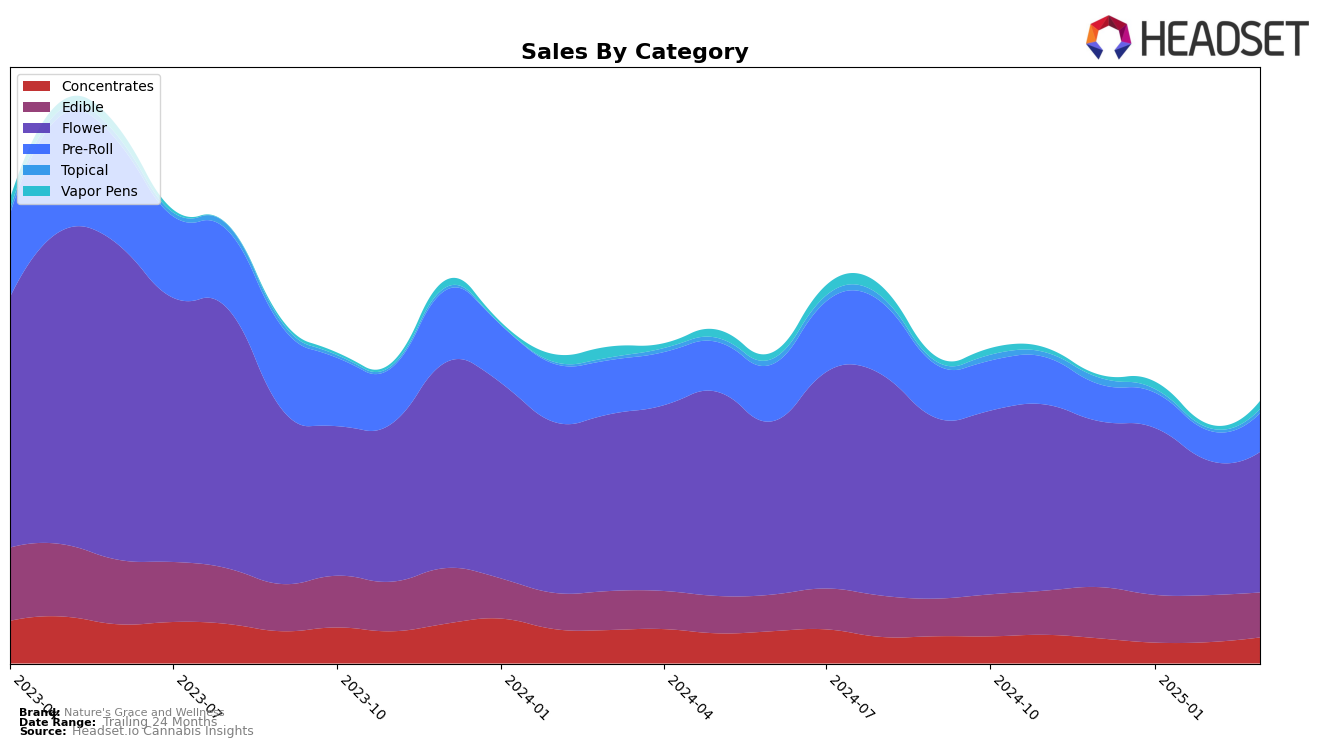

Nature's Grace and Wellness has demonstrated a consistent presence in the Illinois cannabis market, particularly in the Concentrates category, where it maintained a steady rank of 8th from January to March 2025. This stability suggests a strong consumer base and effective market strategies within this category. In the Flower category, the brand showed resilience, ranking 7th in January before settling at 8th in the following months, indicating a competitive but solid standing. However, the Vapor Pens category presents a challenge, as the brand did not make it into the top 30 in December 2024 and struggled to climb back to a competitive position, peaking at 42nd in March 2025. This highlights potential areas for growth or reevaluation of strategy in this category.

In the Edible category, the brand saw fluctuations, starting at 13th in December 2024, improving to 9th in January and February 2025, but then slipping back to 13th by March. This volatility could suggest varying consumer preferences or competitive pressures. The Pre-Roll category also displayed a similar trend, with the brand maintaining its 11th position in December and January, but dropping to 13th in February and March. Meanwhile, Nature's Grace and Wellness showed notable strength in the Topical category, securing the 2nd position in December 2024, though it briefly fell out of the rankings in February 2025 before reclaiming 3rd place in March. This indicates a robust performance in Topicals, despite a temporary setback. Overall, while the brand has solidified its presence in several categories, there are clear opportunities for improvement, particularly in Vapor Pens and maintaining consistency in Edibles and Pre-Rolls.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Nature's Grace and Wellness has maintained a consistent rank, holding the 8th position in December 2024, February 2025, and March 2025, with a slight improvement to 7th in January 2025. This stability is noteworthy, especially when compared to competitors like Good Green, which fluctuated significantly, reaching as high as 5th in February 2025. Despite Nature's Grace and Wellness's stable ranking, Savvy consistently outperformed it, maintaining a higher rank throughout the period. Meanwhile, Grassroots showed a positive trend, climbing from 14th in December 2024 to 10th by March 2025, indicating a potential challenge to Nature's Grace and Wellness's position. The sales figures reflect these dynamics, with Nature's Grace and Wellness experiencing a dip in February 2025, which could suggest a need for strategic adjustments to counter the rising competition and regain market share.

Notable Products

In March 2025, the top-performing product for Nature's Grace and Wellness was the Birthday Cake White Chocolate Bar 10-Pack (100mg), an edible, maintaining its number one rank from the previous month with sales of 8703. The Birthday Cake White Chocolate Macro Bar (50mg) held the second position, dropping from its previous top rank in January 2025. The Peanut Butter & Milk Chocolate Bar 10-Pack (100mg) rose to third place, showing a consistent upward trajectory since its introduction in February 2025. Skywalker, a flower product, entered the rankings at fourth place for March 2025. Lastly, the Mint Cookie Milk Chocolate Crunch Macro Bar (50mg) rounded out the top five, having dropped from its previous third-place position in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.